U.S. Market Indexes Lower with Outlook for Rate Increases

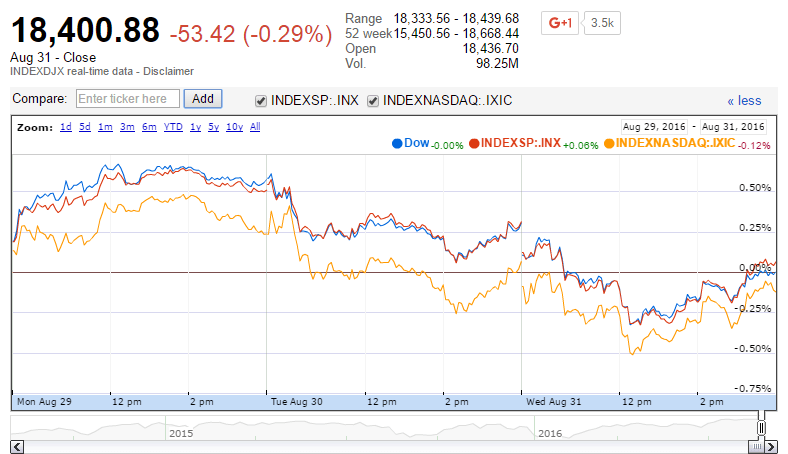

U.S. market indexes were lower Wednesday. For the day the Dow Jones Industrial Average closed at 18400.88 for a loss of -53.42 points or -0.29 percent. The S&P 500 was also down, closing at 2170.95 for a loss of -5.17 points or -0.24 percent. The Nasdaq Composite closed lower at 5213.22 for a loss of -9.77 points or -0.19 percent. The VIX Volatility Index was higher at 13.41 for a gain of 0.29 points or 2.21 percent.

Wednesday’s Market Movers

Reports on the economic calendar Wednesday included MBA Mortgage Applications, the ADP Employment Report, the Chicago PMI, Pending Home Sales, the EIA Petroleum Status Report and August Farm Prices. MBA Mortgage Applications were slightly higher as borrowers likely took advantage of the still low rates. Mortgage applications increased 2.8 percent for the week while refinancing applications increased 4 percent. The ADP Employment report showed an increase of 177,000 payrolls in the private sector. The Chicago PMI was lower at 51.5 down from 55.8. Pending Home Sales increased 1.3 percent from the previous month. The EIA Petroleum Status Report showed an increase of 2.3 million barrels for the week and oil prices were lower. The August Farm Prices report showed agriculture prices down 1.4 percent for the month and 11 percent for the year.

Valuations were lower Wednesday as investors primarily watched the ADP Employment report which showed private sector hiring increasing above expectations at 177,000. While a good thing for the economy, the employment data signaled that the Fed would likely be more aggressive on its timing for interest rate increases which has been slowing momentum in equities.

For the day stocks trading actively included the following:

Bank of America

EMC

Chesapeake Energy

General Electric

Apple

Ford

Wells Fargo

Huntington Bancshares

In the Dow Jones Industrial Average, the following stocks led losses for the day:

Losses (percent)

Chevron Corp -1.1

Boeing Co -1.04

E.I. du Pont de Nemours & Co -0.91

United Technologies Corp -0.86

Microsoft Corp -0.74

In the broad market, sectors leading losses included energy, materials and industrial. Technology stocks were also lower for the day. The Nasdaq Composite closed lower at 5213.22 for a loss of -9.77 points or -0.19 percent. The Nasdaq 100 Index was also lower at 4771.05 for a loss of -4.94 points or -0.10 percent. Stocks leading losses in technology included the following:

Losses (percent)

Baidu Inc ADR -2.5

Alexion Pharmaceuticals Inc -1.84

Biomarin Pharmaceutical Inc -1.12

Autodesk Inc -0.93

NetApp Inc -0.92

Western Digital Corp -0.91

In commodities, gold traded lower as evidenced by the SPDR Gold Trust which reported a loss of -0.25 points or -0.20 percent. The dollar was lower for the day as the U.S. Dollar Index was down -0.03 points or -0.03 percent at 96.02.

Small-Cap Stocks

In small-caps, the Russell 2000 Index was lower at 1239.91 for a loss of -6.12 points or -0.49 percent. The S&P 600 Small-Cap Index was lower at 753.07 for a loss of -3.39 points or -0.45 percent. The Dow Jones Small-Cap Growth TSM Index was lower at 7536.47 for a loss of -45.09 points or -0.59 percent. The Dow Jones Small-Cap Value TSM Index was lower at 8784.39 for a loss of -15.98 points or -0.18 percent.

Other Notable Indexes

Other notable index closes included the S&P 400 Mid-Cap Index lower at 1564.76 for a loss of -5.30 points or -0.34 percent; the S&P 100 Index at 960.08 for a loss of -1.70 points or -0.18 percent; the Russell 3000 Index at 1284.48 for a loss of -3.30 points or -0.26 percent; the Russell 1000 Index at 1203.05 for a loss of -2.85 points or -0.24 percent; and the Dow Jones U.S. Select Dividend Index at 614.81 for a loss of -0.62 points or -0.10 percent.