4 Guru-Backed Restaurant Stocks Worth Owning

Restaurants that survive by creating a solid brand around efficient operations can raise their prices to meet with inflationary demands and have a recurring customer base, no email marketing necessary. Chipotle (CMG), Panera Bread (NASDAQ:PNRA), Buffalo Wild Wings(NASDAQ:BWLD) and BJ’s Restaurants (NASDAQ:BJRI) are all good buys as a basket of stocks that give an investor exposure to this sector of the market.

Chipotle (NYSE:CMG)

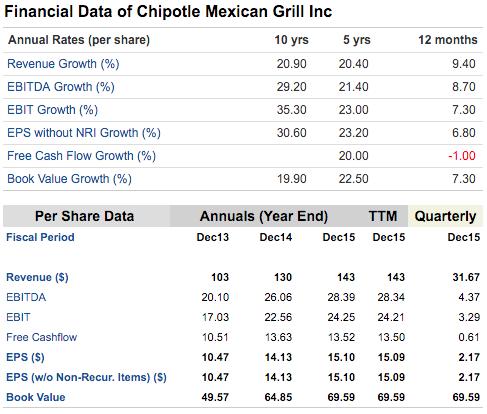

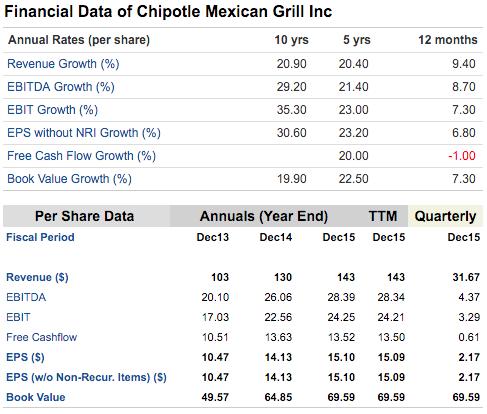

I forecasted the stock to hit $ 400 this year, which almost turned into reality as the stock closed Jan. 12 at $ 404. But with the worst seemingly over from the food safety issues that hit the company at the end of 2015, it’s just as ownership worthy at $ 460 and below. Chipotle did end 2015 on a down note, reporting Q4 earnings of $ 2.17 a share, off 44% from 2014’s numbers. With $ 4.5 billion in sales, however, Chipotle remains the leading company in the $ 9 billion domestic fast-casual Mexican category and one of the largest players in the $ 40 billlion entire fast-casual industry. This year and next should be a good for the business in getting the brand back on track.

- Warning! GuruFocus has detected 2 Warning Signs with BJRI. Click here to check it out.

- BJRI 15-Year Financial Data

- The intrinsic value of BJRI

- Peter Lynch Chart of BJRI

Jim Simons (Trades, Portfolio), Stanley Druckenmiller (Trades, Portfolio), Joel Greenblatt (Trades,Portfolio), Steven Cohen (Trades, Portfolio), Frank Sands (Trades, Portfolio) and Jeremy Grantham(Trades, Portfolio) all have exposure to CMG, with Sands owning roughly 5% of the outstanding shares.

Panera (NASDAQ:PNRA)

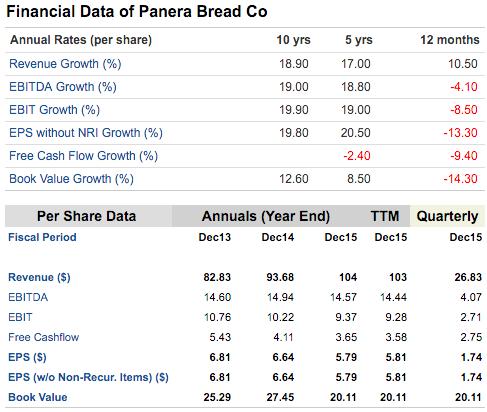

Leading the way in digital technology, Panera has implemented new kiosks to help guests order more quickly on their own, take their number and coffee/drink cup and be seated. This will be the future for every fast-casual restaurant in my opinion. From a financial standpoint, Panera is trading at a fairly high multiple, but with the company buying back stock and boosting growth through intelligent capital spending, the stock is worth owning at these levels. Panera is right up there with Chipotle in the fast-casual sector, Earnings were better than expected in the fourth quarter due to 6.4% comps in company-owned locations through continued price hikes on the menu.

Jim Simons (Trades, Portfolio), Ron Baron and Jeremy Grantham (Trades, Portfolio) all have small portion of AUM in Panera.

Buffalo Wild Wings (NASDAQ:BWLD)

After hitting $ 200 a share last September, BWLD is down about 25%, giving investors a great buying price. Purely from a numbers standpoint, it’s hard to ask for a better growth stock. Now with 490 restaurants, the company generates $ 95 million in net income ($ 5 per share) on $ 1.8 billion in sales. That’s up from $ 16 million in profit on $ 278 million in sales from just a decade ago. While Buffalo Wild Wings’ latest quarterly results missed the mark, the future is still very bright for the company, and its shareholders with the expect EPS to come in around $ 6 per share in 2016.

Steven Cohen owns a little over 1% of BWLD stock and Chuck Royce (Trades, Portfolio), Pioneer Investments and Caxton Associates all have small stakes in Buffalo Wild Wings.

BJ’s Restaurants (NASDAQ:BJRI)

For those unfamiliar with the company, it owns and operates 158 restaurants with a menu of deep-dish pizza, craft beers and other beers, as well as a range of appetizers, entrees, pastas, sandwiches, specialty salads and desserts, including its Pizookie dessert. Right up there with Buffalo Wild Wings, BJ’s has a great growth story of its own. In the last decade, sales have grown by 285%, net income is up 350% and book value has more than doubled. It finished last year strong with $ 233.1 million on the top line and 43 cents a share on the bottom line. In the coming years, investors could see this one well over $ 100 per share.

Jim Simons (Trades, Portfolio) and Paul Tudor Jones (Trades, Portfolio) have small stakes, with Ron Baron owning over 5% of the company’s stock.

Conclusion

The restaurant business is fiercely competitive, but the winners that make it out the pack survive and grow for a long time, and can handle rising prices and market downturns.

Disclosure: I have no positions in any of the stocks mentioned.

Photo: Dubrovnik 5 via photopin (license)