Market Live: Sensex, Nifty continue to trade strong; IndusInd Bank dips on profit booking

2:18 pm GST cess: The government has notified levy of increased GST cess of up to 7 percent on mid-size, large and SUV cars.

The GST Council on September 9 had decided to hike cess on mid-size cars by 2 percent, on large cars by 5 percent and on SUVs by 7 percent to bring tax rates on these cars at pre-GST levels.

The Finance Ministry late last night notified the hike in quantum of cess to be levied on cars, following which the new rates came into effect. The effective GST rate on mid-size cars will be 45 percent, and on large cars it would be 48 percent.

The rate will be 50 percent on sports utility vehicles (SUVs), which include cars with length exceeding 4,000mm and having a ground clearance of 170mm and above.

2:05 pm HDFC Bank’s market cap surges: HDFC Bank today surpassed Tata Consultancy Services (TCS) to become the country’s second most valued firm in terms of market valuation.

During the afternoon trade, the market capitalization (m-cap) of HDFC Bank stood at Rs 4,73,530.72 crore, which was Rs 797.4 crore more than TCS’ Rs 4,72,733.32 crore valuation.

Shares of HDFC Bank gained 0.93 per cent to Rs 1,840 — its 52-week high — on BSE.

1:42 pm Gold ETFs trading dips: Gold exchange traded funds (ETFs) continued losing sheen as an investment class with investors pulling out over Rs 300 crore from the instrument in April-August of this fiscal, preferring equities over them.

Trading in gold ETF segment has been tepid during the last four financial years. It has witnessed outflows of Rs 775 crore in 2016-17, Rs 903 crore in 2015-16, Rs 1,475 crore in 2014-15 and Rs 2,293 crore in 2013-14.

On the other hand, equity and equity-linked saving scheme (ELSS) saw an infusion of more than Rs 61,000 crore during the first five months (April-August) of the current financial year. This included an investment of over Rs 20,000 crore in last month alone.

1:20 pm Macro data expectations: A CNBC-TV18 poll expects August CPI inflation at 3.22 percent against 2.36 percent in previous month due to reduction in vegetable disinflation.

Core inflation is expected to be at 4.2 percent in August against 3.96 percent in previous month.

Industrial output data will also be announced today. A CNBC-TV18 poll expects factory output to grow 1.3 against contraction of 0.1 percent in July.

Economists said sluggishness would continue post GST implementation but they expect some pick up on month-on-month basis aided by inventory restocking ahead of festive season buying.

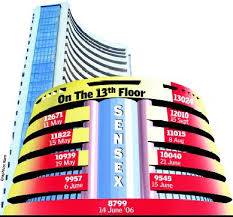

1:10 pm Market Check: Intense buying kept the Indian market on a high note through the morning session, with the Nifty holding on to 10,000-mark.

Midcaps continued to outperform benchmark indices, while other sectoral indices were trading in the green. Pharmaceutical names and PSU banks led among them.

The Sensex was up 158.40 points at 32040.56, while the Nifty was up 49.10 points at 10055.15. The market breadth, however, was narrow as 1,346 shares advanced against a decline of 1,035 shares, while 126 shares were unchanged.

Tata Steel, Sun Pharmaceuticals and BPCL were the top gainers on both indices, while ONGC, Wipro, IndusInd Bank and Tech Mahindra lost the most.

12:45 pm Europe update: European markets opened higher Tuesday as investors enjoyed a lull in the ongoing conflict with North Korea and the worst effects of Hurricane Irma appeared to subside.

Asian shares hit a high not seen since late-2007 on Tuesday as geopolitical tensions appeared to cool on the Korean Peninsula. The United Nations Security Council unanimously agreed to step up sanctions on Kim Jong Un’s North Korea Monday, but U.S. Ambassador Nikki Haley insisted that the U.S. is not looking for war with the closed state.

Meanwhile, oil prices dipped slightly lower as traders looked to assess the damaging effects of Hurricane Irma while factoring in refinery restarts following Hurricane Harvey, which should soon lead to more crude oil processing. At 6:30 a.m. London time Tuesday, Brent oil was trading at $ 53.73 per barrel and U.S. crude was trading at $ 47.98 per barrel.

12:12 pm Interview: The KEI Industries stock has had a stellar two days with a 20 percent gain. It was also up a whopping 165 percent this year.

In an interview to CNBC-TV18, Anil Gupta, CMD of KEI Industries said Q1 performance was not due to advancement of sales due to goods and services tax (GST).

Higher order booking and better execution led to robust Q1 performance, he added.

KEI saw 20 percent volume growth in Q1, said Gupta.

He expects retail business to grow by 30 percent in FY18. Therefore, continuing to focus on developing retail business, he added.

He also expects strong export growth going forward.

11:55 am IPO subscription: The initial public offering of Matrimony.com has been oversubscribed 82 percent so far on second day.

The issue received bids for 23 lakh equity shares against IPO size of 28.11 lakh equity shares (excluding anchor investors’ portion) as per data available on the NSE.

11:46 am Sahara deal: Embattled Sahara group yesterday said a Dubai investment fund has agreed to provide a loan of USD 1.6 billion (over Rs 10,000 crore) against security of 26 percent shares of its Aamby Valley project.

“Royale Partners Investment Fund Limited of Dubai, headed by HE Sultan Al Ahbabi has entered into an agreement with Sahara to provide loan of USD 1.6 billion against the security of 26 percent of the shares of Aamby Valley Ltd,” a Sahara group lawyer said in a statement.

“They (the fund) have committed through a mutual agreement and the agreement was submitted in the last hearing of the court on August 10, 2017. The same was raised in today’s hearing as well,” advocate Gautam Awasthy said in the statement.

The statement came on a day when the Supreme Court directed the official liquidator to go ahead with the scheduled auction of Aamby Valley property in Maharashtra, as it rejected Sahara Group Chief Subrata Roy’s plea for some more time.

11:41 am Buzzing: Share price of Confidence Petroleum locked at 5 percent upper circuit on the back of commissioning of LPG bottling plant and LPG dispensing stations.

There were pending buy orders of 13,000 shares, with no sellers available.

The company has commissioned new LPG bottling plant at Uluberia situated at village Islampur, near Kolkata (West Bengal).

The company has also commissioned three new auto LPG dispensing stations at Chennai.

With the inclusion of above three auto LPG dispensing stations, the company has now total of 110 auto LPG dispensing stations in operation across PAN India.

11:35 am Earnings: Shares of Speciality Restaurants and Ucal Fuel Systems declined 6-8 percent intraday on the back of dismal earnings.

Speciality Restaurants has increased its losses in Q1FY18 to Rs 15 crore from loss of Rs 5.6 crore, in the same quarter last year. Revenue was down 8 percent at Rs 72 crore versus Rs 78 crore.

Ucal Fuel Systems has reported 54 percent fall in its Q1FY18 net profit at Rs 3.7 crore due to higher tax rate against Rs 8.1 crore. Revenue was down 10 percent at Rs 141 crore versus Rs 157 crore.

11:30 am Bullet train: Railway Minister Piyush Goyal yesterday said the fare of the high-speed bullet train would be “affordable for all”.

Prime Minister Narendra Modi and Prime Minister of Japan Shinzo Abe are scheduled to lay the foundation stone of the much-anticipated bullet train project on September 14.

The railways will initially operate 35 bullet trains and by 2053, the number was expected to go up to 105, they added.

While covering the 508-km stretch between Mumbai and Ahmedabad, the train will stop at 10 stations — Thane, Virar, Boisar, Vapi, Bilimora, Surat, Bharuch, Vadodara, Anand and Sabarmati.

The bullet train will run at an average speed of 320 km per hour with a maximum speed of 350 km per hour.

11:25 am Profit booking: IndusInd Bank fell more than 2 percent after hitting a record high of Rs 1,818 in early trade, dragged by profit booking.

The stock rallied 5.6 percent in previous session after the company entered into exclusivity agreement to evaluate with microfinance company Bharat Financial Inclusion for proposed potential strategic combination by way of amalgamation through a scheme of arrangement, or any other suitable structure.

Bharat Financial Inclusion was also down 0.6 percent on profit taking.

11:20 am Buzzing: Jaypee Infratech was locked at 5 percent upper circuit and Jaiprakash Associates lost 3.6 percent after the Supreme Court ordered JP Associates yesterday to deposit Rs 2000 crore before the court by October 27.

The directors of Jaypee Infratech and JP Associates have also been restrained from travelling abroad without permission of the SC. They have also been directed to take the permission of IRP before selling any property. The next date of hearing is November 13.

All proceedings in other forums have been stayed. What this means is all cases pending before consumer courts, NCDRC, etc., will be stayed while the corporate insolvency resolution process under the Insolvency and Bankruptcy Code, 2016 is on.

11:16 am Rupee loses: The rupee dropped further by 6 paise to 63.99 against the US currency in morning at the interbank foreign exchange today as the dollar strengthened overseas.

Dealers said increased demand for the US currency from importers and the greenback’s gains against other currencies overseas weighed on the rupee.

Currency traders also turned cautious ahead of release of key macro data, including IIP and inflation, later in the day. They said gains in domestic equity markets capped the losses.

11:06 am Market Check: Equity benchmarks extended gains in morning trade, with the Nifty reclaiming 10,050 level on support from FMCG and banks stocks.

The 30-share BSE Sensex was up 174.24 points at 32,056.40 and the 50-share NSE Nifty gained 50.95 points at 10,057.

The BSE Midcap and Smallcap indices also extended gains to 0.8 percent each. About 1,327 shares advanced against 840 declining shares on the BSE.

10:58 am Market Expert: As the market stares at issues of high valuation and lack of commensurate growth with fundamentals, Harsha Upadhyaya, CIO-Equity, Kotak Mutual Fund believes only a select few pockets are overbought. The market entirely is not expensive.

This, in the context of surged inflows of Rs 20,000 crore into equity mutual funds in August, is going to be a challenge for fund managers, Upadhyaya told CNBC-TV18 in an interview. However, one could look for stories in sectors with inexpensive valuations. Investors could well be cautious in such a scenario, he advised.

He pointed out to the slow growth trend reflected in June quarter results with no growth in export basket, and disappointing PSU banks’ performance.

One must wait for September and December quarters, which could see better performance, he said. This could largely be due to sectors which are likely to see normalization of numbers, post GST disruption, in this and the next quarter. But, overall, he sees no major change in the economy.

10:45 am Stake buy: Tata Sons, the promoter of major Tata group companies, will hike its shareholding in Tata Global Beverages and Tata Chemicals by up to 6.84 percent and 4.39 percent respectively for a total estimated value of Rs 1,458 crore.

Tata Sons will acquire up to 4.31 crore shares or 6.84 percent stake in Tata Global Beverages Ltd (TGBL) from Tata Chemicals as a part of restructuring of its investment portfolio, TGBL said in a regulatory filing.

Tata Chemicals said Tata Sons will acquire up to 1.11 crore shares or 4.39 per cent stake in the company from Tata Global Beverages Ltd (TGBL).

TGBL and Tata Chemicals said the proposed date of acquisition is on or after September 18 and the shares are proposed to be acquired at the prevailing price on the date of acquisition.

10:35 am Order win: Shares of Larsen and Toubro (L&T) touched 52-week high of Rs 1,231.95, rising more than 1 percent intraday as it has won orders worth Rs 2525 crore.

The construction arm of the company has won orders worth Rs 2525 crore across various business segments.

The metallurgical and material handing business has bagged orders worth Rs 2271 crore in the domestic market to strengthen its presence in the metallurgical sector.

Meanwhile, the other business segments of the L&T construction have won orders worth Rs 254 crore.

The power transmission and distribution business has bagged an order from electricity generating authority of Thailand.

The smart world and communication business has received an order from Electronics Corporation of Tamil Nadu.

10:25 am Buzzing: Shares of Liberty Shoes and Tata Coffee touched 52-week high, gaining 16 percent intraday as Equity Intelligence of Porinju Veliyath has bought stake in the companies.

Equity Intelligence India [P M S] bought 3,21,308 shares of Liberty Shoes at Rs 235.48 and bought 10,00,000 shares of Tata Coffee at Rs 150 on the NSE on Monday.

10:15 am Market Outlook: Suresh Soni, Chief Executive Officer, DHFL Pramerica Asset Managers Private Ltd said stock prices are the slave of corporate earnings, and the ability of the company to compete in the market place. However, in the short term markets are subject to fluctuations due to a variety of reasons, many of which are transient and short term in nature.

You should indeed be looking at selling your shares if you see a sustained impact on your company’s earnings due to a potential US/ N Korea conflict.

Time and again the markets’ reaction to events has given opportunities to acquire stocks at attractive valuations. As equity investors, we will keep reading headlines like Brexit, Greek crisis, Fed moves, potential war etc.

None of these can be forecasted beforehand nor are they likely to have any direct impact on corporate earnings. Investors will do well to ignore these events and stay focused on their long term investment journey.

10:04 am Market Check: Equity benchmarks maintained early gains amid volatility, backed by metals, FMCG, infrastructure and banks stocks.

The 30-share BSE Sensex was up 77.99 points at 31,960.15 and the 50-share NSE Nifty gained 24.35 points at 10,030.40.

The broader markets continued to trade with half a percent gains as about three shares advanced for every two shares falling on the BSE.

Asian markets also continued their ascent, following a firm lead from Wall Street as concerns faded over the potential damage of Hurricane Irma and as Korean Peninsula tensions took a backseat.

Japan’s Nikkei 225 rose 1 percent as the dollar held onto overnight gains against the yen.

9:56 am Tata Steel rallies 4%: Tata Steel has concluded a new agreement under which its UK business stands separated from the 15-billion pound British Steel Pension Scheme (BSPS).

“Tata Steel UK has received confirmation from the pensions regulator that it has approved a regulated apportionment arrangement (RAA) in respect of BSPS,” Tata Steel said in a statement.

As part of the arrangement, a payment of 550 million pounds has been made to BSPS by Tata Steel UK and shares in Tata Steel UK, equivalent to 33 percent stake, have been issued to the BSPS trustee, the steel giant said.

The BSPS has now been separated from Tata Steel UK and a number of affiliated companies, it added.

Last month, Tata Steel had announced clinching of the deal facilitating detachment of the BSPS from its UK business.

9:45 am SEBI approval: Godrej Industries arm Godrej Agrovet has received capital markets regulator Sebi’s go-ahead to raise an estimated Rs 1,000-1,200 crore through an initial public offering.

The company had filed draft red herring prospectus (DRHP) with Sebi in July and received its ‘observations’ on September 8, which is very necessary for any company to launch public offer, as per the latest update with the markets regulator.

Godrej Agrovet’s public issue comprises fresh issue of shares worth Rs 300 crore besides an offer for sale of scrips of up to Rs 300 crore by Godrej Industries and up to 1.23 crore shares by V-Sciences, as per the DRHP.

Besides, the company is considering a pre-IPO placement of up to 5.6 lakh equity shares worth up Rs 252 crore.

9:35 am IPO: The initial public offer (IPO) of Matrimony.com, which runs online match-making portals, was subscribed 67 percent on the first day of bidding on Monday.

The IPO, with an aim to raise over Rs 500 crore, received bids for 18,78,510 shares against the total issue size of 28,11,280 shares, data available with the NSE showed.

The portion set aside for qualified institutional buyers (QIBs) was subscribed 83 per cent and retail investors 1.19 times.

The company had on Friday raised nearly Rs 226 crore from anchor investors.

The price band is Rs 983-985 per share for the IPO which will close on September 13.

9:25 am FII View: Neelkanth Mishra of Credit Suisse said the research house estimated if inflows into life insurance and provident/pension funds do not grow, households’ gross financial savings this year could be Rs 21 trillion versus Rs 18 trillion in FY17.

The challenge increasingly is deployment, he added. The balance of payments surplus is playing a role as well, he feels.

The RBI is thus forced to continue absorbing liquidity, he said.

He feels cost of capital should hence remain low, manifested in low interest rates and high P/E for equities.

Mishra said non-banking finance companies (NBFC) growth should continue, net interest margin though may compress. LIC Housing Finance and Indiabulls Housing Finance should benefit, he added.

9:15 am Market Check: Equity benchmarks opened higher on Tuesday, continuing uptrend for the second consecutive session.

The 30-share BSE Sensex reclaimed 32,000 level in early trade, up 118.77 points at 32000.93. The 50-share NSE Nifty rallied 27.35 points to 10,033.40.

The BSE Midcap and Smallcap indices gained half a percent each on positive breadth. About three shares advanced for every share falling on the BSE.

Tata Steel, Tata Motors, Tata Power, Sun Pharma, HUL, Reliance Industries, Larsen & Toubro, TCS, Lupin, Wipro and Vedanta gained up to 2 percent in early trade.

Bharti Infratel, Coal India and ONGC were under pressure on profit booking.

Tata Coffee and Liberty Shoes rallied 12-16 percent post bulk deals.

Cochin Shipyard, Jet Airways, InterGlobe Aviation, Bata India, Mirza International, Redington India, HCL Infosystems, Emkay, RPG Life, IIFL Holdings, Religare Enterprises and Adani Transmission were early gainers in broader space.