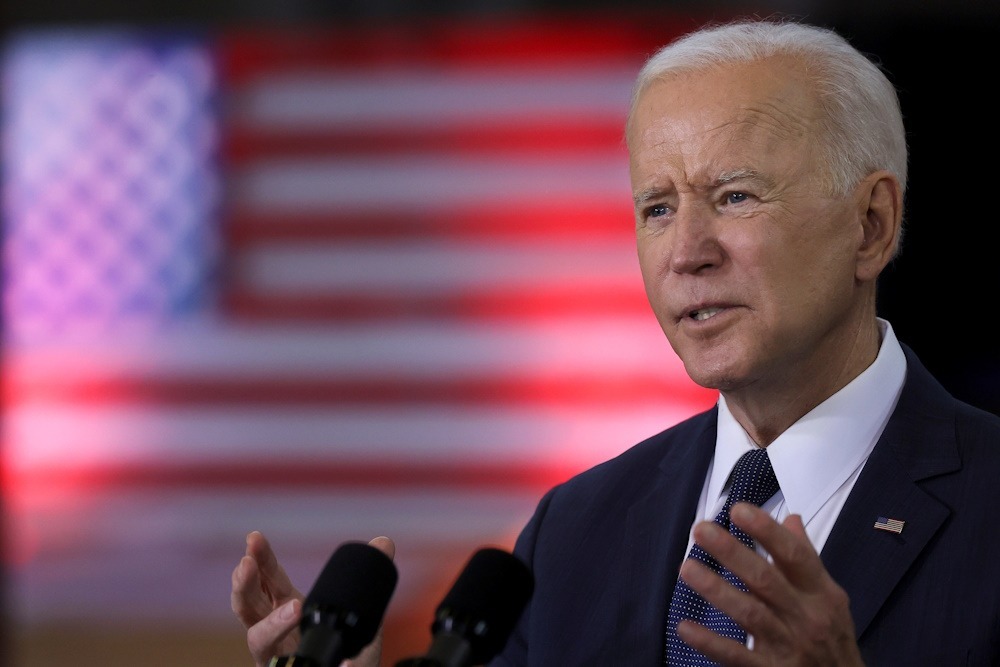

Biden imposes severe tariffs on China

Following the announcement of President Biden’s intention to increase tariffs on Chinese electric vehicles to almost 100%, Donald Trump took action to surpass his competitor in the race for the presidency.

The former president declared at a rally in New Jersey on Saturday that he would impose a 200% tariff on all automobiles imported from Chinese factories located in Mexico. According to him, Biden was plagiarizing his trade plan that focuses on tariffs. “Biden ultimately heeded my advice,” Trump stated. “He is approximately four years overdue.”

The response revealed a dynamic that currently lies at the core of U.S. trade policy: Both political parties’ leaders are competing to swiftly implement stringent trade barriers with China. Trump’s first attempt to undermine the bipartisan belief in free trade has now evolved into a widely accepted viewpoint among the establishment.

In addition to imposing higher tariffs on electric vehicles, the White House has said that President Biden will raise the tariff rate on steel and aluminum products from 7.5% to 25%. Similarly, the tariff on solar cells will increase from 25% to 50%, and a new duty of 25% will be imposed on maritime cranes. The tariff hikes, including a 25% rise for larger storage batteries and a new 25% tariff on natural graphite, will be implemented this year. However, further tariff increases will be introduced in 2026.

Senior officials in the Biden administration have stated that they postponed the implementation of certain tariff hikes in order to provide American firms with sufficient time to reconfigure their supply chains. The White House announced that the newly imposed tariffs will be applicable to $18 billion worth of imports from China. These duties specifically target goods such as EV batteries, essential minerals, and medical equipment. By 2025, the tariff rate for Chinese chips is set to increase from 25% to 50%.

Biden’s decision concludes a prolonged and contentious deliberation within the administration on the tariffs that were initially imposed by Trump on imports from China, amounting to nearly $300 billion. The taxes, which were introduced in 2018 and 2019 and further enhanced by Biden’s recent measures, have now become a presumably enduring aspect of U.S. policy towards China.

Last week, a representative from China’s foreign ministry strongly criticized the anticipated action, stating that it further exacerbated the existing tensions between the United States and China.

Indeed, Biden and his staff have consistently attempted to highlight the differences between his approach to trade and that of Trump. They contend that the president’s actions are aimed at particular sectors that the U.S. is providing financial assistance to in order to enhance local production capabilities. Biden’s approach is more limited in scope compared to Trump’s proposed agenda for a potential second term, which included implementing a minimum 60% tax on all Chinese goods and putting a 10% fee on all imports.

“According to Lael Brainard, the national economic adviser, the president is implementing a strong and strategic approach that involves investing domestically and enforcing regulations against China in important industries. This is different from the previous administration, which did not successfully carry out these actions,” Brainard said reporters. Brainard asserted that Trump’s proposed 10% tariff on all imports would result in inflation, while Biden’s advisers contended that their new measures would not cause an increase in costs.

As Biden contemplated his course of action over Trump’s tariffs, he encountered political pressure from inside his own party to take action, as well as significant disagreements among his top aides regarding the potential consequences of such actions.

A coalition of Senate Democrats hailing from politically contested swing states, led by Senate Majority Leader Chuck Schumer (D., N.Y.), have been advocating for President Biden to either retain or increase tariffs on China. The president was also influenced by labor unions to safeguard domestic industry against inexpensive Chinese goods. Indicating a strong awareness of the political consequences, Biden demonstrated his attentiveness during a campaign visit to Pittsburgh last month, where he preempted the interagency process by providing an advance preview of the forthcoming taxes on steel and aluminum imports from China.

Biden also considered the concerns of economic advisers who regarded certain tariffs implemented during the Trump era as lacking in strategic value and perhaps contributing to inflation. Although certain senior officials in the Biden administration view these tariffs as unfavorable policy, they are maintaining them to exert ongoing pressure on Beijing, according to the officials.

According to Myron Brilliant, a former executive vice president at the U.S. Chamber of Commerce, it is a reality that nobody desires to appear feeble while dealing with China. Brilliant, like many in Washington, expresses concerns about the widespread implementation of tariffs, cautioning about the potential expenses for American consumers. “I believe that President Biden should not attempt to surpass Trump in terms of trade and tariffs,” he stated.

The Biden administration has been increasingly concerned about Chinese economic practices for some months. During the Biden administration, the United States has allocated billions of dollars towards enhancing its domestic manufacturing capabilities in sectors such as electric vehicles, semiconductors, solar panels, and other industries where China holds a strong position.

However, when the Chinese macroeconomy began to decline, policymakers in China increased their efforts in producing goods in the same industries that the United States was focusing on. Biden administration officials are concerned that Chinese manufacturing had sufficient strength to globally reduce prices, so undermining emerging U.S. companies and rendering the subsidies provided by the Biden government ineffective.

“These tariffs are the result of conflicting industrial policies between the two countries and the approaching election season in the U.S.,” stated Eswar Prasad, a distinguished scholar at the Brookings Institution.

Prasad expressed concern that the recent implementation of Biden’s tariffs could lead to Chinese retaliation, perhaps negatively impacting the growth of the U.S. economy. He stated that if both Republicans and Democrats persist in adopting a combative approach towards China in order to secure political positions, it could negatively impact the relations between the two countries.

Trump has pledged to once again utilize tariffs as a tool in his second term, outlining his intentions to slap taxes on both allies and foes. Throughout campaign speeches and other public appearances, the ex-president has expressed inconsistent views regarding his intentions to impose a sequence of further tariffs on China’s economy.

In March, Trump announced his intention to implement a 100% tariff on Chinese vehicles manufactured in Mexico and imported into the United States. During his speech in New Jersey on Saturday, he increased the planned tariff rate to twice its original amount, explicitly stating that it would be applicable to both gasoline-powered and electric vehicles.

“Biden’s plan to increase tariffs on China is merely a strategic maneuver to surpass the election, and subsequently, there will be a catastrophic collapse,” said Trump.