The passing week’s major change of behavior in the stock markets took place in the Dow futures as well. The description and thoughts as of the price action events are covered in the S&P Futures review.

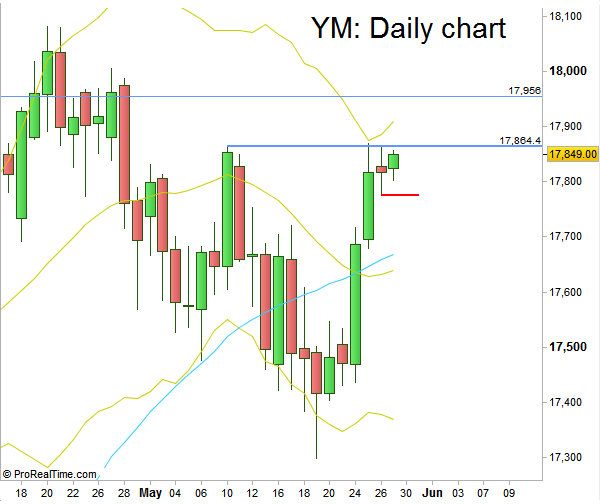

The Dow Jones is currently weaker that the SP500 and the Nasdaq. Still, it managed to take out the high at 17864 which is a clear midterm bullish sign.

Currently there is a short term bullish setup on the Daily timeframe. A thrust above the High of last Wednesday at 17869, only if takes place after one more day in the range (which is quite suitable for Monday’s half trading day) -is a good bullish signal and should give the same move up as the amplitude from the Low made ever since Wednesday (currently the Low of Thursday at 17777), so the target would be the 17960 level (unless the market corrects below 17777 before breaking up). Important resistance lies at 17892.

If the above scenario does happen, there are very good chances to have a Weekly correction after. However, taking out the High of April at 18083 is a setup for a wider bullish move that would probably take out the all time high at 18334 and probably continues to the 18850 level (Initial stop at the Weekly swing Low, 17297).

Dow Futures: Daily chart (at the courtesy of prorealtime.com)

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.