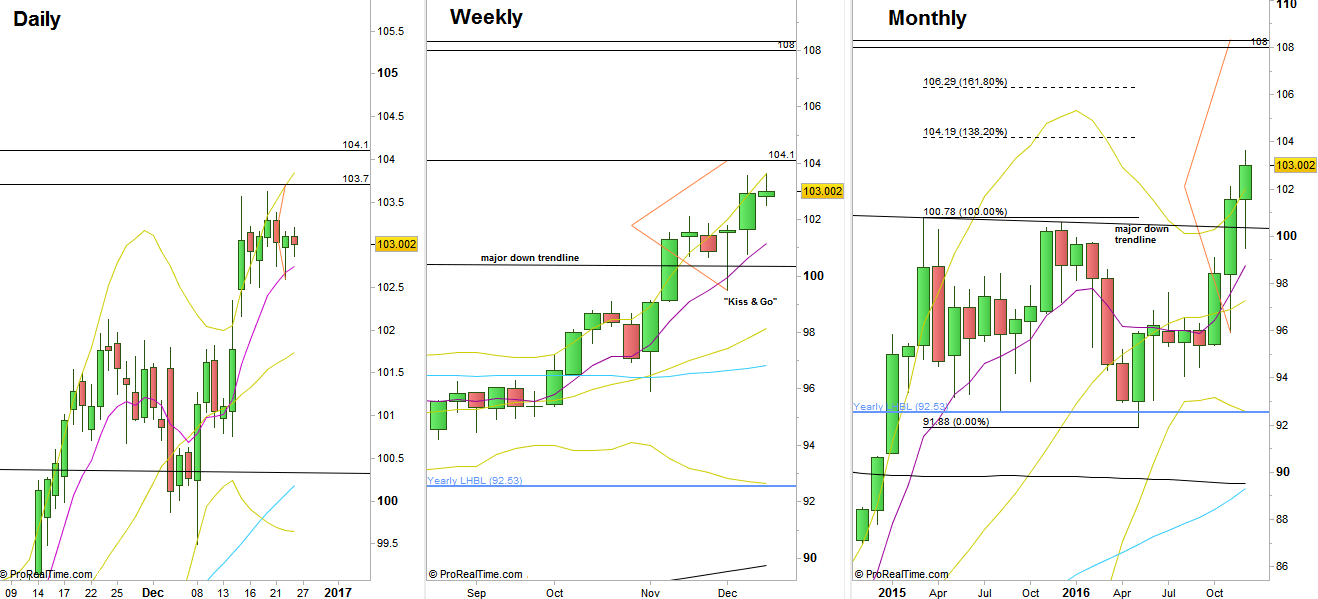

A relatively narrow range Weekly bar has been printed before the holiday, but still a HH HL bar touching the upper Bollinger band, meaning that the momentum is still very strong, and nothing has changed much as for the nearest targets.

Currently there is a bullish signal on the Daily timeframe, last Thursday’s bullish pinbar on sloping 8 EMA – already got a confirmation by the thrust up made last Friday. The target is at 103.7.

On the other hand, any pullback down that doesn’t close the open gap below at 101.77-102.16, followed by signs of strength is a very good signal to continue higher. In this case, the nearest swing target is the 104.1 area that the bullish Weekly pinbar on sloping 8 EMA 3 weeks ago is targeting to. This Weekly bullish pinbar tested the major down trendline above the whole price action since March 2015, in a “Kiss and Go” manner. Slightly above, at 104.19 there is the 138.2% extension for the whole bearish activity since March 2015. The 161.8% extension for that retracement lies at 106.29.

Above that target, the next major target is the previous Semiannual bullish pinbar on sloping 8 EMA pointing towards 108, slightly below the target of the Bullish Monthly bar of last November on sloping 8 EMA pointing at 108.3.

I wouldn’t recommend holding the same position for the higher targets than 104.1, as by the Yearly charts there are very good chances to see a considerable retracement below the stop level of that Weekly bullish pinbar, before the bigger move most likely continues.

Dollar Index, Daily, Weekly and Monthly charts (at the courtesy of prorealtime.com)

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.