Beloved Stock Could Easily Plummet Over Next Few Weeks

Arguably the hottest media stock of the past year, Netflix (NASDAQ: NFLX), has been in serious decline for the past five weeks. And by serious I mean it has shed nearly a quarter of its market capitalization since peaking in early August.

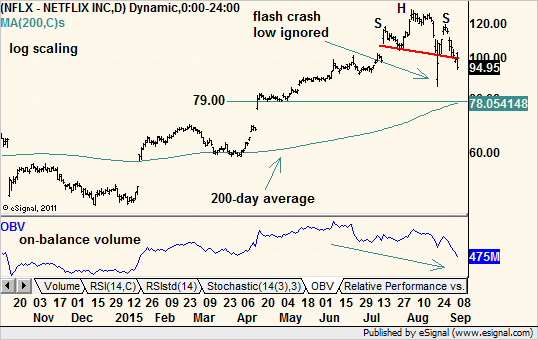

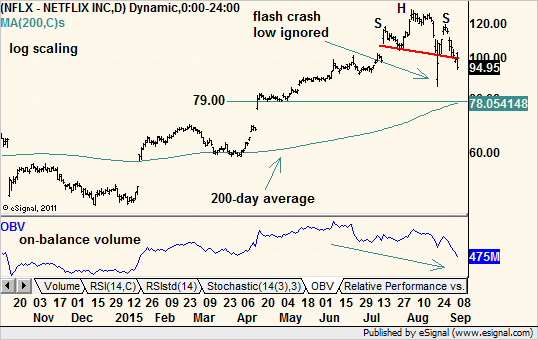

This has bargain hunters chomping at the bit. But a look at the chart tells us at its current “sale” price it is not cheap and could drop another 20% from here in a hurry.

In short, this is a stock for short-term bears that may present a good buying opportunity for long-term bulls in a few weeks.

Since this column focuses on trading, not long-term investing, let’s take a look at the reasons why Netflix has a fork stuck in it.

The rather obvious technical pattern on the chart is the ubiquitous head-and-shoulders with its central high (head) flanked by two lower highs (shoulders) on each side. The bottom of the pattern is bound by the neckline, which connects the troughs between the peaks. Whether it is drawn flat or with a slight downward slope from left to right is not important.

What is important is that Neflix closed below that neckline on Friday after the weak August jobs report. On Tuesday, when trading resumed after the long Labor Day weekend, it jumped with the rest of the market at the open on rumors that China would embark on a stimulus program.

However, unlike the Dow Jones Industrial Average, which went on to post a 390-point gain, Netflix found its daily high immediately and then sold off. Within minutes it gave up its gains, and by the close it was down nearly 4%.

In technical jargon, it was an intraday reversal to the downside and failure at the now-broken neckline. In other words, the initial euphoria wore off in a hurry as the bears grabbed the controls once again and the major trend to the downside reasserted itself.

Of course, in order for a head-and-shoulders pattern to form, prices necessarily must no longer be near their highs. A good deal of the decline is already in the past, but as I mentioned, there is plenty left for new bears to grab.

The downside target is the height of the pattern projected down from the breakdown point. On a linear scaled chart, that would be in the $ 72.50 area. However, I have found that projecting downside targets this way on stocks or indices that have seen very large price moves can result in levels that are too aggressive. For example, projecting a downside target in 2000 after the Internet bubble popped would have given the Nasdaq a negative number target. Clearly, that would be wrong.

That is why I start with a log scaled chart and then physically measure the pattern by holding a pencil or piece of paper up to my computer screen, grabbing the measurement and moving that down from the breakdown point. Rather than measure dollars, I measure pixels or millimeters.

For Netflix, this gives a downside target of $ 79. As supporting evidence, the 200-day moving average will rise up to that level in just a few weeks.

There are other technicals supporting the bearish view. They include falling momentum indicator peaks during the head-and-shoulders pattern, a shift in relative performance versus the market and falling on-balance volume since June. Money has been fleeing this stock and its very lofty trailing price-to-earnings (P/E) ratio.

Maybe Netflix has lost its luster and investors no longer give it the benefit of the doubt with crazy valuations. Or maybe its game-changing business model is already viewed as old hat now that competitors are trying to invade its space.

All of that is for fundamental analysts to hash out. What I see on the charts tells me that Netflix is done — at least for now. It’s time to ride the mo-mo train to the downside.

Recommended Trade Setup:

— Sell NFLX short at the market price

— Set stop-loss at $ 104

— Set initial price target at $ 79 for a potential 20% gain in four weeks

Note: Before you short shares of NFLX, though, consider this: You could turn that 20% drop into a 50% profit risking as little as $ 3,100. A similar trade turned an 8% drop in Alibaba (NYSE: BABA) into a 69% profit. I urge you to take a few minutes to watch this presentation to find out how. After doing so you may never short another stock again. Click here to access it.