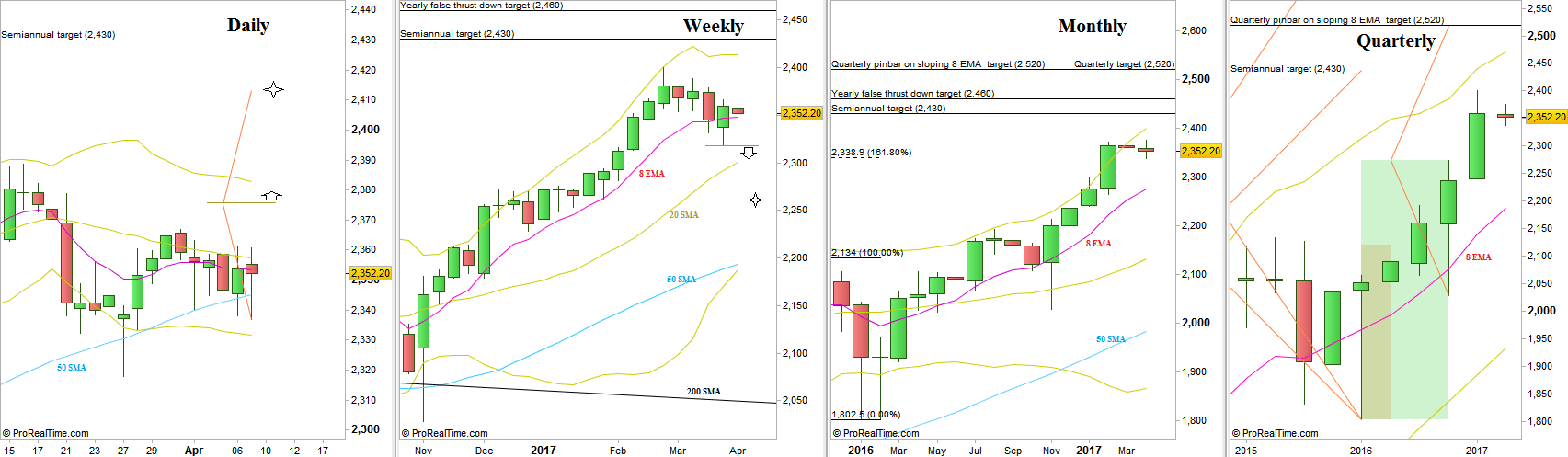

The passing week was very misleading as of its Daily price action, and most of it was comprised of sideways action. A bullish opportunity that the market introduced throughout the week has turned into a trap as Breaking up the Weekly High last Wednesday turned into an Upthrust (false thrust up turning into a reversal down) . So far, it looks like a shakeout as there is no thrust down, and most likely in such situation it is preceding another attempt to go up.

The clear sign of strength is seen by closing both the Weekly bar above the Weekly 8 EMA short term sentiment line, as well as closing all the Daily bars above the Daily 50 SMA.

Taking out the Weekly High (the Top of last Wednesday’s Upthrust) at 2375 is a bullish trigger to reach a new All time High, at 2413, currently the level of the Weekly upper Bollinger band. The target is pretty closed to the year 2016 Semiannual first half Pinbar on sloping 8 EMA, targeted at 2430. I wouldn’t recommend maximizing this position beyond this, if the market does reach that area, as it is a major timeframe target. Besides, the previous Monthly bar was a stopping action bar, and is very likely to get false thrust beyond its tails before the next real move (in the correct scale) develops.

Taking out the Weekly Swing Low, at 2317.75 is bearish, and can cause the price to decline towards 2264, but is not recommended to trade as a Swing trade, because it is the first bearish countertrend setup.

S&P Futures, various timeframes (at the courtesy of prorealtime.com)

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.