3 investing mistakes that could destroy your portfolio

Did your investment portfolio have a rough time last year?

If so, you aren’t alone.

Investing app Openfolio found that out of 3,000 portfolios, most of its users underperformed in relation to a particular, reliable benchmark: target-date funds.

Target-date funds are mutual funds that are pegged to a specific year of retirement, and adjust their investment mix depending on how long remains until the “target date.”

While people have different opinions on whether a target-date fund is an effective enough method of saving to provide a retiree with the money they need in their post-work life, it’s widely recognized that they are relatively conservative, steady investments that most likely won’t see shocking losses or gains over the course of a year.

Ideally, then, you want to outperform it.

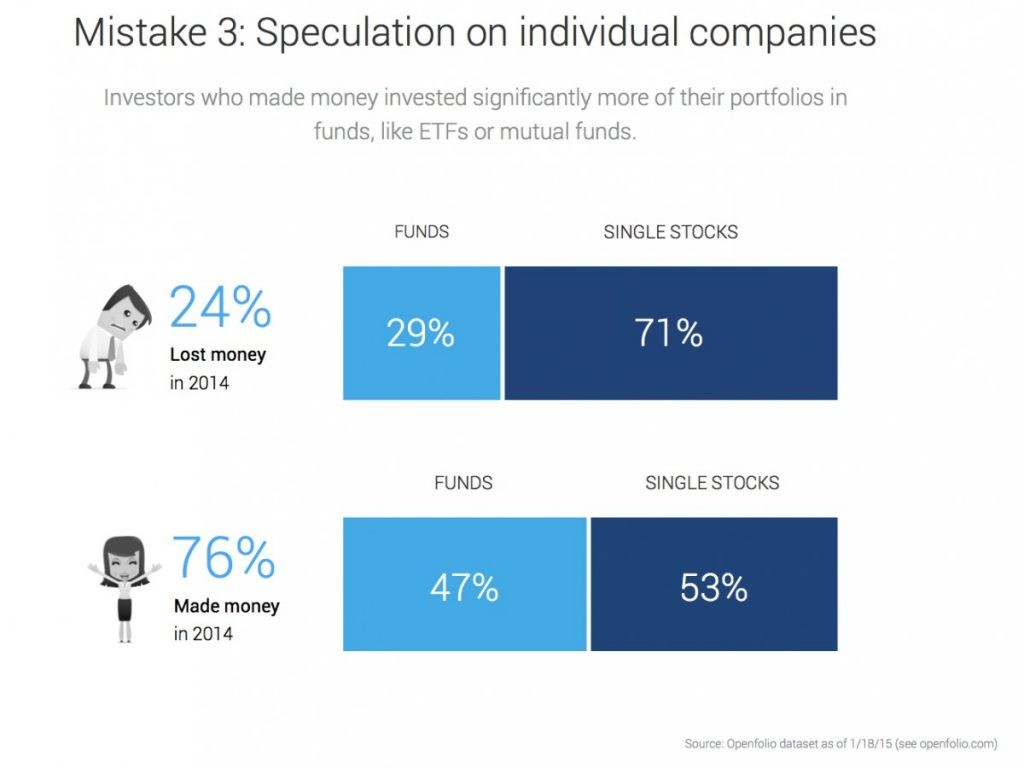

However, Openfolio found that not only did 24% of its users lose money in their investments in 2014, but 35% gained less than the target-date retirement funds applicable to their age — meaning 59% underperformed. A respectable 41%, however, managed to beat the fund.

Looking at Vanguard target-date retirement funds pegged to the years 2020, 2030, 2050, and 2060 with an assumed retirement age of 65, Openfolio found that each had a return of about 7.2%, and used this number to figure out how many of its investor portfolios were underperforming.

It then looked more carefully at the group who lost money to see if their choices provided any insight as to why.

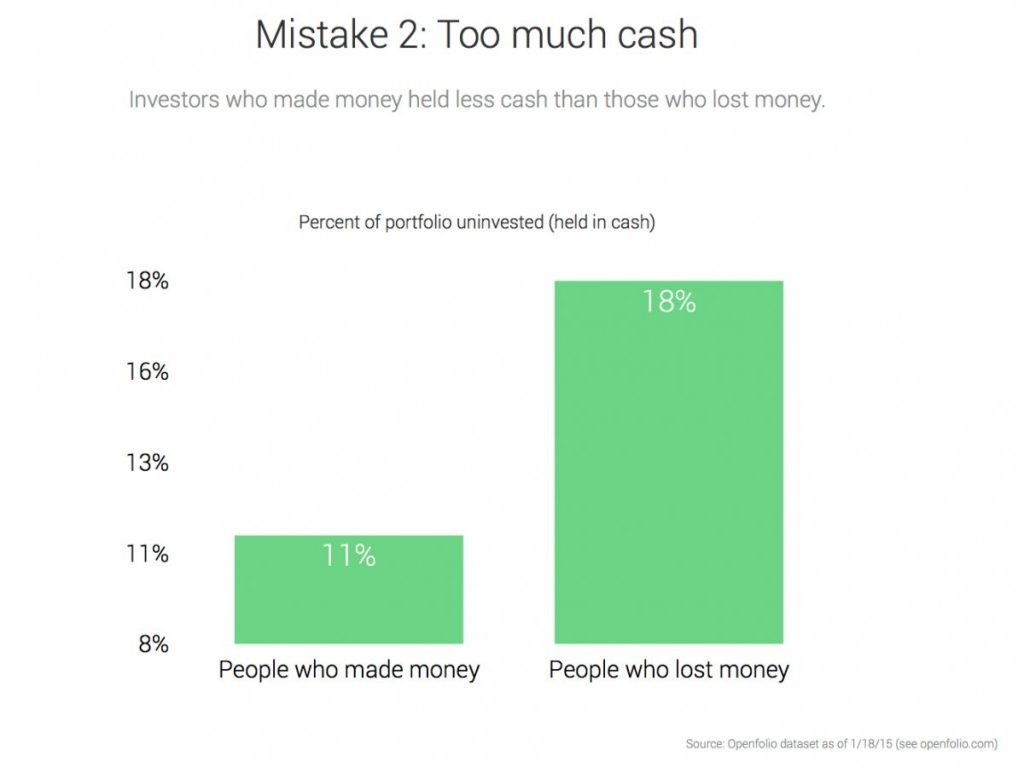

Based on the actions of the 24% who lost money, they narrowed the disappointing results down to three reasons, which might look uncomfortably familiar if you’ve experienced losses in your own portfolio:

Openfolio

Openfolio

Openfolio

Openfolio

Openfolio

Openfolio

There was one bright spot, though: Openfolio found that the number of users making the above mistakes declined in each successive age group, meaning older investors were more likely to see stronger returns.