The outlook for US government debt

THE bond market used to be the prime exhibit for those predicting low long-term economic growth. In the summer of 2016 the ten-year Treasury yield briefly dipped below 1.5%, as expectations for growth and inflation sagged. Things have changed. Earlier this year the ten-year yield briefly went higher than 2.9%. Even after recent share-price gyrations, it remains around 2.8%, well up since the start of 2018. The rebounding interest rate partly reflects higher confidence in global growth. Inevitably, a new set of pessimists now voice a fresh worry: that bond yields might go on rising for less welcome reasons.

They point to three threats. The first is monetary policy. The Federal Reserve has raised short-term interest rates by 1.5 percentage points since December 2015. At their March meeting, rate-setters slightly upgraded forecasts of how far rates should eventually rise. Last October the Fed began shrinking its $ 4.5trn portfolio of assets, mostly government debt, amassed since the start of the financial crisis. Quantitative easing (QE) supposedly worked by depressing long-term interest rates. Unwinding it could push them back up.

American policymakers are not the only ones tightening. Britain raised interest rates in November, and many investors expect the European Central Bank to end its QE programme this year. Economists increasingly think the “term premium”—the reward investors demand for locking their money away—is determined globally. The expectation of tighter money abroad could push American rates up, too.

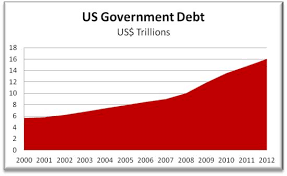

The second threat is fiscal policy. President Donald Trump’s tax cuts, which are expected to cost around $ 1trn over a decade, have deepened the hole in America’s public finances. A budget deal in March raises annual spending by at least $ 143bn (0.7% of GDP). Pension and health-care costs are rising. On April 9th official budget-watchers projected deficits greater than 4% of GDP every year for the next decade. Primary dealers—middlemen between governments and investors in the public-debt market—expect almost $ 1trn of net issuance of new debt in the 12 months to September 2018.

The third threat comes from abroad. China and America have engaged in several rounds of setting or threatening tit-for-tat tariffs on each other’s exports. If a trade war erupts, one way China could retaliate might be to reduce its holdings of Treasuries, currently about $ 1.2trn.

So there is much to worry the bond bears. But all three threats are somewhat overblown. Start with China. If it dumped dollar assets, it would push down the greenback, boosting American exports. That would be a strange move in a trade war. It has been reported that China could do the opposite—boost its exports by devaluing the yuan—though this too is improbable. A big devaluation would damage China’s authority around the world, and might trigger another round of capital outflows. The Chinese government has fought hard to stop these over the past two years.

The Fed, meanwhile, signalled its plans to shrink its balance-sheet well in advance, so the effects of reversing QE should mostly be priced in. And the loose consensus among economists is that asset purchases brought down the ten-year yield by only about a percentage point. Not all think the effect on the way out will be as large.

As for fiscal laxity, net new borrowing of nearly $ 1trn is relatively small compared with the gross amount of debt America regularly rolls over. (In the year to February, the Treasury issued securities worth over $ 9trn.) That interest rates remain low despite plentiful public borrowing indicates that safe assets are still in demand. Thank structural shifts in the world economy, such as rising life expectancy that causes more saving for retirement.

America faces a big challenge balancing its books in the long term. If it does not, interest rates must soar eventually. But countries usually have fiscal wriggle-room as long as they grow, in nominal terms, at a rate higher than the interest on their debt. America remains well within this comfort zone. Rates may rise a little more, but that would give the Fed welcome room to loosen policy the next time recession strikes. Pessimists who thought rates would never rise were wrong. Today’s bond-market doomsayers probably are, too.

This article appeared in the Finance and economics section of the print edition under the headline “Shake it off”