Market Live: Sensex gains, Nifty above 10100; Reliance up 3%, pharma in focus

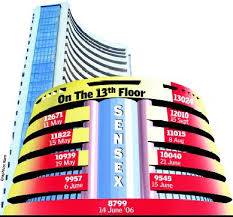

12:25 pm Expert Speak: Indian market which has gained over 20 percent so far in the year 2017 and is among the best-performing markets in the world has more steam left. So, if you are waiting for a correction, chances are market may not oblige you with a big one.

If you are a long term investor, allocate money to equity markets as the rally on Nifty might just well stretch from 10,000 currently to 17,000 in the next 4 years, said an analyst.

We are in the midst of global rally and emerging markets are likely to lead the next leg of the rally, Atul Suri of Marathon Trends said in an exclusive interview with CNBC-TV18.

“I expect a 40% kind of an up move in global equities in the next 4 years and 70% of the 40% up move in global equities is likely to come from emerging markets,” he said.

He feels India is a leader in emerging markets currently and expect Nifty to be at levels around 17,000 in the next 4 years.

12:10 pm Market Check: Benchmark indices continued to trade in the green and held on to the gains from the first hour of trade.

The Sensex was up 79.04 points at 32237.70, while the Nifty was up 10.80 points at 10103.85. The market breadth was narrow as 1,203 shares advanced against a decline of 1,102 shares, while 151 shares were unchanged.

Midcaps continued to outperform frontline indices, while a good rally was seen in sectoral indices of PSU banks, pharmaceuticals and energy stocks.

Reliance Industries, Sun Pharma and Tata Power gained the most on both indices, while ITC, Larsen and Toubro and BPCL were the top losers.

11:55 am Expert Speak: Leon Cooperman, the billionaire founder of hedge fund Omega Advisors, says a market correction could start “very soon,” reports Bloomberg. Cooperman, who’s known for his bullish stock picks, said any number of events could prompt markets to fall.

“North Korea, a disappointing earnings report, anything…We can have a 5-8% correction anytime. We’re getting closer to one,” Cooperman stated.

11:40 am Management Speak: The Muthoot Finance stock has been buzzing in trade and gold financiers are in focus on the back of merger and acquisition (M&A) buzz. Also rural market conditions have improved. In an interview to CNBC-TV18, George Alexander Muthoot, MD of Muthoot Finance gave the ground check.

Muthoot said demonetisation difficulties are behind and collections with regards to old dues are on track.

He further said that cost of borrowings have declined by 1-1.2 percent year-on-year (YoY).

11:25 am Twitter inks pact: Microblogging platform Twitter today said it has signed more than 35 partnerships in the Asia Pacific region for premium video content. Twitter has joined hands with entities like International Cricket Council (ICC), Filmfare Awards, NDTV and Network18.

These partnerships will help bring hundreds of hours of new exclusive videos and live original programming, live games and events on to the platform, Twitter said in a statement.

The announcement also includes extensions of existing global live deals, it added.

11:05 am Market Check: The benchmark indices are trading firm with Nifty trading above 10100 level.

The Sensex was up 78.63 points at 32237.29, and the Nifty was up 15.50 points at 10108.55. About 1234 shares have advanced, 950 shares declined, and 115 shares are unchanged.

Reliance Indistries, Sun Pharma, Dr Reddys Labs, M&M, BHEL, Tata Power and Bank of Baroda are top gainers on the indices.

10.50 am Buzzing Stock: Shares of Dr Reddy’s Laboratories added 2 percent intraday Wednesday as the company is planning for phase 2 trial of CA-170.

The company’s wholly owned subsidiary Aurigene Discovery Technologies is planning to initiate a Phase 2 trial of CA-170, a PDL1-VISTA inhibitor to be conducted at sites in India.

CA-170 is an oral small molecule targeting the immune checkpoints PDL1 and VISTA.

10.40 am IPO opens: The subscription of Mumbai-based construction company Capacit’e Infraprojects initial public offering has opened on Wednesday, with a price band of Rs 245 to Rs 250 per share.

The issue will close on September 15. Bids can be made for minimum of 60 equity shares and in multiples of 60 shares thereafter.

The book running lead managers to the issue are Axis Capital, IIFL Holdings and Vivro Financial Services. Its equity shares are proposed to be listed on NSE and BSE.

10:30 am Pharma stocks gain: Divis Laboratories extended its gains from the previous session, jumping around 4 percent intraday.

Investors continued to bet on hopes of better outcome from its unit’s inspection by the US FDA.

Simultaneously, the rally spilled over to a couple of other stocks as well. Sun Pharmaceuticals and Dr Reddy’s Laboratories gained around 2 percent. The latter gained after it sad that its wholly owned arm Aurigene Discovery Technologies plans to initiate phase II clinical trials of oral small molecule CA-170 that targets cancer. The trials will be conducted at various sites in India, Dr Reddy’s said in a filing to BSE.

10:05 am Market Check: Benchmark indices extended their gains from the opening tick, with the Nifty trading above 10,100-mark. Sharp rally in pharmaceuticals and an upmove on Reliance Industries lent support to the Street.

The Sensex was up 77.73 points at 32236.39, while the Nifty was up 22.75 points at 10115.80. The market breadth was positive as 1,192 shares advanced against a decline of 715 shares, while 79 shares were unchanged.

Midcaps continued their outperformance versus frontline indices, while pharmaceuticals, power and PSU bank index were trading on the higher side.

Tata Motors, Reliance Industries, and Tata Power were the top gainers on both indices, while ITC and Larsen & Toubro lost the most.

9:55 am Buzzing Stocks: Shares of Shemaroo Entertainment, V2 Retail and Future Lifestyle Fashions gained 3-12 percent on the back of strong Q1 earnings.

Shemaroo Entertainment has reported 22 percent jump in its Q1FY18 net profit at Rs 16 crore versus Rs 13.1 crore, in a year ago period.

V2 Retail’s Q1FY18 net profit, meanwhile, was up 87 percent at Rs 8.6 crore versus Rs 4.6 crore, in the same quarter last year.

Additionally, Future Lifestyle Fashions registered 29 percent increase in its Q1FY18 net profit at Rs 23.5 crore versus Rs 18.2 crore.

9:45 am Results: The second largest airline Jet Airways on Tuesday said its standalone net income more than doubled to Rs 53.5 crore in the three months to June against Rs 25.9 crore a year ago in spite of a large one-time provisioning of Rs 56.6 crore.

This is the ninth consecutive profitable quarter for the airline after the recovery driven by a rising market and a low fuel price regime since mid 2014.

Total income of the Naresh Goyal-promoted airline rose to Rs 5,953 crore from Rs 5,341 crore, an increase of 11.3 percent driven by increased load factor and an average rise in fares, which was also boosted by increased codeshares with international airlines.

Standalone numbers do not include its subsidiary JetLite. Including this, net rose to Rs 58 crore helped by an 11.8 per cent rise in passenger revenue at Rs 5,136 crore.

9:30 am Corporate update: Drug firm Dr Reddy’s Laboratories (DRL) said its wholly owned arm Aurigene Discovery Technologies plans to initiate phase II clinical trials of oral small molecule CA-170 that targets cancer.

The trials will be conducted at various sites in India, Dr Reddy’s said in a filing to BSE.

Commenting on the development, Aurigene CEO CSN Murthy said: “Together with Curis, we have designed a phase II trial in selected populations of patients of interest in the CA-170 programme to be treated at major cancer centres in India”.

9:15 am Market Opens: After two consecutive sessions of positive trade, benchmark indices opened on a flat note.

Adani Transmission, Tata Power and Tata Motors were the top gainers on both indices, while Videocon, IPCA Labs, L&T and Aurobindo Pharma lost the most.

The Indian rupee opened higher by 6 paise at 63.98 per dollar on Wednesday against the level of 64.04 on Tuesday.

Pramit Brahmbhatt of Veracity said, “Easing of North Korea problem helped dollar find support at 63.80 mark. As far as it trades above 63.80, bias will remain positive towards dollar.” “Trading range for the spot USD-INR pair will be 63.80-64.20,” he added.

The dollar extended its sharp rally against the yen, although it was capped against the euro with a potentially supportive spike in US yields neutralized by a similar move by their German counterparts.

Meanwhile, the pound hovered within distance of a one-year high after a robust UK inflation report added pressure on the Bank Of England to do more to support the currency.

Among global markets, Asian shares inched up to a 10-year high on Wednesday, cheered by record highs on Wall Street, while the dollar’s rise against the yen helped boost Japanese shares.

The major Wall Street indexes hit record closing highs on Tuesday, with financial stocks leading the charge, but gains were stunted by a decline in Apple Inc shares after it unveiled its latest line of iPhones.

In case of commodities, Gold prices held steady on Wednesday as the dollar remained firm, with safe-haven demand for the metal buoyed after U.S. President Donald Trump’s latest comments on tensions over North Korea.

Oil prices were mixed early on Wednesday, but largely held on to gains in the previous session after OPEC said it expected higher demand for its crude next year.