Market Live: Nifty opens above 10,000, Sensex moderately higher; LT gains 2%

10.22 am Market Check: Equity benchmarks continued to trade higher, with the Sensex rising 84.66 points to 32,394.54 and the Nifty up 17.30 points at 10,031.80.

The rally was driven by Kotak Mahindra Bank, L&T, ICICI Bank, Maruti Suzuki, ONGC and Tata Steel that gained up to 3 percent.

Healthcare stocks were under pressure today, with Sun Pharma, Dr Reddy’s Labs, Lupin and Cipla down up to 2 percent.

HDFC slipped 0.5 percent again after recovery in early trade. FMCG majors ITC and HUL were also down up to 1 percent.

The market breadth was positive as about 1,161 shares advanced against 899 declining shares on the BSE.

10:10 am FII View: Sakthi Siva of Credit Suisse said percentage of negative returns in August over the last ten years for MSCI Asia ex-Japan and MSCI Asia Pacific ex-Japan is 71 percent.

MSCI Asia ex-Japan has passed the year-end target of 640, and investors may be tempted to lock in profits given this year’s gains exceeding 25 percent in dollar terms, she added.

While it is only four days, foreigners have turned net sellers of Emerging Asia ex-China of USD 1.01 billion over the last four days, he said.

With the theme being the best return on equity fundamentals in six years with Asia Pacific ex-Japan return on equity rising from a low of 10 percent to 10.6 percent, continue to suggest buying the dips, he feels.

9:55 am IPO: HDFC announced that it is going to divest 9.57 percent of its stake in HDFC Life.

We are not supposed to discuss the timeline but our intention is to get the initial public offering (IPO) out as soon as possible, said Amitabh Chaudhry, MD & CEO of HDFC Life.

Had started work on HDFC Life’s IPO last year itself, he added.

He further said that a lot of the general insurance companies have been filing for IPOs lately.

Chaudhry said that chairmen of both HDFC Life and Max Life mentioned that merger is off the table.

9:37 am Analysts on L&T post earnings: Bank of America Merrill Lynch has maintained buy call on the stock with a target price of Rs 1,322, saying Q1 surprised positively on strong domestic execution. Large order backlog & execution pick-up would help meet FY18 guidance, it feels.

Jefferies has also retained its buy rating on L&T, with 32 percent upside to target price of Rs 1,533. It said order pipeline of USD 50 billion should help co meet the full year guidance and macro tailwinds needed for the next leg of upside.

9:26 am Rupee opening: The Indian rupee started off the week on a positive note. It has opened at 64.11 against the US dollar, up 4 paise from Friday’s closing value of 64.15.

Pramit Brahmbhatt of Veracity feels the rupee will trade positive below 64.20 against the US dollar.

Weak Dollar Index will help rupee to appreciate further, he said.

Trading range for the spot USD-INR pair will be 63.80-64.20 per dollar, according to him.

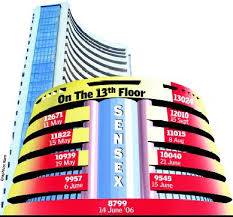

9:15 am Market Check: Equity benchmarks started off the week on a positive note, with the Nifty holding 10,000-mark. Investors awaited the decision of two-day monetary policy committee meeting that will begin on Tuesday.

The 30-share BSE Sensex was up 45.59 points at 32,355.47 and the 50-share NSE Nifty rose 10.05 points to 10,024.55. About two shares advanced for every share falling on the BSE.

L&T was top gainer among Sensex stocks, up 2.2 percent followed by Lupin, ICICI Bank, Vedanta, Kotak Mahindra Bank with moderate gains. HDFC rebounded after initial fall.

Sarda Energy, Coromandel, Capital First and Cholamandalam Finance gained up to 5 percent.

Central Bank of India, Dena Bank, Equitas Holdings, Oberoi Realty and Kitex Garments fell up to 5 percent.