Donald Trump had a rocky campaign. And the transition has been bumpy as well. But he looks to be rolling onto the presidency on the smoothest economic path of any president in a long time.

Data ranging from wage and job growth to manufacturing-sector indicators show that Donald Trump is getting an economy in better shape than any new president in a generation. Take a look at the following four indicators to see just how fortunate the President-elect is:

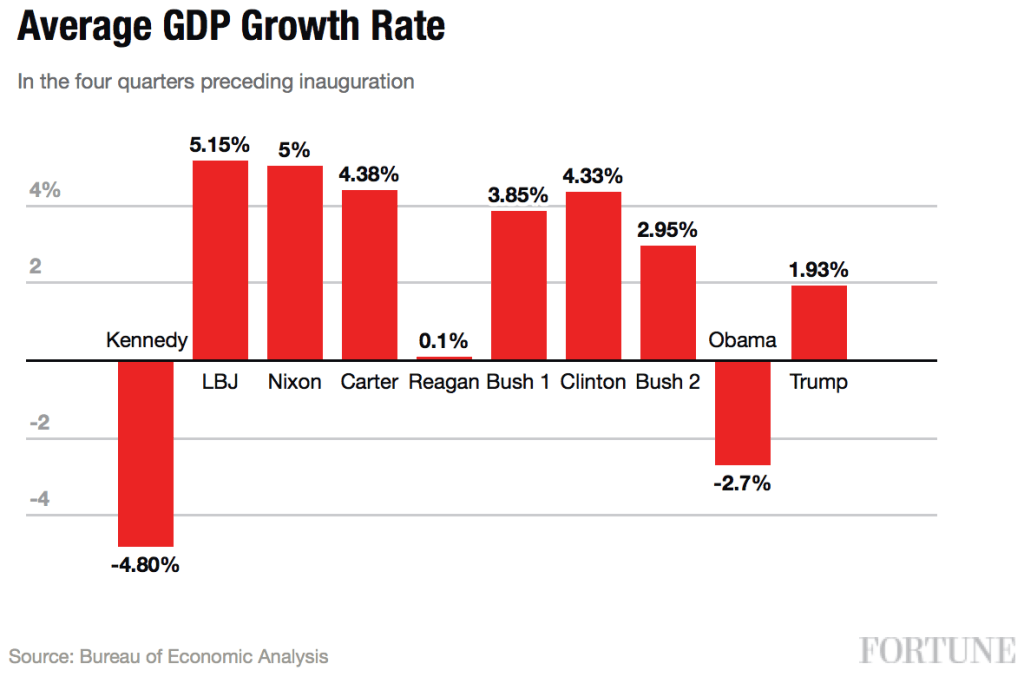

GDP Growth

The only indicator that shows Trump inheriting a generally weaker economy than is typical is GDP growth. As you can see from the following chart, while Trump will assume management of a much stronger economy than Obama did eight years ago, GDP growth over the past year has been historically weak.

This fact is mitigated somewhat by a more slowly growing population, which leads to slower overall growth than a quickly growing population does. (Although even per capita measures of real GDP growth show the U.S. becoming richer at a slower pace.) And the fact that growth has been picking up recently. The economy grew at a 3.2% pace in the third quarter.

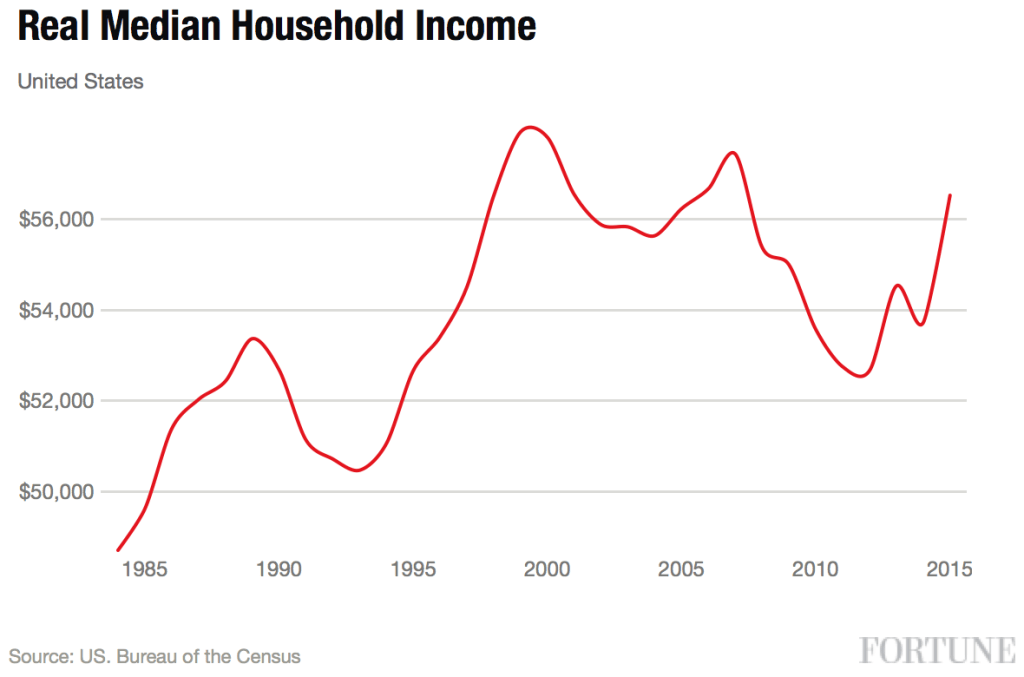

Wage Growth

Despite the good economy, voter surveys show that a good portion of Americans were unhappy with the economy. And that’s why GDP matters. It’s much more common for the typical American’s material situation to improve in an economy when overall GDP is growing quickly. So slow GDP growth has equally little or no raises. And that’s resulted in unhappy workers.

But that’s changing too. Recently there’s evidence that growth in wages in outpacing growth of the overall economy.

In 2015, the Census Bureau reported that the typical American saw the largest one-year increase in household income since it began surveying citizens on this question back in 1968. Other measures of wage growth, like the Employment Compensation Index and the average hourly earnings metric released by the Labor Department also show the average pace of wage gains increasing of late.

Given that takehome pay is the way most Americans interact directly with the economy, the trends in these statistics bode well for worker attitudes toward the Trump Administration.

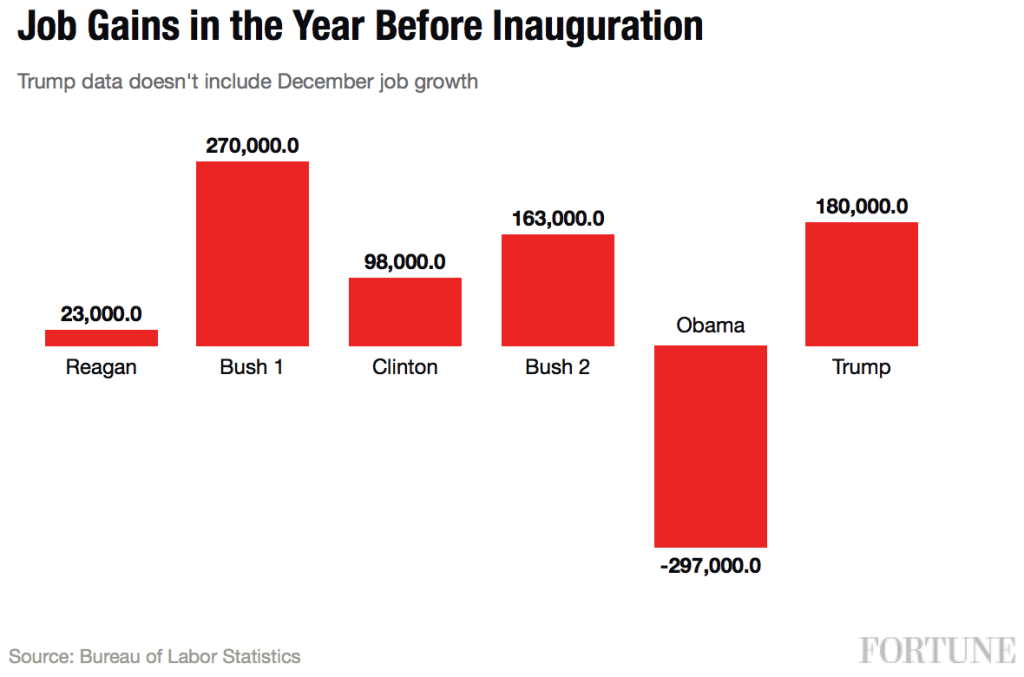

Jobs

Economists point to the declining employment rate and the steady creation of new jobs as the drivers of wage growth. Indeed, the U.S. economy has been adding new jobs at a healthy pace, with job growth over the past year posting the highest monthly average in an election year since George H.W. Bush won in 1988:

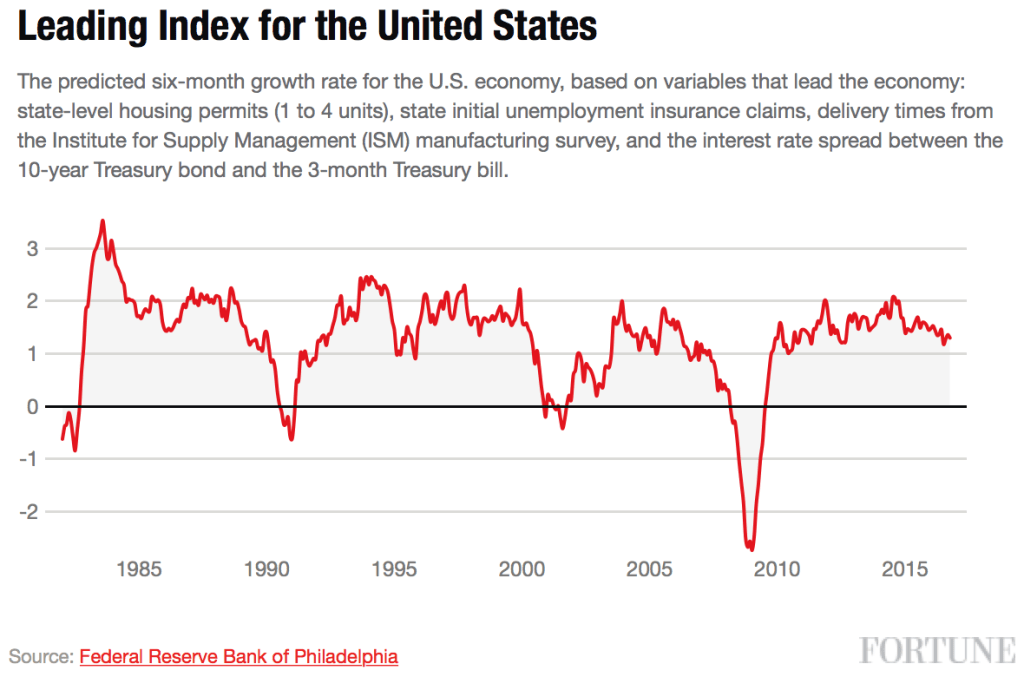

Manufacturing, Housing, and Other Leading Indicators

The difficulty in projecting how economic trends will affect an incoming presidential administration is due to the tendency of recessions to unexpectedly materialize. The economy was booming, for instance, when George W. Bush took office in the winter of 2001. Growth had averaged more than 3.5% in the previous 3 quarters. But by March, the economy was in contraction, and stock markets began to falter following the Sept. 11 attacks later than year. The malaise of the dot-com crash set in in 2002, even as economic growth began again.

Although recessions are notoriously difficult to predict, there were warning signs at the turn of the millennium. The Federal Reserve Bank of Philadelphia produces a leading index which predicts the current 6-month growth rate for the U.S. economy. As you can see from the chart below, this index correctly predicted the past three downturns. This year: It is predicting modest growth between 1% and 2% this year. Nowhere near flashing the sort of recession signals that greeted President George W. Bush or Barack Obama.

That doesn’t mean that President Trump shouldn’t tread carefully. His more experimental policies, like his tough talk on trade and the institution of tariffs, have the potential to trigger a recession on their own. But the above data show that Trump is one of the luckier President-elects in recent memory, when judged by the economic conditions he is inheriting.