Why I’m Following Buffett Into This Beaten-Down Market

As an economist for the state of Iowa, I learned that economic stimulus can affect growth — but only if given time to work. Of course, patience is not something investors or the markets are known for.

The lagging nature of stimulus on the economy can be excruciating for those with a stake, especially when the market wants instant gratification. This often manifests in whipsaws, where stock prices jump on news of economic stimulus, only to fall when the stimulus doesn’t come through in immediate economic growth.

With this in mind, and with a little patience, you can make good money as the rest of the market misses out on the bigger picture.

For instance, a surge in stimulus measures in one country may soon jumpstart its economy. As a result, a key trading partner could see its market jump as well. Plus, Warren Buffett has taken an interest in this beaten-down market. And one of my favorite strategies offers a chance to get paid while we wait for a rebound.

China Ramps Up Stimulus Measures

As of July 8, the Hang Seng index in Hong Kong had plummeted 14% in just a month as investors took profits following a huge rally in 2015. In response to this weakness, the Chinese government accelerated the stimulus measures it had been managing since November.

The People’s Bank of China (PBOC) has cut the benchmark interest rate four times since November and just lowered the reserve ratio for banks by another percentage point. The government has regularly used loan programs to jumpstart the economy. Earlier this month, the PBOC extended $ 25 billion in loans to a state-owned lender for the redevelopment of slum neighborhoods.

We already saw these new stimulus measures start trickling through when the world’s second-largest economy beat second-quarter growth expectations with 7% annualized GDP growth. And while iShares China Large-Cap (NYSE: FXI) is nearly 20% off its April high, shares are still up 13% in the past year. That momentum is likely just the beginning.

Today, I want to look at another market that moves closely with China’s GDP — Australia. This country sent almost a third of its $ 266.8 billion in 2014 merchandise exports to China. As a result, its stock market, which is down 20% over the past year, could get a big boost from the recovering Chinese economy.

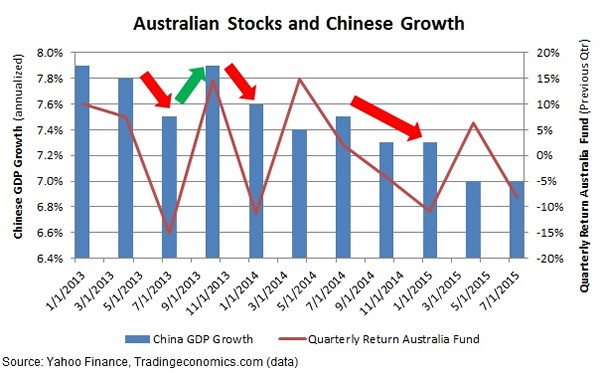

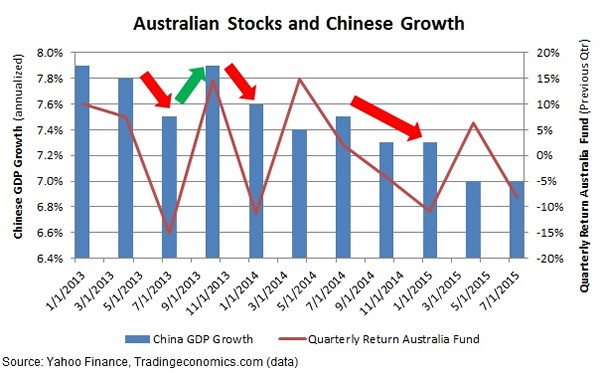

The chart below plots annualized GDP growth in China against the quarterly return on the iShares MSCI Australia (NYSE: EWA), an ETF with exposure to 70 Australian companies. The data points are for trailing results, so GDP growth and fund return shown are over the preceding quarter.

While Chinese economic growth and Australian stocks are not completely in sync, there is a clear relationship. GDP growth plunged 0.3% in the second quarter of 2013 and shares of Australian companies plummeted 15.3% over the quarter. When economic growth rebounded the following quarter, stocks jumped 14.7% over three months.

There have been a few quarters where Aussie stocks managed to overcome weaker China growth for positive returns, but the trend has been fairly consistent. When Chinese economic growth picks up, so do Australian stocks.

What does that mean now? Strong stimulus in China since November could surprise the market with stronger economic growth over the next six months. That would be a welcome surprise for investors in Australian equities and should send shares higher.

Buffett Invests Down Under

I am not the only one looking at the Australian stock market. Warren Buffett told CNBC recently that he plans on allocating an additional $ 2 billion a year of Berkshire Hathaway’s (NYSE: BRK-B) portfolio to companies in the country.

Shares of Australian companies look cheap, trading for less than 16 times trailing earnings, a 9% discount to valuations on the MSCI World Index, according to Goldman Sachs (NYSE: GS) analysts.

But Buffett’s time horizon of 10 to 30 years is a little longer than I want to wait for a trade. Instead of taking the long-term approach, we can use a strategy that pays us while we wait for a rebound. In fact, we could profit without ever taking a position in shares.

By selling put options on EWA, we commit to buying the shares at a certain price if they are below that price on expiration. For this commitment, we collect a premium now and keep that premium no matter what the shares do.

With EWA trading for $ 21.04 at the time of this writing, we can sell the EWA Oct 22 Put for about $ 1.40 each ($ 140 per contract). If EWA closes below the $ 22 strike price at expiration on Oct. 16, we will be assigned 100 shares per contact at that price. Since we received $ 1.40 in options premium, our actual cost is $ 20.60 per share — a 2.1% discount to the current price.

To be prepared for this scenario, we want to make sure we have enough money in our account to cover the purchase. This means setting aside $ 2,060 for every put contract we sell plus the $ 140 we collected.

If EWA closes above $ 22 on expiration, we keep the premium for a gain of 6.8% in 89 days. That’s a 28% annualized return.

The October expiration will give us time for Chinese monthly economic data to start showing the effects of recent stimulus. As China and possibly even global growth starts to brighten, the Australian market could turn up, allowing us to collect a nice profit on this trade.

Note: If you’d like to remove your fear of options for good, I urge you to watch this free put selling training video. In just eight minutes, an options expert with a 100% success rate reveals how she averages 53% annualized gains per closed trade — and how you could collect hundreds of dollars starting this week. Click here to watch.