U.S. Market Indexes Higher after Last Week’s Jobs Report

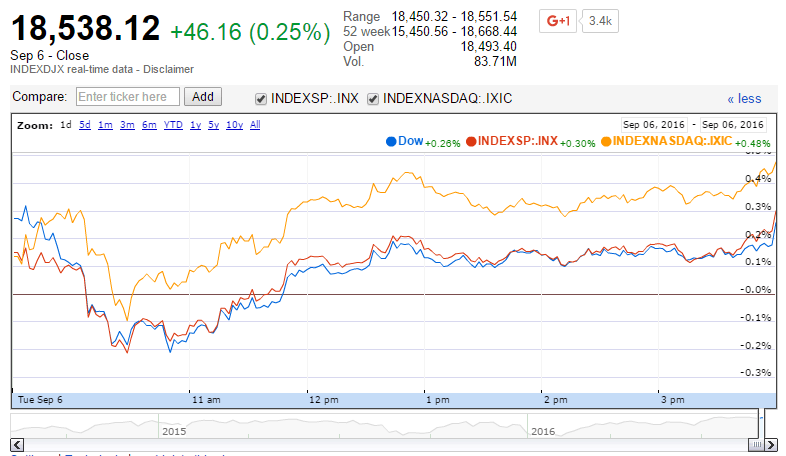

U.S. market indexes were higher on Tuesday. For the day the Dow Jones Industrial Average closed at 18538.12 for a gain of 46.16 points or 0.25 percent. The S&P 500 was also higher, closing at 2186.48 for a gain of 6.50 points or 0.30 percent. The Nasdaq Composite closed higher at 5275.91 for a gain of 26.01 points or 0.50 percent. The VIX Volatility Index was lower at 11.93 for a loss of -0.05 points or -0.42 percent.

Tuesday’s Market Movers

A main focus for the day’s trading on Tuesday was the ISM Non-Manufacturing Index which reported on the U.S. economy’s services sector. The ISM Non-Manufacturing Index was down over 4 points from July to 51.4. The August report was also below consensus of 55.0.

The lower ISM Non-Manufacturing Index report combined with last week’s weaker data in the manufacturing sector both signal slower growth than expected overall in the economy. In August, the PMI Manufacturing Index was lower at 52.0 versus 52.9. The ISM Manufacturing Index was also lower with the Index falling to 49.4 in August from 52.6 in the previous month’s report.

Despite the lower report, the market gained Tuesday as investors were satisfied with Friday’s employment data and also seem more comfortable with the Fed’s plans for a rate increase.

Other leading economic reports released on Tuesday included the Gallup U.S. Consumer Spending Measure and the Labor Market Conditions Index. The Gallup U.S. Consumer Spending Measure showed consumers spending an average of $91 per day in August, down from $100 per day in July. The Federal Reserve’s Labor Market Conditions Index was lower in August. The Index reading for August was -0.7 which was down from 1.3 in July.

Stocks trading actively on Tuesday included the following:

Bank of America

EMC

Spectra Energy

Chesapeake Energy

Ford

General Electric

Facebook

Regions Financial

Apple

In the Dow Jones Industrial Average, stocks leading gains included the following:

Gains (percent)

Chevron Corp 1.49

Boeing Co 1.40

Intel Corp 1.36

Exxon Mobil Corp 1.32

McDonald’s Corp 1.23

Top sectors for the broad market were energy and utilities. Technology was higher for the day with S&P 500 technology companies gaining 0.51 percent. Stocks leading gains in the technology sector included the following:

Gains (percent)

Baidu Inc ADR 6.34

Yahoo! Inc 3.3

Netflix Inc 2.78

Facebook Inc 2.55

Tesla Motors Inc 2.55

In commodities, gold traded higher as evidenced by the SPDR Gold Trust which reported a gain of 2.14 points or 1.69 percent. The dollar was lower for the day as the U.S. Dollar Index was down -0.92 points or -0.96 percent to 94.85.

Small-Cap Stocks

In small-caps, the Russell 2000 Index was higher at 1253.37 for a gain of 1.54 points or 0.12 percent. The S&P 600 Small-Cap Index was lower at 760.43 for a loss of -1.44 points or -0.19 percent. The Dow Jones Small-Cap Growth TSM Index was higher at 7631.74 for a gain of 11.25 points or 0.15 percent. The Dow Jones Small-Cap Value TSM Index was lower at 8855.17 for a loss of -2.45 points or -0.03 percent.

Other Notable Indexes

Other notable index closes included the S&P 400 Mid-Cap Index, closing at 1576.04 for a loss of -2.64 points or -0.17 percent; the S&P 100 Index at 966.84 for a gain of 3.17 points or 0.33 percent; the Russell 3000 Index at 1294.76 for a gain of 3.54 points or 0.27 percent; the Russell 1000 Index at 1212.40 for a gain of 3.47 points or 0.29 percent; and the Dow Jones U.S. Select Dividend Index at 621.41 for a gain of 2.47 points or 0.40 percent.