Market Live: Sensex, Nifty cautious ahead of Infosys Q3 nos, macro data

1:55 pm Buzzing: Motilal Oswal has initiated coverage with Buy call on MAS Financial Services and target price of Rs 740, implying 18 percent potential upside as it is an efficient player in high growth product segment. The stock rallied nearly 5 percent intraday.

It believes MAS has all the ingredients of a good investment: (a) a small base and presence in well-developed states for strong growth, (b) superior asset quality, (c) relentless management focus on generating sustainable, high return ratios, (d) healthy capitalisation, and (e) consistent dividend payout.

1:40 pm Earnings: HT Media has reported a 36.1 percent growth in profit at Rs 124.4 crore for October-December quarter, compared to Rs 91.4 crore in year-ago, driven by operational performance.

Revenue during the quarter declined 3.8 percent to Rs 625.4 crore from Rs 649.9 crore YoY while operating profit jumped 21.9 percent to Rs 134.7 crore and margin expanded to 21.53 percent from 17 percent YoY.

1:25 pm Market Update: Benchmark indices continued to be rangebound, wiping out morning gains after four Supreme Court judges raised concerns over administration of the top court.

Traders also turned cautious ahead of Infosys Q3 earnings and macro data (November IIP and December CPI inflation) due later today.

A CNBC-TV18 poll expects Infosys’ dollar revenue and constant currency growth at 1 percent in Q3.

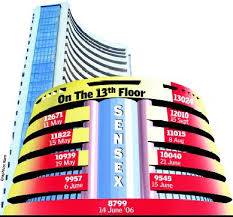

The 30-share Sensex was down 33.92 points at 34,469.57 and the 50-share NSE Nifty fell 12.60 points to 10,638.60.

About three shares declined for every two shares rising on the BSE.

1:20 pm BHEL commissions plant: BHEL has successfully commissioned a 250 MW thermal power unit in Bihar. The unit has been commissioned at Barauni Extension thermal power project of Bihar State Power Generation Company Limited.

Barauni Extension power project has two units of 250 MW each. BHEL has so far commissioned around 4,400 MW capacity of power plant in Bihar for various power developers, accounting for about 84 percent of total installed capacity in the state.

1:05 pm Product Launch: Havells India today unveiled a range of unique water purifiers capable of handling new age pollutants.

“These purifiers maintain the pH balance in water and add various essential minerals and trace elements lost during the reverse osmosis (RO) process,” the company said.

Commenting on the occasion, Shashank Shrivastav, Vice President, Havells India Limited, said, “With only 1 percent of the country covered, this is an extremely under penetrated and much needed product, our products will address consumers need and we target to garner at least 10 percent market share in next 3-4 years.”

Here are the top headlines at 1 pm from Moneycontrol News’ Sakshi Batra

12:50 pm Market Update: Benchmark indices extended losses amid volatility after Supreme Court judges said the working of top court not in order.

The 30-share BSE Sensex was down 119.87 points at 34,383.62 and the 50-share NSE Nifty fell 39 points to 10,612.20.

About two shares declined for every share rising on the BSE.

Justice J Chelameswar, the second senior most judge in the Supreme Court, today said the administration of the apex court is “sometimes not in order”

and many “less than desirable things” have taken place.

12:20 pm Management interview: In what has come as a shot in the arm for companies making air conditioners for the auto segment, the government has made use of air blowers compulsory in trucks; they should have an AC cabin. One of the big beneficiaries could be Subros. The stock has run up over 50 percent in the last three sessions and about 75 percent in the last three months.

In an interview to CNBC-TV18, PK Duggal, VP-Corporate Planning & Marketing at Subros said that we supply products to truck manufacturers.

He further said that we expect revenue of Rs 150-175 crore from the truck segment. We have the highest market share in the segment, he added.

Talking about capital expenditure, he said we require marginal amount for capital expenditure going ahead.

According to him, profitability from truck segment should be similar to car segment.

12:01 pm Stake Sale: Tata Chemicals has completed the sale of its urea and customised fertilisers business to Yara Fertilisers India Pvt Ltd for Rs 2,682 crore.

“The sale and transfer of urea and customised fertilisers business to Yara as contemplated in the scheme of arrangement has been completed today after the receipt of requisite regulatory approvals, fulfilment of conditions precedent and sanction of the National Company Law Tribunal, Mumbai,” Tata Chemicals said in a BSE filing.

The company has received the consideration of Rs 2,682 crore (subject to post completion working capital adjustments) from Yara on January 12, 2018, it added.

Here are the top headlines at 12 pm from Moneycontrol News’ Anchal Pathak

11:44 am Market Update: Equity benchmarks were trading higher but were off record highs. Banks, auto and metal stocks gained while IT, pharma and select FMCG stocks were under pressure.

The 30-share BSE Sensex was up 99.19 points at 34,602.68 and the 50-share NSE Nifty gained 28.10 points at 10,679.30.

About three shares advanced for every two shares falling on the BSE.

11:21 am Order Win: India’s largest IT firm Tata Consultancy Services (TCS) today said it has bagged an over USD 2-billion deal from Transamerica to transform the latter’s US insurance and annuity business lines.

The partnership enables Transamerica to rapidly enhance its digital capabilities, simplify the service of more than 10 million policies into a single integrated modern platform, TCS said in a statement.

The multi-year agreement is worth more than USD 2 billion in revenues, and is expected to be completed by the second quarter of 2018, it added.

11:05 am Gold Update: Gold prices rose 0.26 percent to Rs 29,465 per 10 grams in futures trading today as speculators raised bets, tracking firm trend overseas.

Gold for delivery in February was trading Rs 75, or 0.26 percent, higher at Rs 29,465 per 10 grams, in a business turnover of 376 lots.

Similarly, the metal for delivery in April was also trading higher by Rs 56, or 0.19 per cent, at Rs 29,430 per 10 grams in 34 lots.

Here are the top headlines at 11 am from Moneycontrol News’ Sakshi Batra

10:53 am Market Outlook: Midcap stocks witnessed a stellar rally last year with the Nifty Midcap index rising 50 percent in 2017. They were seen as one of the major reasons behind the market clocking fresh highs last year.

So, will the streak continue in this year? Macquarie Capital Securities strongly believes so. “Midcaps will perform strongly…in the near term, there could be some surprises in IT and pharma names. This could be a year where smaller businesses do well,” Sandeep Bhatia, Head of Equity-India at Macquarie Capital Securities told CNBC-TV18 in an interview.

Speaking on different sectors, Bhatia believes non-banking financial companies (NBFCs) are richly-valued. “They have gone through a bubble phase and we would want to stick to larger banks. PSU banks should do well. In the housing finance space, we are sticking to HDFC,” he told the channel.

10:40 am Management Interview: Bajaj Corp posted a weak set of earnings in the third quarter ended December, 2017 as advertising spends were on the rise. Growth in revenue however was supported by other operating revenues

Sumit Malhotra, MD, Bajaj Corp in an interview to CNBC-TV18 clarified that the decline in profits was not due to ad spends but more due to other income falling by Rs 9 crore on account of large treasury book.

The company has a large treasury book of around Rs 480 crore and returns from that came off, which accounted for mark to market (MTM) losses, said Malhotra.

He said business is coming back to normal post goods and services tax (GST) and Patanjali competition. The urban market growth is coming back and the Ayurvedic hair oil segment was the lowest growing segment in Q3.

However, the rural volume growth is a cause of concern. In hair oil volume growth is down to 2 percent and in light hair oil it is down to 9 percent.

The rural demand is expected to come back by April, May post the Rabi crop and government initiatives in terms of MSP and other likely announcements in the upcoming Budget.

10:20 am Market Update: Benchmark indices continued to trade higher in morning, with the Sensex hovering around 34,600 level despite Brent crude oil hit December 2014 high of USD 70 a barrel.

The 30-share BSE Sensex was up 99.01 points at 34,602.50 and the 50-share NSE Nifty gained 29.80 points at 10,681.

About 1,584 shares advanced against 732 declining shares on the BSE.

10:10 am Market Outlook: Hadrien Mendonca of IIFL said the New Year cheer extended to the second consecutive week in a row in the year 2018 as the benchmark indices once again closed at fresh lifetime highs. We may call it a pre-Budget rally or positive global wave but what is evident is that the momentum continues to persist.

For the past few days, the Nifty50 has been trying to digest the rally from 10,400 to 10,600 in the previous week. These are healthy signs as even when the index is consolidating it is managing to hit fresh highs.

What’s more intriguing is that the weekly chart is pointing out at another fresh breakout. The projections indicate that Nifty is all set to fire up towards the 10,850-10,900 zone.

While any decline towards the 10,575 mark should be a healthy opportunity to re-enter which is the crucial near-term support for the Nifty.

Here are the top headlines at 10 am from Moneycontrol News’ Anchal Pathak

9:55 am Rupee Trade: The rupee strengthened by 11 paise to 63.55 against the dollar in opening trade today on fresh selling of the US currency by exporters and banks.

Forex dealers said a weak dollar in overseas markets on fears that a huge amount of foreign demand for American currency would dry up bolstered the rupee.

Yesterday, the rupee had settled lower by 6 paise at 63.66 on fresh bouts of demand for the American currency.

9:40 am Buzzing: Shares of Shree Cements rose 1.5 percent in the early trade on strong December quarter numbers.

The company has reported a better-than-expected December quarter numbers, with net profit increased 41.6 percent at Rs 333.3 crore against Rs 235.4 crore posted during the same quarter last year.

The revenue also grew 23.1 percent at Rs 2,296.2 crore against Rs 1,864.4 crore, year-on-year.

The company in its board meeting held on January 11 approved the acquisition of majority equity stake (minimum 92.83 percent) in Union Cement Company (UCC), UAE for an enterprise value of USD 305.24 million (Rs 1,945 crore).

9:29 am IPO Subscription: The initial public offer (IPO) of Apollo Micro Systems, which caters primarily to the defence and aerospace sectors, was subscribed 9 times on the second day of bidding on Thursday.

The IPO, to raise Rs 156 crore, received bids for 3,72,44,150 shares against the total issue size of 41,44,955 shares, data available with the NSE showed.

The category set aside for qualified institutional buyers (QIBs) was subscribed 3.25 times, non institutional investors 1.58 times and retail investors 15.14 times.

9:20 am Buzzing: Jain Irrigation rallied 5 percent and IFCI gained 4 percent after both stocks came out of F&O ban.

9:15 am Market Check: Equity benchmarks opened at fresh record high on last day of the week, with the Nifty inching towards new milestone of 10,700, tracking record highs on Wall Street.

The 30-share BSE Sensex was up 112.01 points at 34,615.50 and the 50-share NSE Nifty rose 31.10 points to 10,682.30.

About four shares advanced for every share falling on the BSE.

TCS fell nearly 1 percent on profit booking. Brokerage houses maintained their ratings following in-line numbers.

Infosys gained 0.5 percent ahead of Q3 earnings later today. A CNBC-TV18 poll expects 1 percent growth in dollar revenue.

Vedanta, IOC and Indiabulls Housing Finance were other gainers.

Nifty Midcap index was up 0.4 percent. Amtek Auto, Subros, Sarda Enegy and Aban Offshore gained 3-5 percent while Sintex Plastics fell 4 percent.

All three major US indices finished solidly higher at records as investors appeared to jump at the chance to buy stocks at lower prices following Wednesday’s modest pullback.