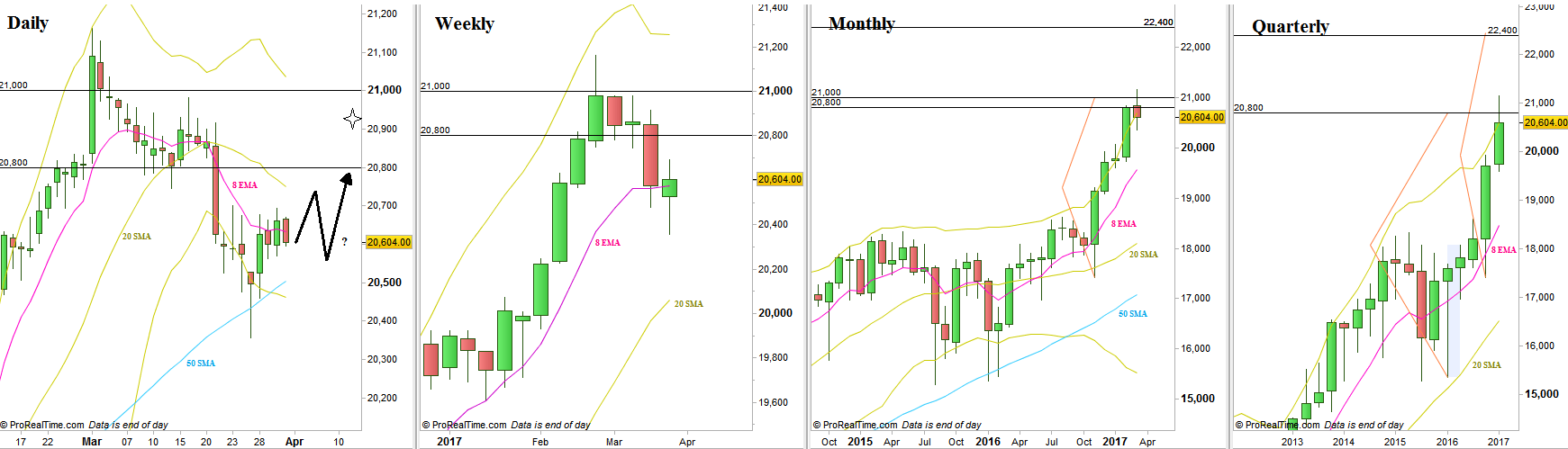

After the previous bearish week, the last week of March and the 1st Quarter of 2017 was rather bullish, ending as a bullish Weekly Pinbar. Important to notice that in this case it is not on a sloping 8 EMA, the 8 EMA short term sentiment line is currently rather horizontal. The Monthly bar showed some supply, closing the whole bar as a stopping action to the former bullish months, ending the last two quarters very bullishly, with the 1st Quarter of 2017 penetrating the upper Bollinger band deeply.

Most of the major targets for the price mentioned lately have been achieved, mainly the area level of 20800 to 21000 that has been the target for the Semiannual pinbars on the bottom of the last major correction (mid 2015 till mid 2016), as well as the target for the Monthly Spring created last November after the US elections.

Currently, a bullish setup can develop on the Daily timeframe. For that, the market has to take out the 20702 level, then corrects, assuming that the Weekly Low at 20356 remains respected. Then new signs of strength and a Follow-through can push the price back to the 21000 level.

Dow Futures, various timeframes (at the courtesy of prorealtime.com)

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.