Goldman: Unemployment will drop to lowest since ’69

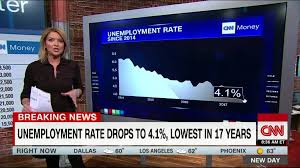

America’s unemployment rate has plummeted from 10% during the Great Recession to 4.1% today. Goldman Sachs thinks it’s not done falling.

The unemployment rate is likely to tumble to 3.5% by the end of 2019, Goldman Sachs predicted in a report published late Friday.

The last time unemployment was 3.5% was December 1969, according to the Bureau of Labor Statistics.

“Such a scenario would take the U.S. labor market into territory almost never seen outside of a major wartime mobilization,” Goldman Sachs chief economist Jan Hatzius wrote.

It’s a remarkable transformation given the millions of jobs lost and 10% unemployment experienced in the aftermath of the Great Recession.

Hatzius said 3.5% unemployment would symbolize an evolution from the “weakest labor market in postwar U.S. history to one of the tightest.”

Trump has frequently predicted his plan for tax cuts will be a huge boon for the economy.

Goldman Sachs explained its economic optimism by pointing to “impressive momentum” that will be bolstered by post-hurricane rebuilding and “tax cuts now on the horizon.”

However, the firm said it expects the GOP tax plan will only have a “moderate” impact on the economy.

No matter the cause, Americans may finally get a much-needed raise. Hatzius predicted that “unimpressive” wage growth will finally accelerate thanks to the shrinking pool of available workers. He said wage growth should reach the 3% to 3.25% rate consistent with full employment in 2018.

Wage growth has been a glaring missing ingredient in the economic recovery. Nearly half of Americans polled by Pew in October feel their wages haven’t kept up with the cost of living.

Related: Is now really the time for massive tax cuts?

There’s no doubt that stronger wages and 3.5% unemployment would be terrific news for Americans who have long been disappointed by the recovery from the Great Recession.

But for Wall Street, there could be reason for caution in the longer run. One reason: significant pay hikes would eat into corporate profits, and thus stock prices.

Moreover, if the unemployment rate gets to 1969 levels, the Federal Reserve may be forced to speed up interest rate hikes out of concern inflation will rear its ugly head. That could alarm investors because the Fed’s promise to only gradually raise rates has been a major driver of the stock market boom.

The job market “strength is becoming ‘too much of a good thing,'” Hatzius wrote. “Containing further overheating will become a more urgent priority in 2018 and beyond.”

That’s why he forecasts the Fed will raise interest rates four times next year, which is more than Wall Street is anticipating. Raising rates too quickly could even bring on a recession.

Morgan Stanley recently warned that adding expensive tax cuts to a healthy economy could cause the economy and stocks to “boom then bust.”

David Kelly, chief global strategist at JPMorgan Funds, wrote in a report on Monday that he’s also worried the economic expansion and bull market could get “overcooked” by continued low rates and tax cuts that are “entirely inappropriate.”

“For now, there are still only minor signs of overcooking. However, looking ahead to 2018, fiscal policy is about to turn up the heat,” he wrote.

<!--