Investors Should Say ‘No’ Because Knowledge Is Like Compound Interest

The plight of the investor is to say, “No,” “Nope”, or “Oh hell no! you lying, cheating… ” not once, twice but over and over again. The simple fact is that there are more unattractive opportunities than stellar prospects. It would be so much easier on the human psyche, if the amount of time we spent on research yielded a steady predictable return. Instead, we invest lots of time analyzing individual stocks only to find many “close but can’t pull the trigger” situations.

I’ve found there’s another way to look at the arduous task of research. The more you say “no” and the more you improve as an investor, the more you can appreciate your own development. You begin to notice many of the companies you say “no” to drift down in price or languish. The more you say “no,” the more patterns and connections appear. The task is most difficult in the beginning because the knowledge base is nonexistent so no connections or patterns exist. But once you get over the hump and knowledge accumulates, saying “no” becomes satisfying. To quote Warren Buffett (Trades, Portfolio), “That’s how knowledge works. It builds up, like compound interest.”

Last year, I actually did say, “Oh hell no! you lying, cheating…” to Corinthian Colleges(COCOQ), one of the largest for-profit colleges in the U.S. The stock plummeted after the government began investigating the company, but that happens in many cases and companies get off with light penalties. Readers may recall news stories of students who refused to pay their debts for enrolling at COCOQ. It turns out the company was accused of falsifying graduation rates and could not recover from the bad publicity. In May of this year, COCOQ filed for bankruptcy. In the past, I’ve also quickly skimmed Apollo Education Group (NASDAQ:APOL) which operates the University of Phoenix.

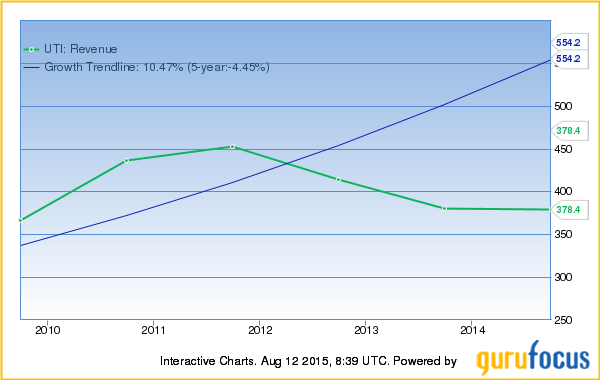

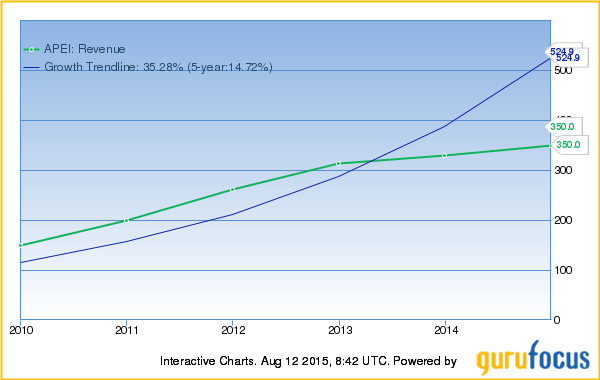

This week, two for-profit colleges, Universal Technical Institute, Inc. (NYSE:UTI) and American Public Education, Inc. (NASDAQ:APEI), had large percentage drops and showed up on my screener. UTI trains auto mechanics. APEI is a for-profit college that serves military students with online and offline offerings and also a separate independent nursing college.

Tough times for the “for profit college” industry

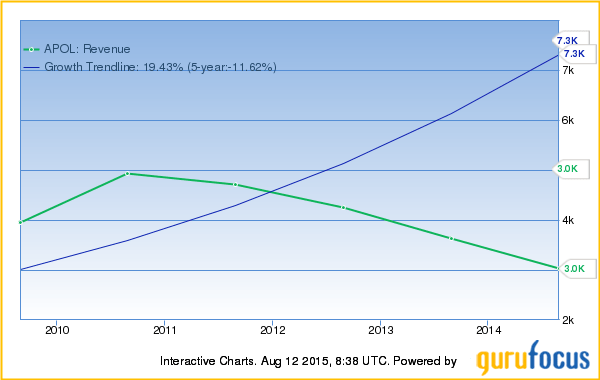

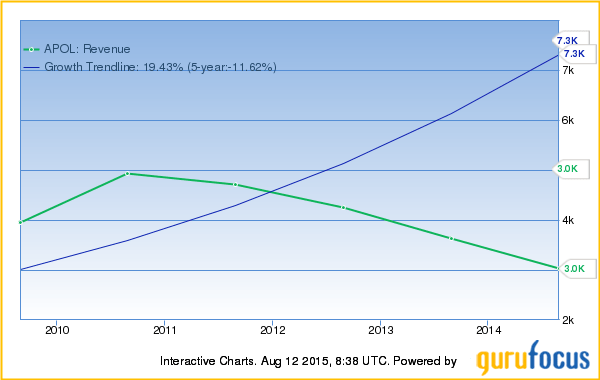

Understanding COCOQ’s situation, gave me context for the industry’s rapid decline. You can see the revenue trends for APOL, UTI and APEI in the last five years. There’s a steady decline starting from 2011. APEI’s chart doesn’t look as bad as the other two companies, but it will be affected by upcoming military budget cuts. As a result, analysts are negative on the company.

Researching UTI and APEI

- Both companies appear to have competitive advantages in their space. I can’t find another college that specializes in training auto mechanics. I don’t think community colleges are competitors. APEI appears to have an advantage for its targeted military students.

- Enrollment numbers disappointed for both last quarter

- Shortages for the occupations that they’re training – auto mechanics for UTI and nurses for APEI. The majority of APEI’s revenue comes from their other occupations, however.

- Advertising spend for digital media went up for both last quarter

- Both companies are using IT and data to select students who are more likely to graduate. Most likely a result of tougher regulations from the Department of Education.

- APEI was negatively affected by changes in tuition assistance. On the other hand, UTI management says more employers are picking up the tab for its students

Compounding knowledge

- For the time being, I’m saying no to both UTI and APEI.

- I’m still glad I took the time to read about each company. Learning that both companies spent more on data analytics and digital advertising gives me insight into companies like Google (NASDAQ:GOOG) and (NASDAQ:GOOGL) (now Alphabet) and Facebook(NASDAQ:FB).

- I researched Viacom recently and they were spending money on offering customers’ data analytics. UTI and APEI customers are most likely the same demographic that Viacom serves with channels like Comedy Central, MTV and VH1.

- I noticed that APEI had better ROI metrics than UTI and wondered why two companies in the same industry had such different economics. Knowledge gained from investing experience helped me realize that APEI generates part of its revenue from online classes which are much more scalable than UTI’s classes which require students to work on physical auto parts.

- My research gave me insight into student behavior. I speculate that customers want a quicker return on investment and job placement and are extremely wary of debt. This reinforces the hypothesis that consumers are focused on repairing personal balance sheets as lower oil prices have not translated into expected retail spending.

- It’s interesting that there’s a shortage for auto mechanics and nurses. Other industries I’ve researched lately include oil and aviation. There’s a surplus of oil workers and a shortage of airline pilots. UTI has a campus in Texas. Did former oil industry workers enroll?

- Both UTI and APEI will go on my watchlist. In coming quarters, I’ll check to see when the revenue decline reverses and if the price is right, I’ll confidently say, “I guess it looks good enough.” I can see Warren Buffett (Trades, Portfolio) in his office uttering those same words.

- Irrespective, knowledge yields benefits in the future.