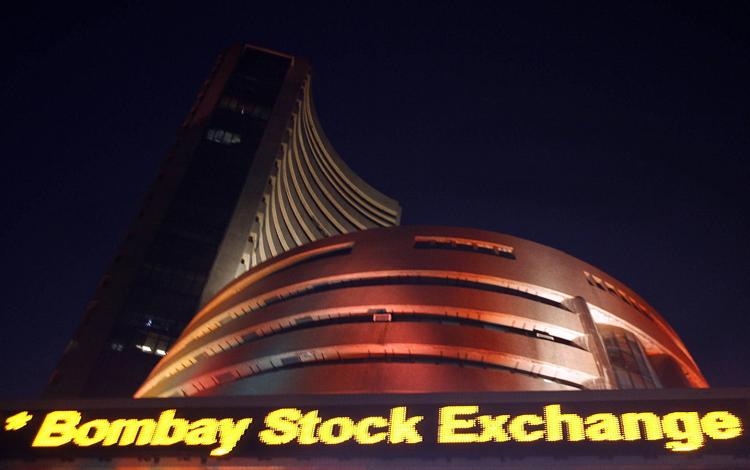

India : Global cues, profit booking drag Sensex 374 pts; ONGC sinks 4%

Bears dominated at Dalal Street on Monday as the BSE Sensex plunged nearly 400 points intraday on profit booking and global weakness, weighed by banks, infra, auto, FMCG and PSU oil & gas stocks.The 30-share BSE Sensex was down 373.94 points or 1.30 percent at 28294.28, continuing downtrend for the second consecutive session. The 50-share NSE hit an intraday low of 8715, before closing down 108.50 points or 1.23 percent at 8723.05.

The broader markets also ended lower but outperformed benchmarks, falling half a percent on weak breadth. About 1655 shares declined against 1035 advancing shares on the BSE.

The market correction is warranted, experts say, adding a 5-8 percent fall is normal after rallying 20-23 percent from February lows. According to them, US presidential election (to be held in November) will be closely watched by global investors.

Shankar Sharma of First Global believes the emerging markets’ down cycle bottomed out in February and the next few years look very good for these markets on a relative basis.

While growth for large caps look tepid, he expects mid caps and small caps to outperform as they typically grow lot faster than large caps.

UR Bhat, Director of Dalton Capital Advisors says emerging markets like India will remain a favourite spot for foreign investors till the next US Fed rate hike.

If foreign money continues to flow in, the market should trade in a range despite selling by domestic institutions, he feels.

European stocks were lower on profit booking and as investors trod cautiously ahead of an OPEC producers meeting in Algeria this week. Britain’s FTSE, Germany’s DAX and France’s CAC were down 1-1.5 percent, at the time of writing this article. Asia closed lower with the major indices Shanghai, Nikkei and Hang Seng falling 1.3-1.7 percent.

Back home, the Nifty Bank, Auto and FMCG indices fell more than 1.5 percent.

ONGC shares plunged 4 percent after sources told CNBC-TV18 that divestment of 5 percent stake is likely this fiscal. The government is likely to raise Rs 10,000-12,000 crore via stake sale.

Reliance Industries rallied 2.4 percent intraday to touch 27-month high of Rs 1,128.90 but wiped out some gains in afternoon. The stock gained 0.58 percent at close.

ICICI Bank, ITC, Tata Motors, L&T and HDFC Bank were top five contributors to Sensex’s fall, losing 1-3 percent while Coal India and Lupin gained 0.5-1 percent.

Telecom stocks were in focus as the Department of Telecom started two-day mock auction that will end on September 27. Seven companies have deposited Rs 14,653 crore and the government is looking to mop up around Rs 1.46 lakh crore through the spectrum auction that will actually begin on October 1.

Idea Cellular fell over 2 percent. Morgan Stanley has slashed target price of the stock to Rs 70 from Rs 89 earlier as it believes the share price will fall relative to the country index over the next 60 days. This is because of lowered forecast/guidance, it says.

Auto component maker GNA Axles closed at Rs 245.05 on day 1, up 18.5 percent over issue price of Rs 207.

Marksans Pharma shares surged 10.8 percent on approval from the US health regulator for antihistamine drug Loratadine liquid filled capsules 10 mg.

Kilitch Drugs was locked at 20 percent upper circuit after Ethiopia government allotted land to its subsidiary for setting up pharma unit.