Equity REITs: Still Worth Buying?

Equity REITs, which invest typically in commercial buildings, apartments and other properties, have been a hot asset class over the past 14 months. As a sector, REITs are up about 30% since January of last year, including dividends. That’s about double the S&P 500’s total return over that period.

After a run like that, are REITs still cheap enough to consider buying?

You bet they are.

As I wrote last week, mainstream U.S. stocks are very expensive at today’s prices, trading at a cyclically-adjusted price earnings ratio of 27. This is more expensive than they were in 1929 and 2007 — both before their respective meltdowns.

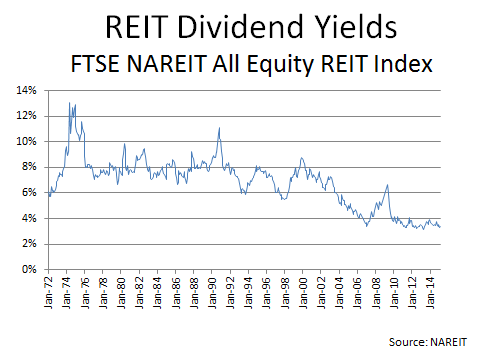

But looking at REIT dividend yields, we see a very different story. Apart from the brief spike in yields that happened during the 2008 meltdown — remember, falling prices mean rising yields — REIT dividend yields have barely budged over the past decade. Since 2006, they’ve essentially bounced around in a range of about 3.2% to 4.0%:

As you can see, that’s a far cry from the 8% yields that were the norm for the 1970s, ‘80s and even parts of the ‘90s. But remember, we’re in a very different world today, one in which bond yields scrape along at lows that few ever believed possible.

In 1980, CPI inflation was 13.9% and the 10-year Treasury yielded over 12%. That made the 8% dividends offered by REITs look terrible by comparison.

Today, REITs as an asset class may yield only 3.4%, but that looks pretty good in a world where CPI inflation and the 10-year Treasury yield are both below 2%.

If you believe — as I do — that this period of low inflation and low bond yields still has a few years left to run, then REIT dividends at today’s levels look like a very solid value.

About the author:

Charles Lewis Sizemore, CFA is the Chief Investment Officer of Sizemore Capital Management. Please contact our offices today for a portfolio consultation.

Mr. Sizemore has been a repeat guest on Fox Business News, has been quoted in Barron’s Magazine and the Wall Street Journal, and has been published in many respected financial websites, including MarketWatch, TheStreet.com, InvestorPlace, MSN Money, Seeking Alpha, Stocks, Futures, and Options Magazine and The Daily Reckoning.