Generate Thousands a Week From ‘Secret’ Trading Ground

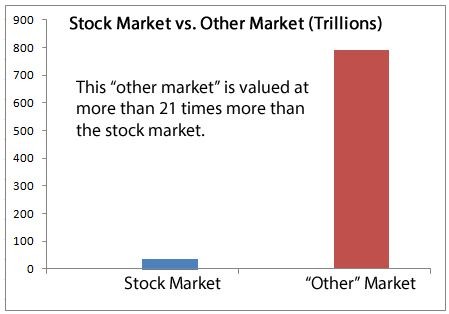

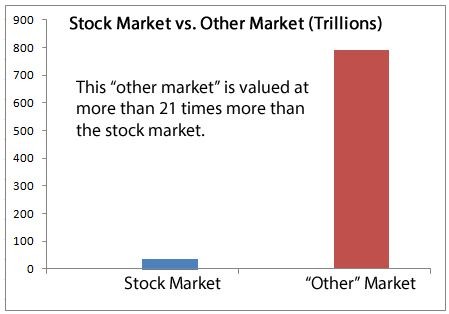

When most people think of investing, they think of the stock market, which is valued at about $ 36.6 trillion.

That’s a lot of money.

But few people realize that there is a much bigger market out there — one that’s valued at over $ 790 trillion, 21 times more than the stock market.

In fact, The Economist calls it “the biggest financial exchange you have never heard of.”

The reality is that the stock market is only a tiny portion of the whole financial system. And when it comes to the Wall Street investment banks, hotshot traders and brokerage houses, stocks aren’t their main source of income.

Instead, a large portion of their profits come from a category of investments known as derivatives. These are various types of “bets” — what interest rates will be next month… where fuel prices will trade at… or even stock prices themselves.

Many of these derivatives serve a purpose. For example, they allow airlines to hedge against rising fuel prices, and they protect farmers from falling crop prices or bad weather.

But many of the bets being placed in this behind-the-scenes market are downright risky.

For instance, I recently saw a bet that Netflix (NASDAQ: NFLX) would nearly double to $ 180 in three weeks. Netflix’s share price has never gone up that high or that fast, so the chances of that happening are close to nil.

Who would place such a bet? Maybe a hotshot trader or one of Wall Street’s wealthy clients with perhaps more money than common sense.

How to Win in Wall Street’s Casino

Allow me to use a casino analogy to better illustrate how this market works.

Every day, people walk through the casino’s doors seeking that one big payout. Sure, a few hit the jackpot, but most are lucky to simply break even or only lose a little, while others lose their shirts.

Regardless, the house always wins.

That’s exactly how the derivatives market works on Wall Street. It’s like a financial casino where risk-loving speculators come to place bets. And it’s for this very reason that it’s one of Wall Street’s main sources of income.

In most cases, Wall Street firms will simply take the speculator’s money like a dealer collecting bets at a gaming table in Las Vegas.

Surprisingly, though, a number of average traders have learned how to skim some of those profits from Wall Street, intercepting bets and putting the money directly in their brokerage accounts.

Before I go any further, let me assure you that what they are doing is 100% legal. The way I see it, it’s better they get the money than Wall Street.

And I’m not talking about $ 10, $ 20 or $ 50 bets here. Most of them are skimming hundreds or thousands of dollars… on multiple stocks… and they’re doing it week after week.

It might be hard to believe, but they really are just regular people.

David C. is a prime example. He is an auto mechanic who wasn’t making nearly enough to retire on, so he figured he’d end up working in a garage for the rest of his life.

Then I showed him how easily he could skim a few hundred — even a few thousand — dollars on a regular basis, and he wrote me afterward:

“Thank you for your easy to understand [instructions]. I started out conservatively to make sure I understood what would happen, making $ 200 to $ 500 a month. Now I make between $ 1,000 and $ 2,000.”

There’s also California warehouse manager Stephen M., who told me, “I am very impressed. I can generate enough to live on without having to work, a long-term goal of mine.”

And Martin F., a Pennsylvania state fire marshal, who said, “Once I wrapped my hands around it, it became almost second nature. I made over $ 24,700 dollars last year.”

These people didn’t have any specialized skill or training. Yet each learned how to supplement their income by skimming money from this other market.

I’ve personally skimmed tens of thousands of dollars this way over the past two years. Each time, it takes me only two to three minutes. And I do it from my laptop, sitting comfortably in my living room.

If you’re interested doing the same, I’ve put together a free presentation that you can access here.