As opposed to the election’s volatile week, the passing week showed consolidation on the Highs, a clear shortening of the thrust.

After closing the most important gap since the Monthly correction has started, at levels 2171.75-2177.5, a typical correction and the reversal back up, – the market succeeded in making a follow through. Most likely the High of September 8th at 2189.25 is going to be taken out before a considerable correction starts (if any).

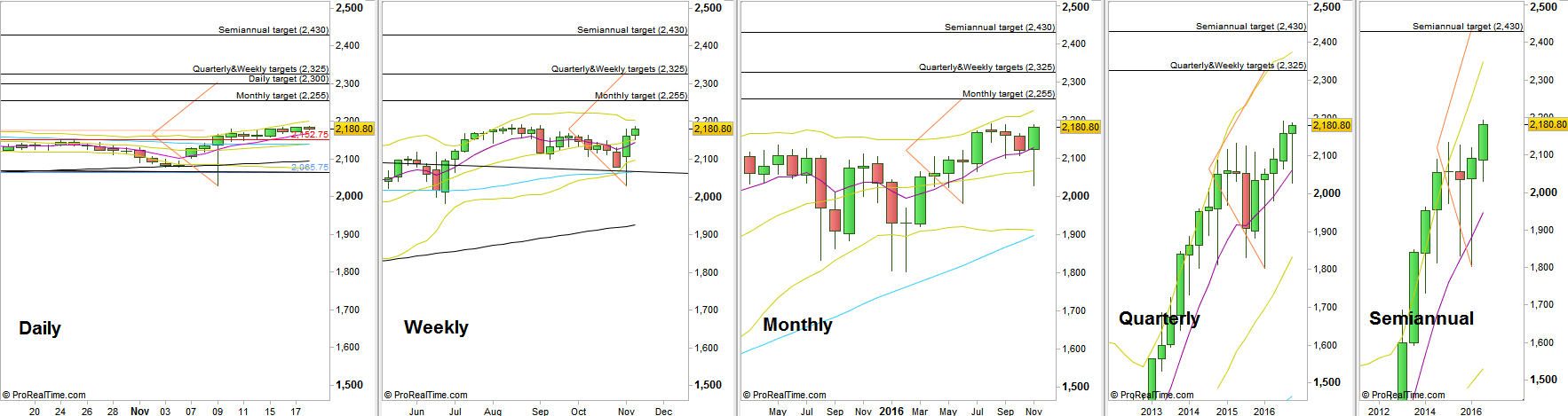

The signs for lack of enthusiasm could be seen clearly back on the previous Friday which was a Daily inner bearish bar that didn’t manage to touch the upper Bollinger band. The whole passing week advanced lazily upward in the same manner – bars that don’t touch the upper Bollinger band, trading in the range of more than 50% retracement of the former bar.

The most important price level currently is the Quarterly High, at 2191.5. Taking out this level completes a bullish Quarterly OKR, after the false thrust down made by the elections volatility. If happens, it is a very strong sign for the midterm. On the other side, a Weekly reversal down below this level means by most chances that the market would like to stay in the current Quarterly range till the end of this year, and at best closing the Quarterly bar as a bullish pinbar (delaying the probable thrust up to the next year).

Interesting to see that for each important timeframe, from the Daily up to the Semiannual (all charts attached), all have at least one bullish signal by the form of bullish pinbar on a sloping 8 EMA or in the form of a false thrust down on the lower Bollinger band, with a considerable higher target – all signals have already gotten the bullish trigger by taking out their highs.

S&P Futures, bullish pinbars across all important timeframes (at the courtesy of prorealtime.com)

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.