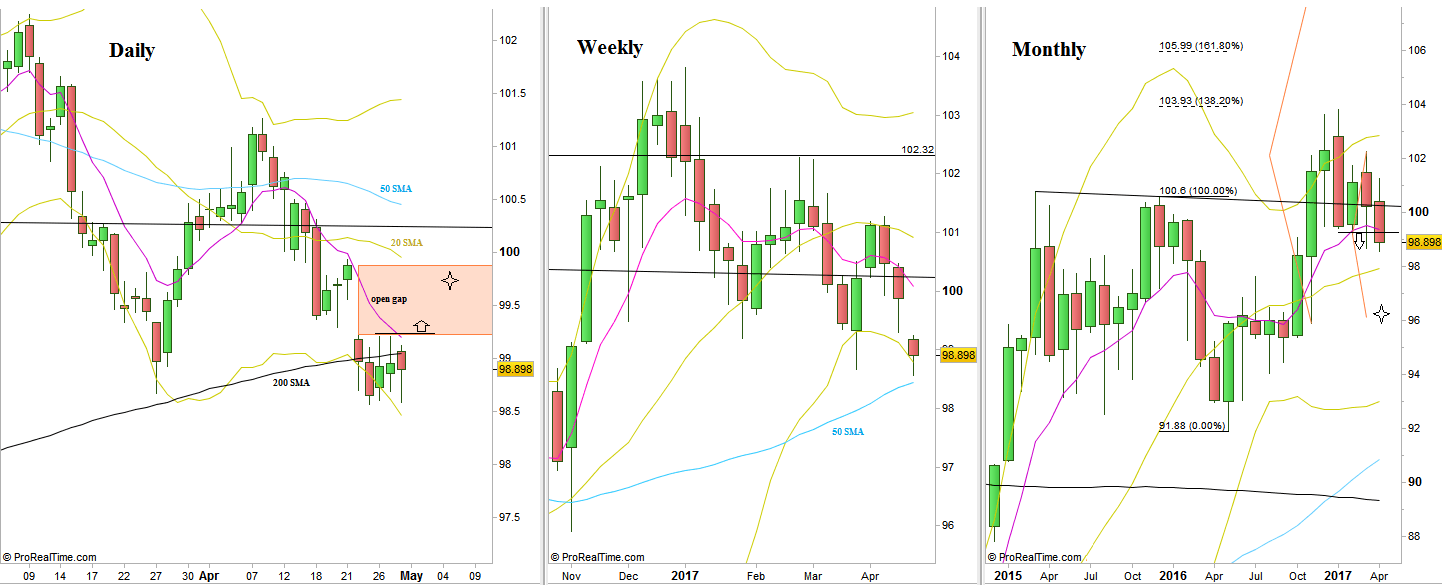

The news finally took over, turning the market into the bearish side, as the Dollar Index was traded throughout the passing week in a small range, after a relatively big gap down.

The Monthly bar of April closed bearish below the 8 EMA short term sentiment line, as a LL LH bar continuing the big bearish model to reach the 96.15 level area, described on previous reviews.

The Weekly bar penetrated the Lower band and left a big open gap down above it, currently supported above the Weekly 50 SMA.

Throughout the passing week the market has been struggling with the Daily 200 SMA, closing last Friday below it.

Taking out the High of last Thursday, at 99.21 is a bullish trigger to reach the 99.8 levels, an attempt to close the open gap, towards the Daily 20 SMA and Weekly 8 EMA. A Daily reversal down without closing the gap fully, even leaving a tiny gap as small as a tick, is very bearish and might start the Monthly move towards 99.15 as described above.

A Daily thrust above last Friday’s High at 99.125 that doesn’t take out the High of last Thursday at 99.21 within the same momentum, can turn into a an Upthrust, and might cause the price to make a new Weekly Low eventually.

Taking out the Weekly Low at 98.565 is bearish and might take the Index down to the 98 level where the Monthly 20 SMA is currently lying.

However, the current area is still a strong support on the higher timeframes, so the way down to 96.15 (if so) is probably not going to be rapid and easy.

Dollar Index, Daily, Weekly and Monthly charts (at the courtesy of prorealtime.com)

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.