Market Live: Sensex, Nifty erase early gains; RIL, Kotak Bank gain ahead of Q1 nos

11:26 am IPO: HDFC Life, the part of country’s largest housing finance company HDFC, has filed a draft for initial public offering with Insurance Regulatory and Development Authority, according to CNBC-TV18 reports quoting unnamed sources.

The insurance regulator is likely to issue in-principle approval to HDFC Life IPO by next week.

Both shareholders mortgage lender HDFC & Standard Life Plc are likely to dilute stake in ratio of 3:1 through IPO.

HDFC owns 61.65 percent stake and Standard Life holds 35 percent in HDFC Life Insurance.

After failure to get approval from shareholders as well as insurance regulator for the merger of HDFC Life and Max Life, HDFC decided to go for IPO of its life insurance business.

11:09 am Earnings: Private banking major Kotak Mahindra Bank posted 23 percent year-on-year rise in its standalone June quarter net profit at Rs 913 crore.

The number came in lower than a poll of analysts done by CNBC-TV18, which pegged the profit growth at 40.3 percent at Rs 1,041.1 crore for April-June quarter.

Standalone net interest margin came marginally higher at 4.5 percent against 4.4 percent in the same quarter last year. The loan growth for the bank grew to Rs 1,42,359 crore against Rs 1,20,765 crore in the June quarter last year. Net non-performing assets, meanwhile, saw declining at 1.25 percent from 1.26 percent QoQ.

The net interest income (NII) for Q1FY18 was up 17 percent at Rs 2,246 crore from Rs 1,919 crore in Q1FY17. During the quarter, it spent Rs 63 crore towards marketing and other expenses in relation to Rs 811 crore.

10:45 am Buzzing: Share price of Natco Pharma advanced nearly 3 percent intraday as EIR received from USFDA for its drug formulations facility.

The company has received the successful Establishment Inspection Report (EIR) from the United States Food and Drug Administration (USFDA) for the inspection conducted at its drug formulations facility at Kothur Unit, Telangana, India, during the period January 16-24, 2017.

The Kothur formulation facility predominantly caters to regulated international markets, including USA.

The company’s Kothur plant had received 6 observations from USFDA.

10:35 am IPO: Godrej Industries arm Godrej Agrovet filed draft papers with markets regulator Sebi to raise an estimated Rs 1,000-1,200 crore through an initial public offering.

The public issue comprises fresh issue of shares worth Rs 300 crore besides an offer for sale of scrips of up to Rs 300 crore by Godrej Industries and up to 1.23 crore shares by V- Sciences, as per the Draft Red Herring Prospectus (DRHP).

Besides, the company is considering a pre-IPO placement of up to 5.6 lakh equity shares worth up Rs 252 crore.

Godrej Industries owns 60.81 per cent in Agrovet, which is in businesses such as agri-inputs, animal feeds, palm oil manufacturing, dairy and poultry.

Proceeds of the IPO will be utilised towards repayment of loans and for other general corporate purposes.

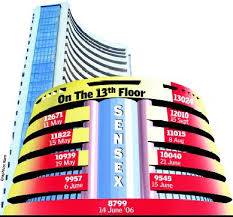

10.14 am Market Check: Equity benchmarks erased early gains, with the Sensex falling below 32,000 level and the Nifty hovering around 9900.

Ahead of June quarter earnings, Kotak Mahindra Bank, Reliance Industries and Wipro gained up to 1.7 percent while Bajaj Auto fell 0.4 percent.

The 30-share BSE Sensex was down 1.26 points at 31,954.09 and the 50-share NSE Nifty fell 3.45 points to 9,896.15 whlie the broader markets were flat with a positive bias.

About 1,155 shares advanced against 897 declining shares on the BSE.

9:53 am Buzzing: Share price of Sutlej Textiles and Industries declined 7.6 percent intraday on the back of poor numbers declared by the company in the quarter ended June 2017 (Q1FY18).

The company has reported 47.7 percent declined in its net profit at Rs 23.6 crore against Rs 45.1 crore, in the same quarter last fiscal.

The operating profit (EBITDA) was down 10.5 percent at Rs 69.5 crore and EBITDA margin slipped 330 bps at 10.7 percent.

However, the revenue has increased by 18 percent to Rs 652 crore versus Rs 552.7 crore.

9:40 am FII View: Derek Higa of William O’Neil said the MSCI Asia continued to trend near all-time highs constructively despite distribution days being at an elevated level across markets.

He remained bullish on the region.

According to him, the strongest in the region are India, South Korea and Hong Kong which he continued to advise being overweight on.

9:29 am Buyback: Shares of Just Dial rose 5 percent in morning as the company will consider buyback of its equity shares.

The meeting of board of directors of the company is scheduled to be held on July 24, to consider the unaudited financial results for the quarter ended June 2017.

In the said meeting the board will also consider a proposal for buyback of equity shares of the company.

Also read – Bull’s Eye: Buy Indian Bank, DLF, SPARC, Just Dial, Dhampur Sugar, SREI Infra

9:15 am Market Check: Equity benchmarks opened moderately higher, with the Sensex reclaiming 32,000 level, backed by Reliance Industries and ITC. Nifty Bank also started off with 100 points gains.

The 30-share BSE Sensex was up 62.88 points at 32,018.23 and the 50-share NSE Nifty gained 14.40 points at 9,914.00. About two shares advanced for every share falling on the BSE.

HPCL was down 4 percent while ONGC gained 1.6 percent after cabinet gave ONGC in-principle approval to buy government’s stake in HPCL.

Coal India, ITC, Kotak Mahindra Bank and Bharti Airtel were early gainers among largescaps.

In the broader space, Canara Bank, Mindtree, KPIT Technologies and Marico fell up to 4 percent while Just Dial, Sintex Industries, Balrampur Chini, Triveni Engineering, Bajaj Hindusthan, Mastek, Tata Elxsi, Jain Irrigation, Sterlite Technologies and MRPL gained nearly 7 percent.