Why Verizon Will Keep Investing In Its Network Over Big Acquisitions

After a $ 1 billion misstep in the video entertainment market, Verizon is moving to clarify its strategy as a new CEO takes over. Incoming CEO Hans Vestberg, the first outsider to run the telecom giant, says he’s going to continue emphasizing the company’s fiber optic and wireless networks and avoiding any big Hollywood merger distractions.

Under current CEO Lowell McAdam’s tenure, Verizon has skipped the big entertainment acquisitions that peers like AT&T and Comcast pursued, instead making smaller bets–not all of which have paid off. On Tuesday, the carrier disclosed write-offs totaling $ 1.1 billion (or $ 900 million after taxes) to shut down its failed mobile video service Go90 and complete the acquisitions needed to build its online content and advertising play, known as Oath.

Both Verizon executives renewed their support for the current direction, rejecting rumors that Vestberg, who takes over next month, would try to buy a major content company or sidetrack or spin off Oath.

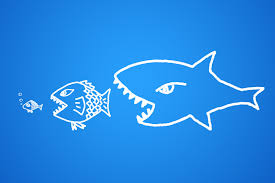

At least at the start, Vestberg said he sees no need to follow competitors spending big bucks for entertainment. AT&T (t) just completed its purchase of Time Warner after buying DirecTV and Comcast (cmcsa) bought control of NBC Universal. Verizon (vz) has been rumored as a possible buyer of CBS or a merger partner with Disney.

Get Data Sheet, Fortune’s technology newsletter.

“I’ve been sitting together with Lowell, the management team, and the board on the strategic decisions we’ve done and I’m fully on board on all of them,” Vestberg said on a call with analysts on Tuesday. “When I look at the assets we have, I’m really happy with them and I’m encouraged to see what we can do with them.” Vestberg also mentioned “the massive confidence we have in Oath.”

“We’re not going to be owning content, so we’re not going to be competing with other content providers,” McAdam added. “We’re going to be their best partner from a distribution perspective.”

The incoming and outgoing CEOs said they met with many content companies at the recent industry gathering in Sun Valley, Idaho, last month to explain the benefits of Verizon’s coming super-fast 5G wireless network. “I agree with Lowell that we can partner with anyone and we’re betting that we’re going to have best network,” Vestberg explained.

Strong earnings

Investors were generally pleased to hear that the company’s strategy would remain steady amid the CEO transition. They were no doubt also pleased that Verizon reported second-quarter revenue increased 5% to $ 32.2 billion, more than Wall street forecast, and adjusted earnings per share of $ 1.20 also beat forecasts. Shares of Verizon, which have gained 21% over the past year, were up almost 1% in midday trading on Tuesday.

Analysts supported Verizon’s strategy to invest in building a 5G network, rather than acquiring movie and TV studios. Verizon disclosed on Tuesday that Houston would be one its first test markets for 5G starting later this year.

“At a time when AT&T’s story is clouded by balance sheet concerns and Comcast’s story by quixotic M&A ambitions, Verizon’s story is blissfully simple,” longtime industry analyst Craig Moffett of MoffettNathanson Research wrote. “Verizon’s wireless-first network superiority strategy is working. No, it isn’t as sexy as a big splashy M&A story. But it is far preferable financially.”