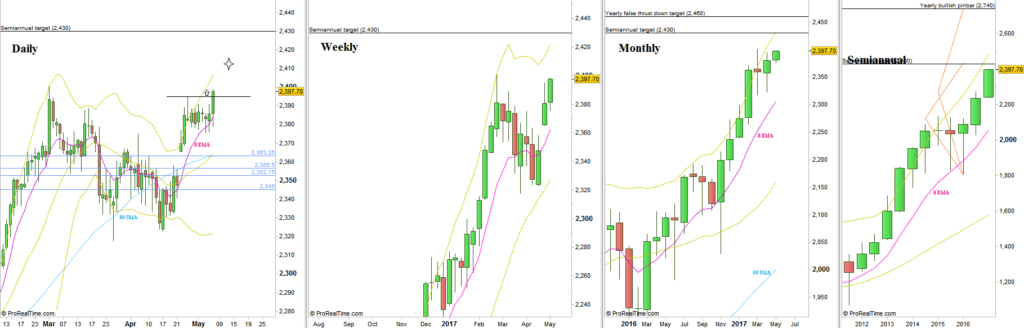

The passing week continued the bullish sentiment revealed in the week before, climbing higher, but the Monthly High which is also the current all time High wasn’t reached finally.

The market is in a bullish setup on the Daily Swing, a Follow through that had already been made last Friday, pointing at the level of 2414, meaning a new all Time High.

Looking at the Monthly chart, the current price action calls for another test of the Monthly mid range at the 2350-2370 area, with or without taking out the all time High. This means a shakeout below the current Daily Swing Low at 2375.5, maybe testing once again the open gap left at 2347.5-2365.25, and anyone who joins the trend currently should be aware of that potential.

The next major target lying above, is the first 2016 Semiannual bar, a Pinbar on sloping 8 EMA pointing at the target of 2430-2440, and a good bullish momentum can carry the market to that level prior to the testing of the current Monthly range, mentioned above.

A Daily reversal down right at the beginning of the week(that takes out last Friday’s Low and closing weak), which doesn’t make an all time High first is a clear sign of weakness and can send the market down to the Monthly range Low, but I would give very slim chances for that scenario.

S&P Futures, various timeframes (at the courtesy of prorealtime.com)

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.