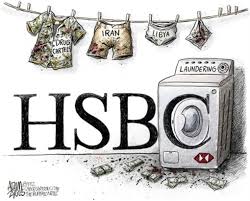

HSBC Has Been Accused of Ignoring Money Laundering in an Epic Corruption Scandal

The British banking giant HSBC hsbc chose to ignore money laundering by the Indian-South African Gupta family through its services, a British peer has claimed.

Peter Hain, who grew up in South Africa and was a high-profile anti-apartheid activist, on Tuesday sent the U.K. Treasury and Financial Conduct Authority (FCA) printouts of the Guptas’ money transfers from their South African HSBC bank accounts to accounts with the same bank in Dubai and Hong Kong. Some of the transactions were legitimate, but others weren’t, he said.

As Hain put it in a Wednesday speech in the House of Lords: “The latter illicit transactions were flagged internally in the bank concerned as suspicious, but I am reliably informed that it was told by the U.K. headquarters to ignore it. That is an iniquitous breach of legal banking practice in the U.K.…and it is also an incitement to money laundering, which has self-evidently occurred in this case, sanctioned by a British bank, as part of the flagrant robbery from South African taxpayers of many millions of pounds and many billions of their local currency, the rand.”

The brothers Ajay, Atul, and Rajesh Gupta have very close ties to South African president Jacob Zuma and his family, and have been implicated in many allegations of severe corruption. Multiple politicians have said that the Guptas offered them senior political positions, along with wads of cash, in order to get them on-side. Email leaks and investigative journalism by outfits such as amaBhungane have also strongly indicated that the Guptas are in control of many lucrative state contracts, and that they demanded kickbacks from multinationals to facilitate these deals.

Since these allegations surfaced, a number of multinational companies have taken serious reputational damage for their parts in the scandals, including KPMG, McKinsey, SAP and the now-shuttered public relations agency Bell Pottinger, which orchestrated a racially divisive campaign on the Guptas’ behalf.

Now, it seems, the spotlight is turning to the international financial services industry—South African banks stopped serving the Guptas in mid-2016 due to money-laundering fears, and India’s Bank of Baroda has been trying to follow suit.

A couple of weeks ago, Hain informed the U.K. Financial Conduct Authority (FCA) that the Guptas may have siphoned off funds through their HSBC and Standard Chartered accounts in the United Arab Emirates and Hong Kong. The FCA subsequently launched an investigation, and Standard Chartered scbff said it had closed Gupta accounts in 2014 “after an internal investigation.”

Read This: SAP Is Being Investigated by the U.S. Over a Major International Kickback Scandal

The question now is whether, as Hain alleged this week, HSBC ignored the red flags raised by its own compliance unit. Not only could this be a criminal issue in the U.K.—it could also have an effect on HSBC’s deferred prosecution agreement with the U.S. authorities over its money laundering for clients including Mexican drug cartels, if the relevant transactions took place within the last five years and involved U.S. dollars.

When asked for comment on Hain’s latest allegations, HSBC referred only to his previous communications with the Treasury, quoting what CEO Stuart Gulliver said about that subject on a Monday results call: “Obviously we are responding to those enquiries that have come in from the FCA and also from South African authorities, and there is nothing more I can really add at this point in time.”

Standard Chartered said in a statement: “We have found no evidence that we banked the Guptas directly, but we closed all accounts we identified as linked to their business interests some time ago following internal investigations. If new information becomes available we will review our records and take appropriate action where warranted. Standard Chartered takes its responsibility to combat financial crime very seriously and is fully committed to doing business in accordance with local and international regulatory and legal requirements. We will provide full assistance to all relevant authorities in connection with any enquiries into this matter.”

Hain’s Wednesday speech in the Lords is worth reading, as it recounted the human impact of the Guptas’ alleged misdeeds, including as an example the infamous case of the Estina dairy farm.

A regionally-funded project was supposed to build a dairy farm in the South African countryside town of Vrede, to stimulate the local economy—the farm was to be part-owned by poor locals. The project was never put out to tender and was awarded to a Gupta-linked company called Estina, which reportedly then laundered most of the $ 8 million in funding via now-shuttered Standard Chartered accounts, through shell companies in the UAE, then back into South Africa to pay for a lavish family wedding. The Vrede townspeople’s cows died of apparent malnutrition.

Numerous attempts to remove Zuma through votes of no confidence have failed, despite the last taking place through a secret ballot. Veterans of the struggle against apartheid have now begun what they hope will be a major campaign of civil disobedience, in the hope of securing Zuma’s arrest for corruption.