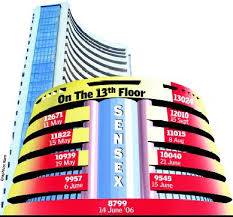

Market Live: Sensex remains sluggish, Nifty trades around 9600

3:24 pm Coal supply: Supply of coal by state-owned Coal India to power plants dipped by nearly two per cent to 64.7 million tonnes (MT) in April-May period of the ongoing fiscal even as demand by the power sector showed an upturn.

According to recent government data, Coal India (CIL) dispatched 65.8 MT fuel to the power sector in the same period of last fiscal.

CIL’s supply to the power sector last month declined by 3.52 per cent to 32.8 MT over 34 MT in May, 2016, the data said. The company is a major supplier of coal to the power sector.

In contrast, the overall dispatch in April and May increased to 91.7 MT over 88.2 MT in the corresponding period of 2016-17.

3:10 pm Market Check: Equity benchmarks extended losses, with the Sensex down 164.09 points at 31,126.65 and the Nifty down 56.80 points at 9,573.20.

2:59 pm Modi’s US visit: As Prime Minister Narendra Modi readies to go to the United States this weekend, the Indian information technology industry hopes that he will talk tough on visa issues plaguing the sector, as well as highlight the contributions India is making towards hiring locals in the US.

The H-1B work visas, which allow highly skilled foreign workers to travel to the US, have been at the centre of a storm since US President Donald Trump’s presidential campaign.

The over USD 155 billion Indian IT outsourcing industry has been a beneficiary of the H-1B visa programme, the most favored route to send Indian engineers to the US, and has for long been accused of misusing the current system to send more people to the US.

2:38 pm Fortis Healthcare down 11%: After months of speculation about a possible acquisition of controlling stake from Malvinder and Shivinder Singh in Fortis Healthcare, Fortis Malar and SRL Diagnostics, Malaysia-based Integrated Healthcare Holdings (IHH) is said to have pulled out of the talks at the last hour, according to a media report.

IHH, the Asia’s largest healthcare group operates the Parkway Pantai chain of hospitals in Malaysia, Singapore, China, India and Turkey.

The reasons for IHH pullout were not known immediately.

IHH has been in exclusive negotiations with the Singh brothers, Malvinder and Shivinder, to acquire a controlling interest in Fortis Healthcare and Fortis Malar and SRL Diagnostics.

Earlier media reports indicated that IHH is close to finalising the deal by paying around Rs 3,600 crore for a 26 percent stake in Fortis.

2:15 pm Market Check: Benchmark indices were sluggish, but staged a recovery from its morning levels of decline.

The Sensex was down 75.18 points at 31215.56, while the Nifty was down 32.25 points at 9597.75. The market breadth was negative as 599 shares advanced against a decline of 1,884 shares, while 144 shares are unchanged.

ICICI Bank, Dr Reddy’s Laboratories and Power Grid Corporation gained the most on both indices, while SBI, BHEL, GAIL and Bosch lost the most.

1.30 pm Market Check: Equity benchmarks recouped some losses but the Nifty is still trading below 9600 level in afternoon trade.

The 30-share BSE Sensex was down 94.01 points at 31,196.73, dragged by HDFC Bank, Tata Motors, SBI, ITC and L&T. The 50-share NSE Nifty fell 37 points to 9,593.

The BSE Midcap index slipped 0.9 percent and Smallcap down 1.4 percent as about three shares declined for every share rising on the exchange.

ICICI Bank rebounded to over a percent after Joint Lenders Forum (consortium of 23 banks) approves Essar Oil’s Rs 86,000 crore stake sale to Rosneft & Trafigura-UCP consortium.

Infosys, Reliance Industries, HUL, Wipro, Sun Pharma, NTPC and Dr Reddy’s Labs were other gainers.

1:15 pm Interview: Nasscom expects the Indian IT industry’s export revenue to grow at 7 to 8 percent and domestic revenue to grow at 10 to 11 percent in FY18.

Explaining the impact of this on the Indian IT companies, Anand Deshpande, Founder, MD & CEO, Persistent Systems said the industry is going through a major transformation. The new work is quite different from the old work we have been doing for many years, he said.

With use of new technologies, the same work is being done with less people, said Deshpande.

The company has shifted its business model which was traditionally only focused on services to now selling IP plus services, which in turn is being sold in the digital market, said Deshpande, adding that this enhances the ability to deliver quickly.

With regards to revenues, he says they would look at low double-digit growth in FY18. Last year’s stellar performance was due to the acquisition, he said.

In FY17, the dollar revenue growth was 22 percent for the company.

12:55 pm Europe Update: European bourses were under pressure as investors monitored oil prices and focused on any developments from the EU Summit in Brussels.

On the political front, European leaders will be getting ready for the second day of talks at a European Council meeting today; with terrorism, Brexit, and globalisation expected to be discussed. Friday also marks the one-year anniversary of the UK voting in its EU referendum.

12:30 pm Citi on Petronet LNG: Investment banking and financial services firm Citi has maintained a buy rating on Petronet LNG after a media reports indicated that the company is in talks to acquire 25 percent stake in the upcoming 5 MMTPA Mundra LNG terminal from Gujarat State Petroleum Corporation.

The research house expects the stock to hit a target price of Rs 541, implying 22 percent upside. It said it believes this could be a positive use of cash for Petronet LNG, though, valuations apart, there remain some uncertainties.

12.13 pm Market Check: Equity benchmarks fell further in afternoon trade, with the Sensex down 134.05 points at 31,156.69 on profit booking amid consolidation.

The 30-share NSE Nifty dropped 53.05 points to 9,576.95 on weak market breadth.

The BSE Midcap index shed 1.4 percent and the Smallcap index extended losses, down 1.8 percent as about five shares declined for every share rising on the exchange.

11:45 am CLSA on Tata Motors: “Our analysis of global luxury autos shows that industry volume growth has moderated in recent months driven by softening demand in Europe and the US although China continues to grow well,” CLSA said.

On the positive side, JLR has been gaining market share in most regions led by the success of its new product launches.

The research house still likes JLR’s strong product pipeline but remained concerned on its margins and the India business.

“FY18-19 consensus EPS has been cut by around 10 percent in the past three months but we are still 15-30% below the Street and see further consensus downgrades ahead,” CLSA said while maintaining sell rating with a target price of Rs 405.

11:20 am Listing: Optical and data networking products company Tejas Networks is expected to make a stock market debut on June 27. The issue price is fixed at higher end of price band of Rs 250-257 per share.

Its initial public offer (IPO), which oversubscribed 1.88 times, opened for subscription during June 14-16, 2017.

The category reserved for qualified institutional buyers (QIBs) was oversubscribed 2.16 times and non-institutional investors 48 percent while retail investors’ category saw subscription of 3 times.

The company raised nearly Rs 777 crore through the issue; of which it raised Rs 350 crore from anchor investors on June 13.

The IPO comprised of fresh issue of shares worth Rs 450 crore and an offer for sale of up to 1.27 crore shares.

10:55 am Jefferies on metals: Optimism around support from trade measures, improving domestic demand supply has supported Indian steel stocks despite a fall in domestic steel prices.

Jefferies stayed negative on steel stocks as contrary to consensus it believes domestic steel prices should fall further driving margins lower esp at integrated mills; ADD may not set the floor; and import parity rather than domestic demand-supply drives domestic steel prices – softer regional prices would weigh on domestic prices.

10:30 am Buzzing: Shares of Indiabulls Real Estate rose 4 percent intraday as it is going to raise Rs 500 crore via issue of debentures.

“The company is propose to issue secured, redeemable, non-convertible debentures of face value Rs 10 lakh each aggregating Rs 500 crore, on a private placement basis,” as per company release.

Credit Analysis and Research (CARE) has assigned AA- rating to the said securities, which has tenure of 36 months.

The issue will open on June 28, 2017.

10.08 am Market Check: Equity benchmarks extended losses in morning trade, with the Nifty falling below 9600 level and the Midcap losing over a percent on profit booking ahead of long weekend.

The 30-share BSE Sensex was down 85.74 points at 31,205 and the 50-share NSE Nifty fell 42 points to 9,588.

The BSE Midcap and Smallcap indices lost 1.4 percent each as about three shares declined for every share rising on the exchange.

Equity markets will remain shut on Monday for Ramzan Id holiday.

9:59 am Court settlement: Wockhardt shares gained as much as 3 percent in morning trade after its subsidiaries settled commercial litigation with Teva Pharmaceuticals.

“Wockhardt UK Holdings and CP Pharmaceuticals, in the United Kingdom have settled an ongoing commercial litigation before the High Court in London, UK in relation to supply contract for a drug named Trisenox,” the healthcare firm said in its filing.

The dispute between parties was in respect of the price charged by CP to its counterparty to the contract, Cephalon Inc, an affiliate of Teva Pharmaceuticals USA Inc.

As per settlement, CP Pharma has agreed to waive its claim for the outstanding trade receivable of 20 million pound and accordingly dropped its counterclaim for the said amount and further paid a sum of 23 million pound to Teva and Cephalon by way of full and final settlement of Teva’s claims, Wockhardt said.

Pursuant to this settlement, the ongoing litigation stands closed and all claims are dismissed.

9:43 am Buzzing: Shares of Mindtree gained nearly 3 percent intraday as it is going to consider buyback of its equity shares.

A meeting of the board of directors of the company will be held on June 28, to consider the proposal to buyback the fully paid-up equity shares of the company.

The company’s 18th annual general meeting (AGM) will be held on July 18, 2017.

9:30 am FII View: Laurence Balanco of CLSA said recent divergence suggests the market is due a pause/correction in the short term.

However, due to the bullish long-term profile for the Nifty, any short-term weakness back towards the 8,989-9,191 area should be seen as an attractive buying opportunity in anticipation of further gains towards our next target areas at 10,350, 11,547 and 12,000, he feels.

Also read – Buy, Sell, Hold: 4 stocks and 1 sector are on analysts’ radar today

9:15 am Market Check: Equity benchmarks opened flat with moderate gains as investors cautiously awaited Goods & Services Tax that is expected to be implemented from July 1.

The 30-share BSE Sensex was up 65.58 points at 31,356.32 and the 50-share NSE Nifty rose 12.25 points to 9,642.25.

TCS, Mahindra & Mahindra, Bharti Airtel, Lupin, Dr Reddy’s Labs, Kotak Mahindra Bank and GAIL were early gainers while Tata Steel, Wipro, ITC, Hero Motocorp and HCL Technologies were under pressure.

About two shares advanced for every share falling on the BSE.

Shriram EPC rallied 10 percent on orders worth Rs 165 crore under water management business.

Reliance Defence, HUDCO, Wockhardt, Manappuram Finance, Indiabulls Real, Himatsingka Seide and Amtek Auto gained 1-5 percent while Fortis Healthcare and Electrosteel Steels and Lanco Infratech fell 4-6 percent.

The Indian rupee opened marginally higher at 64.56 per dollar against previous close of 64.59.

Ashutosh Raina of HDFC Bank said the USD-INR pair continued to consolidate in a very narrow band, with the dollar index rising from recent lows and the dollar gaining against most other currencies.”

He expects the pair to continue trading in the 64.40-64.70/dollar range today.

Markets in Asia traded sideways as oil prices advanced off 10-month lows.