Sensex closes rangebound session lower ahead of Fed rate decision, GST Council meet

Dalal Street took a breather on Wednesday as investors preferred to book profits after a 496-point rally on the Sensex in previous session. Equity benchmarks closed rangebound session lower on caution ahead of Federal Reserve rate decision tonight and GST Council meet on Thursday. Increase in CPI inflation (to 3.65 percent against 3.17 percent MoM) also weighed on the sentiment.

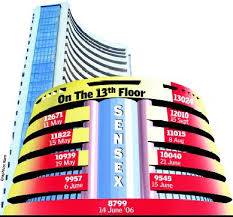

The 30-share BSE Sensex slipped 44.52 points to 29,398.11 and the 50-share NSE Nifty declined 2.20 points to 9,084.80, dragged by technology stocks.

While a rate hike by the US Federal Reserve is already factored in, markets will keenly watch the Fed’s commentary, experts say. They feel the rally is likely to continue in market, atleast till end of March.

With US growth coming back, 2017 is expected to be great for other economies also, James Glassman of JP Morgan said, adding India and China are likely to grow at 6.5-7 percent this year.

Taher Badshah of Invesco Mutual Fund says the momentum in the market is really strong and another rally of 8-10 percent is not really very difficult in the presence of such strong liquidity. He feels the market remains constructive post the big BJP win and on the back of global recovery.

The broader markets outperformed benchmarks smartly despite the market breadth was balanced. The Nifty Midcap and Smallcap indices gained 0.8 percent each. About 1423 shares advanced while 1392 shares declined on the BSE.

Meanwhile, the rupee gained past 65.50, the highest level since November 2015 as the dollar buying slackened ahead of Federal Reserve meeting outcome. It closed at 65.68 a dollar, up 13 paise.

The Goods and Services Tax (GST) Council headed by Finance Minister Arun Jaitley is expected to approve the remaining two crucial bills — State GST (SGST) and Union Territory GST (UTGST) — on Thursday. If it approved, then that would be another decisive step in the run up to the implementation of the overhauled tax regime from July 1. Final drafts of the three other bills — Integrated GST (IGST), Central GST (CGST) and Compensation bill — already cleared by the Council.

Idea Cellular was biggest gainer among Nifty stocks, up 9.75 percent after sources told CNBC-TV18 that US-based ATC is close to completing buyout of company’s tower business.

Technology stocks remained under pressure throughout the session on stronger rupee, with the Nifty IT index falling more than 1.5 percent. TCS was down 2.7 percent and Infosys fell 2.2 percent.

BHEL gained 3 percent after the company has commenced commercial operation of its first 800 MW thermal unit at Yeramarus thermal power station of Raichur Power Corporation in Karnataka.

Tata Power was up 1.7 percent on expansion of its Bengaluru cell & module manufacturing unit by 65 percent to 300 MW.

Reliance Industries, SBI, HDFC Bank, Tata Motors, HDFC and Tata Steel among others gained 0.4-1.2 percent whereas HUL, ICICI Bank and L&T were losers in trade.

Markets in Europe and Asia were mixed ahead of a Federal Reserve rate-setting meeting in the US.