Daniel Loeb Parts With Stake in Alibaba

Hedge fund manager Daniel Loeb (Trades, Portfolio), the founder and chief executive of Third Point LLC, a New York-based hedge fund with a $ 14 billion portfolio, is known for his public letters that have been critical of CEOs and other investment managers. His approach to investing is event-driven and value-oriented.

While he has said he is only interested in making money for his investors, his personal portfolio activity in the first quarter shows he is also interested in making money for himself as well.

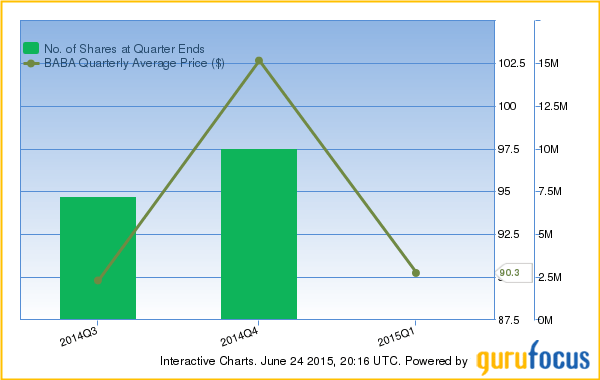

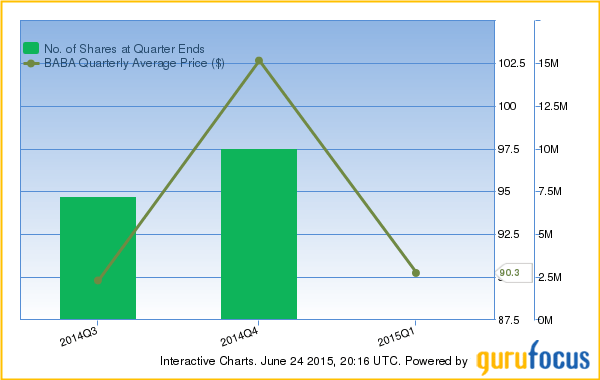

The most significant transaction Loeb made in the first quarter was the sale of his stake in Alibaba Group Holding Ltd (BABA), a Chinese ecommerce company. Loeb sold his 10,000,000-share stake for an average price of $ 90.25 per share. The sale had a -9.4% impact on Loeb’s portfolio.

Alibaba has a market cap of $ 213.22 billion and an enterprise value of $ 205.93 billion. It has a P/E of 49.0, a Price/Book of 9.3 and a Price/Sales of 18.3. Frank Sands (Trades, Portfolio), Jeremy Grantham (Trades, Portfolio), Andreas Halvorsen (Trades, Portfolio), Chase Coleman(Trades, Portfolio), George Soros (Trades, Portfolio), PRIMECAP Management (Trades, Portfolio), Louis Moore Bacon (Trades, Portfolio), John Griffin (Trades, Portfolio), Manning & Napier Advisors, Inc, Matthews Pacific Tiger Fund (Trades, Portfolio), Julian Robertson(Trades, Portfolio), Ron Baron (Trades, Portfolio), Howard Marks (Trades, Portfolio), Stanley Druckenmiller (Trades, Portfolio), Matthews China Fund (Trades, Portfolio), Paul Tudor Jones(Trades, Portfolio), John Burbank (Trades, Portfolio), Chris Davis (Trades, Portfolio) and Steven Cohen (Trades, Portfolio) have shares of Alibaba in their portfolios.

Alibaba plans to take down products carrying Confederate flag imagery following the mass killing at a black church in South Carolina last week.

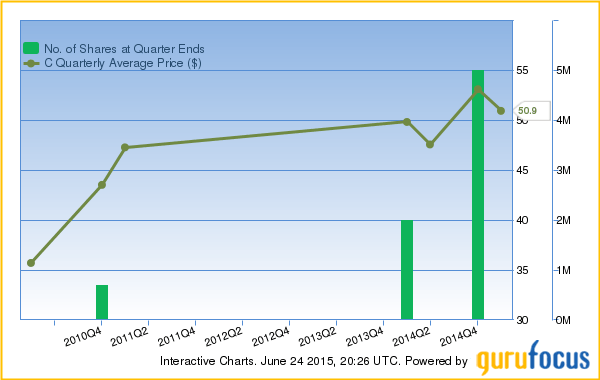

Loeb also sold his stake in Citigroup Inc (C), a Manhattan-based multinational banking and financial services corporation. Loeb sold his 5,000,000-share stake for an average price of $ 50.92 per share. The transaction had a -2.4% impact on Loeb’s portfolio.

Citigroup has a market cap of $ 171.82 billion and an enterprise value of $ 279.35 billion. It has a P/E of 22.4, a Price/Book of 0.9 and a Price/Sales of 2.3. James Barrow (Trades, Portfolio), HOTCHKIS & WILEY, Ken Fisher (Trades, Portfolio), Richard Pzena (Trades, Portfolio), First Pacific Advisors (Trades, Portfolio), Andreas Halvorsen (Trades, Portfolio), Steven Romick(Trades, Portfolio), Bill Nygren (Trades, Portfolio), Diamond Hill Capital (Trades, Portfolio), Larry Robbins (Trades, Portfolio), Leon Cooperman (Trades, Portfolio), Charles Brandes(Trades, Portfolio), NWQ Managers (Trades, Portfolio), Ken Heebner (Trades, Portfolio), Sarah Ketterer (Trades, Portfolio), Pioneer Investments (Trades, Portfolio), Kahn Brothers (Trades, Portfolio), RS Investment Management (Trades, Portfolio), Jeremy Grantham (Trades, Portfolio), Arnold Schneider (Trades, Portfolio), Signature Select Canadian Fund (Trades, Portfolio), Caxton Associates (Trades, Portfolio), Mario Gabelli (Trades, Portfolio), Francis Chou (Trades, Portfolio), Julian Robertson (Trades, Portfolio), Chris Davis (Trades, Portfolio), Manning & Napier Advisors, Inc, Jeff Auxier (Trades, Portfolio), Mohnish Pabrai (Trades, Portfolio), David Dreman (Trades, Portfolio), Louis Moore Bacon (Trades, Portfolio), Paul Tudor Jones (Trades, Portfolio), Prem Watsa (Trades, Portfolio), John Keeley (Trades, Portfolio), Dodge & Cox and Ruane Cunniff (Trades, Portfolio) have shares of Citigroup in their portfolios.

Loeb also sold his stakes in EMC Corp (EMC), American Airlines Group Inc (AAL), CF Industries Holdings Inc (CF), Shire PLC (SHPG), Hertz Global Holdings Inc (HTZ), Allergan PLC (AGN) and four others.

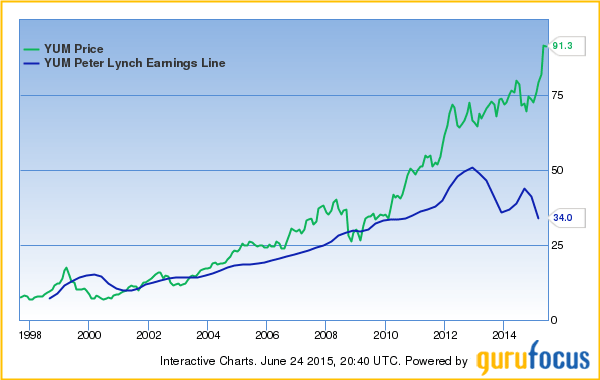

Loeb made nine new buys in the first quarter, the most significant being his purchase of 15,000 shares of Yum! Brands Inc (YUM), a fast-food company based in Louisville, Kentucky. Loeb paid an average price of $ 75.94 per share; the purchase had a 2.41% impact on Loeb’s portfolio.

Yum! Brands has a market cap of $ 39.75 billion and an enterprise value of $ 42.51 billion. It has a P/E of 41.2, a Price/Book of 23.3 and a Price/Sales of 3.2. Manning & Napier Advisors, Inc, Matthews Pacific Tiger Fund (Trades, Portfolio), George Soros (Trades, Portfolio), Jeremy Grantham (Trades, Portfolio), Jana Partners (Trades, Portfolio), Caxton Associates (Trades, Portfolio), Steven Cohen (Trades, Portfolio), Ron Baron (Trades, Portfolio), Mark Hillman(Trades, Portfolio), Jeff Auxier (Trades, Portfolio) and John Hussman (Trades, Portfolio) have shares of Yum! Brands in their portfolios.

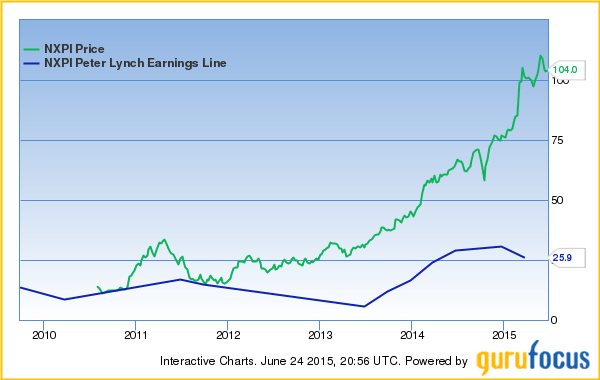

Loeb bought a stake in NXP Semiconductors NV (NXPI), a Dutch semiconductor manufacturer. He purchased 1,593,200 shares for an average price of $ 88.08 per share. That transaction had a 1.49% impact on his portfolio.

NXP has a market cap of $ 24 billion and an enterprise value of $ 27.04 billion. It has a P/E of 100.5, a Price/Book of 51.6 and a Price/Sales of 4.3. Andreas Halvorsen (Trades, Portfolio), David Tepper (Trades, Portfolio), Jim Simons (Trades, Portfolio), Ken Heebner (Trades, Portfolio), Signature Select Canadian Fund (Trades, Portfolio), First Eagle Investment (Trades, Portfolio), Steven Cohen (Trades, Portfolio), RS Investment Management (Trades, Portfolio), Mariko Gordon (Trades, Portfolio), Caxton Associates (Trades, Portfolio), Julian Robertson(Trades, Portfolio), Mario Gabelli (Trades, Portfolio), Paul Tudor Jones (Trades, Portfolio) and John Keeley (Trades, Portfolio) have shares of NXP in their portfolios.

Loeb’s other new buys in the first quarter were FedEx Corp (FDX), McKesson Corp (MCK), JM Smucker Co (SJM), Maxim Integrated Products Inc (MXIM), Precision Castparts Corp (PCP), Clayton Williams Energy Inc (CWEI) and Energy Transfer Equity LP (ETE).

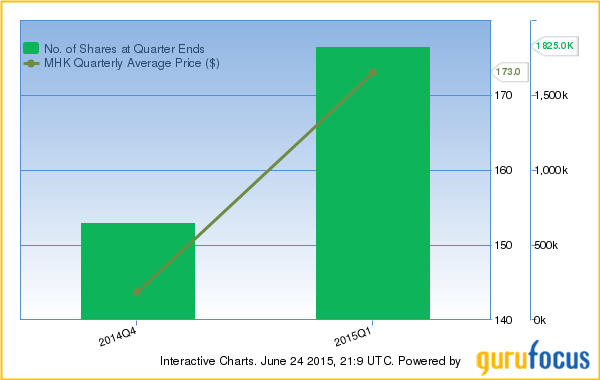

Loeb added to six existing stakes in the first quarter, the most noteworthy being Mohawk Industries Inc (MHK), a Georgia-based flooring manufacturer. Loeb bought 1,175,000 shares for an average price of $ 173.03 per share. The acquisition had a 2.03% impact on his portfolio.

Mohawk has a market cap of $ 14.13 billion and an enterprise value of $ 16.44 billion. It has a P/E of 30.0, a Price/Book of 3.4 and a Price/Sales of 1.8. Andreas Halvorsen (Trades, Portfolio), Ruane Cunniff (Trades, Portfolio), Steve Mandel (Trades, Portfolio), Larry Robbins(Trades, Portfolio), Meridian Funds (Trades, Portfolio), John Rogers (Trades, Portfolio), Steven Cohen (Trades, Portfolio), Ron Baron (Trades, Portfolio), David Tepper (Trades, Portfolio), Chuck Royce (Trades, Portfolio), Pioneer Investments (Trades, Portfolio), Westport Asset Management (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), Louis Moore Bacon(Trades, Portfolio) and Murray Stahl (Trades, Portfolio) have shares of Mohawk in their portfolios.

Mohawk announced plans this week to close a yarn plant in Chatsworth, Georgia, and move 156 workers to other northwest Georgia facilities.

Loeb also added to his stakes in Delta Air Lines Inc (DAL), Roper Technologies Inc (ROP), Allergan PLC (AGN), Fleetcor Technologies, Inc. (FLT) and IAC/InterActiveCorp (IACI).

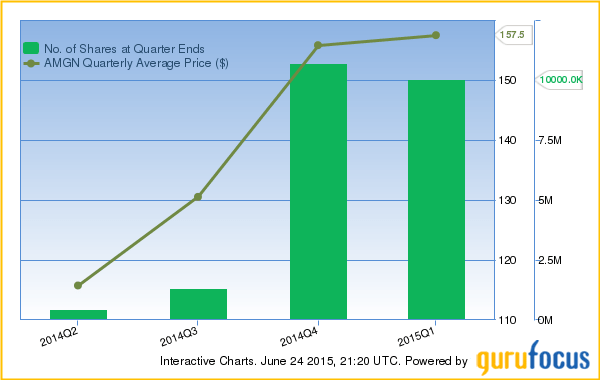

Loeb reduced seven of his stakes in the first quarter. He sold 675,000 shares of Amgen Inc(AMGN), a California-based biopharmaceutical company, for an average price of $ 157.49 per share. The sale had a -0.97% impact on Loeb’s portfolio.

Amgen has a market cap of $ 122.94 billion and an enterprise value of $ 126.16 billion. It has a P/E of 21.9, a Price/Book of 4.6 and a Price/Sales of 6.1. PRIMECAP Management (Trades, Portfolio), Vanguard Health Care Fund (Trades, Portfolio), Jim Simons (Trades, Portfolio), Jeremy Grantham (Trades, Portfolio), First Eagle Investment (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), Ken Fisher (Trades, Portfolio), Alan Fournier (Trades, Portfolio), John Buckingham (Trades, Portfolio), Dodge & Cox, Mario Gabelli (Trades, Portfolio), Pioneer Investments (Trades, Portfolio), Bill Frels (Trades, Portfolio), Paul Tudor Jones (Trades, Portfolio), Mark Hillman (Trades, Portfolio), Ray Dalio (Trades, Portfolio), RS Investment Management (Trades, Portfolio), Ruane Cunniff (Trades, Portfolio) and Lee Ainslie (Trades, Portfolio) have shares of Amgen in their portfolios.

Loeb sold portions of his stakes in Ally Financial Inc (ALLY), Phillips 66 (PSX), eBay Inc(EBAY), Anheuser-Busch Inbev SA (BUD), SunEdison Inc (SUNE) and Intrexon Corp(XON).