Does the Increase in Volatility Signal a Dangerous Market Environment?

Over the last several weeks stock price volatility has increased significantly above norms. All of a sudden it is not uncommon to see stock prices moving 5%, 10% or more in a single trading day. Interestingly, this volatility is occurring both to the upside and the downside. Common sense would suggest that the intrinsic value of a business cannot change by those orders of magnitude from one day to the next. Logic dictates that the market is either inaccurately pricing the stocks now or it was incorrectly pricing them the day before.

Stock price volatility is an unavoidable and undeniable reality. The stock market is an auction, and as a result, prices are continuously fluctuating up and down. Of course, that is stating the obvious because every investor in common stocks surely understands the associated daily volatility. However, my experience in talking with investors suggests that not every common stockholder embraces the complete unpredictability of stock price movements in the short run.

However, once you accept the undeniable reality that it is impossible to predict where the price of a stock will go in the short run other than by chance, your perspective on investing in stocks changes dramatically. For starters, you quit attempting to worry about the unpredictable and are inclined to focus on matters that are more reliable. When investing in businesses (stocks) you begin to understand that business fundamentals are more predictable and trustworthy than attempting to guess price action.

The venerable mutual fund manager Martin Whitman put it quite succinctly as follows:

“I remain impressed with how much easier it is for us, and everybody else who has a modicum of training, to determine what a business is worth, and what the dynamics of the business might be, compared with estimating the prices at which a nonarbitrage security will sell in near-term markets.” – Martin J. Whitman, chairman, Third Avenue Value Fund

A dangerous side effect of not embracing the unpredictability of short-term stock prices is extreme bouts of anxiety when stock prices do not behave as the investor hopes they will. Forgetting that short-term stock price movements can also be irrational can cause investors to question their decisions even when their decisions were sound and prudent in the first place.

Anxiety typically leads to knee-jerk reactions and excessive trading in their portfolios. In short, emotionally-charged investors have a tendency to sell when they should buy and buy when they should sell. Fear engenders irrational sell decisions, and greed provokes unreasonable and aggressive purchases. In both cases, investors are more likely to lose than they are to gain when emotion dominates reason. As a result, I suggest that investors heed the Wall Street maxim – “in times of crisis, money moves from weak hands to strong hands.” As investors, we should strive to be those with the strong hands.

Stock prices are often pathological liars

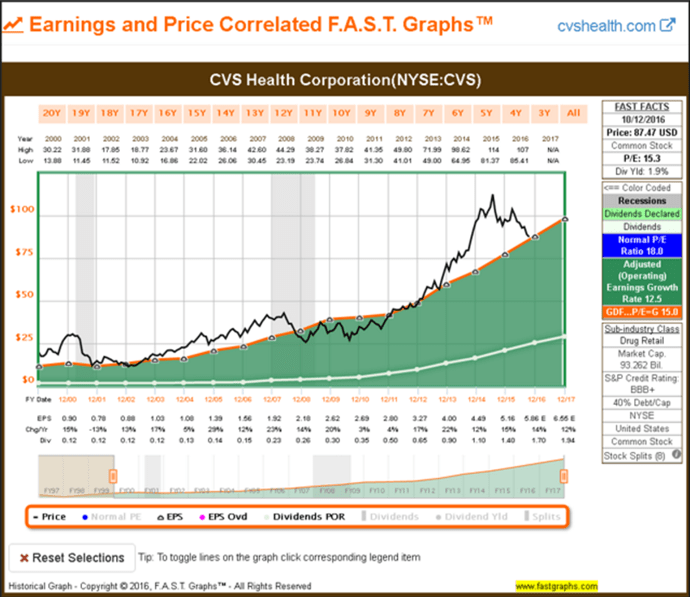

On Oct. 13, I wrote an article titled “Why I Am Now Interested in CVS Health Corp.” In the article I pointed out that the market was significantly overvaluing the shares of CVS Health Corp.(NYSE:CVS) for most of 2014 and 2015. In other words, this was a classic example of the market pricing a stock in excess of what fundamentals would indicate. Over this timeframe, I am putting forward that the market was telling a lie regarding the true worth or value of this excellent company. Consequently, the approximately 32% drop in CVS’s stock price since July 31, 2015 was predominantly attributed to overvaluation.

When a stock is being excessively valued by the market it becomes vulnerable to any issues that may occur. This is where the real risk of overvaluation comes into play. When a stock is excessively overvalued, you could say it is priced to perfection, and therefore, extremely vulnerable to any hint of bad news.

However, so-called bad news is not always readily apparent. Here is a copy of the CVS graph as presented in the article. Consensus earnings estimates for fiscal year 2016 were $ 5.86, and earnings for 2017 were estimated at $ 6.55. Based on these numbers, the company was approaching fair value, and therefore, I indicated that I was becoming interested in researching the stock deeper because it was beginning to look attractive.

[ Enlarge Image ]

[ Enlarge Image ]

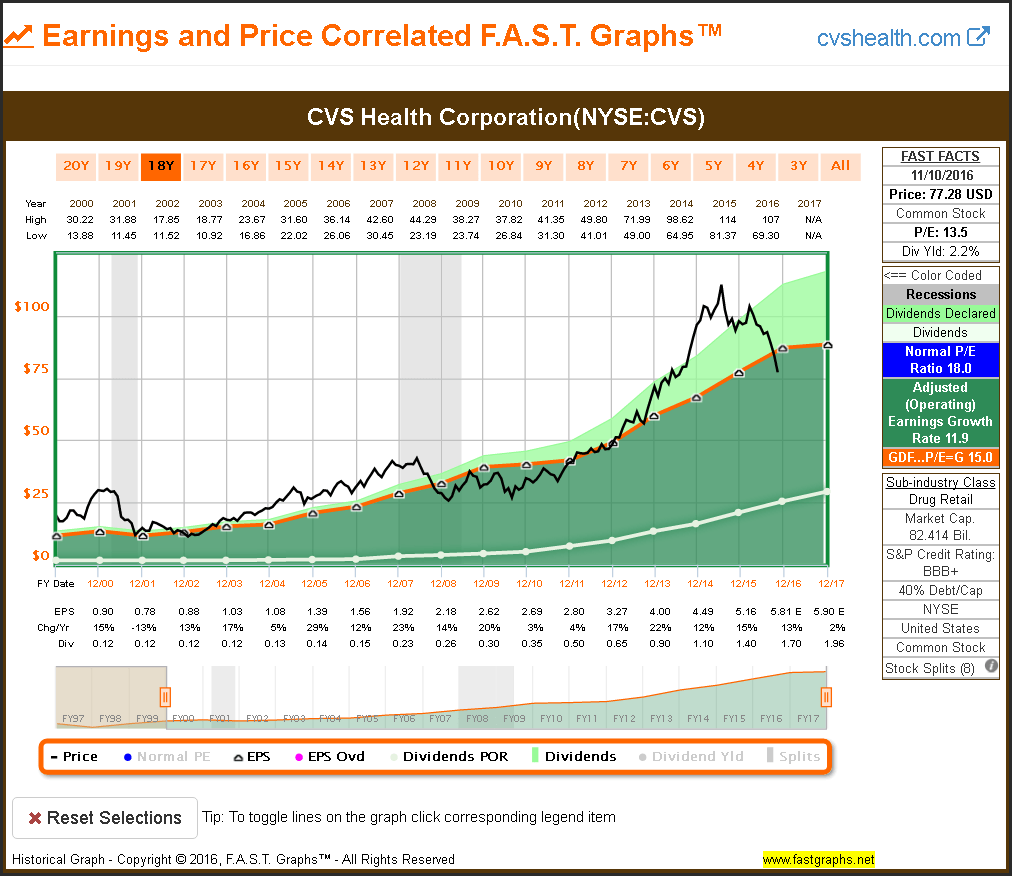

However, on Nov. 8 the company reported earnings and softened their guidance below previous expectations. Consequently, moderately bad news that was not apparent when I wrote the article had suddenly become apparent. This is what CVS’s earnings and price-correlated graph currently looks like based on updated estimates.

[ Enlarge Image ]

[ Enlarge Image ]

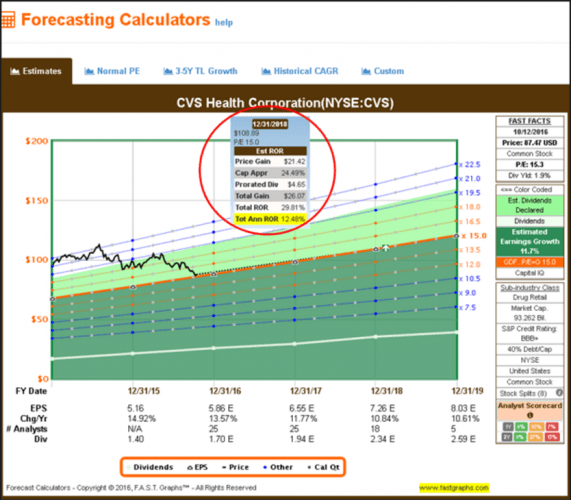

The following forecast calculators reflect a longer forward-looking timeframe than the historical-oriented graphs. The forecast calculator for CVS looked like this in October when I wrote the article.

[ Enlarge Image ]

[ Enlarge Image ]

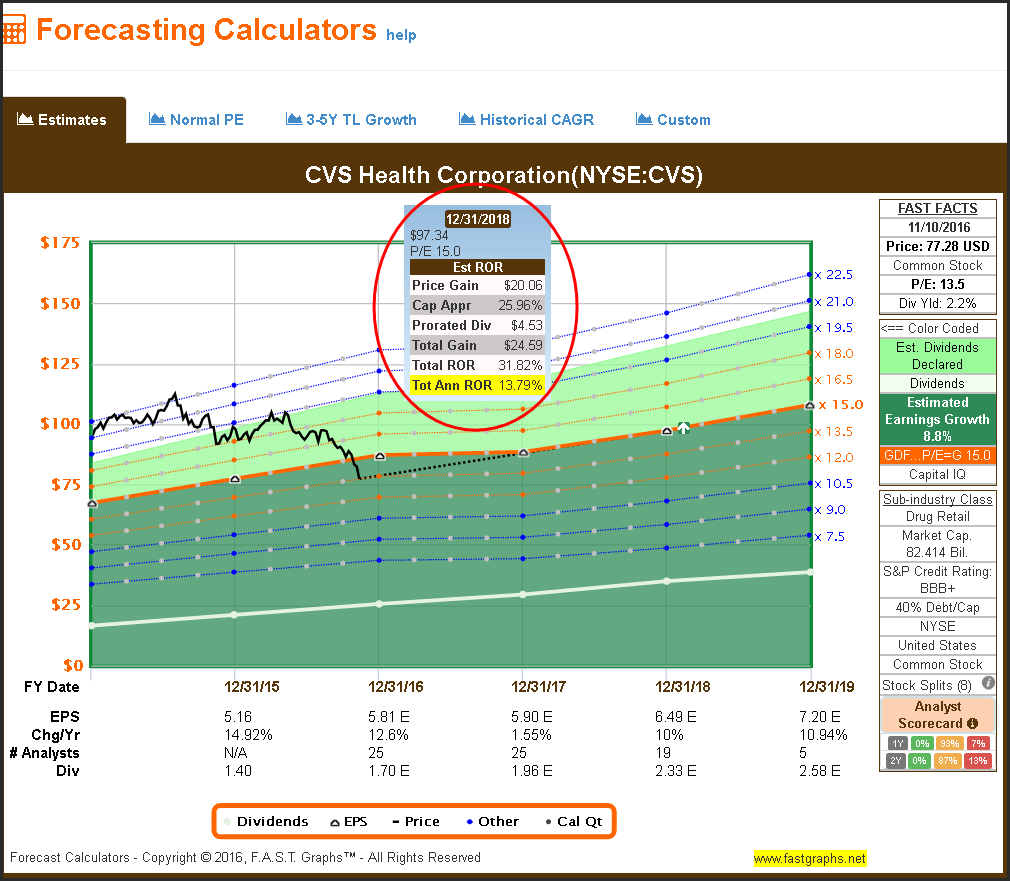

Here is the updated forecast calculator as it looks today. Price volatility was significantly more dynamic than changes in the company’s fundamentals (earnings).

[ Enlarge Image ]

[ Enlarge Image ]

My message is straightforward and clear. Judge your holdings by how well their businesses are performing rather than what an often “schizophrenic” Wall Street may be saying. If fundamentals are good and the price falls, hold or buy more as appropriate. If the price rises to unjustifiable valuations, sell and replace to protect against risk regardless of fundamentals.

I realize that attempting to forecast markets or stock prices in the short run is an exercise in futility. Short-term market movements are driven and dominated by emotion and not rational thought. At any given moment in time, the powerful emotions of fear or greed can and will overshadow reason. However, in the longer run, rational thinking and fundamental strengths prevail. The followingWarren Buffett (Trades, Portfolio) quote speaking about Ben Graham summarizes my views:

“Ben Graham said you should look at stocks as small pieces of the business. Look at (market) fluctuations as your friend rather than your enemy – profit from folly rather than participate in it. He said the three most important words of investing: ‘margin of safety.’ I think those ideas, 100 years from now, will still be regarded as the three cornerstones of sound investing.” – Warren Buffett (Trades, Portfolio)

Is the stock fairly valued or a value trap

To add clarity to the thesis of this article, I am advising that investors focus more on fundamentals than short-term stock price movements. The true message underpinning the Marty Whitman quote I presented above can be better understood by thinking about the timing of real information versus daily and hourly price variations.

Companies report earnings quarterly or only four times a year. I contend that it is primarily through these quarterly financial reports where relevant information about a company and its fundamental health can be found. As previously stated, in the short run, stock prices are often pathological liars. Additionally, stock price volatility is relentless and continuous.

Consequently, I do my best to ignore short-term price volatility other than to measure it against the fundamental valuations that I see in each company in which I invest. However, I am keenly focused on evaluating the company’s financial performance when each quarterly report is posted. Sometimes the real news is good, and sometimes it’s not so good. However, it is only at these times that I began drawing a conclusion regarding whether I will buy, hold or sell.

I recently received a suggestion from a reader and F.A.S.T. Graphs™ subscriber to write an article featuring Chicago Bridge & Iron Co. (NYSE:CBI). The reader suggested that this company would be a case study of a value trap. If I understood him correctly, he invested in the stock thinking it was undervalued based on what he saw on the earnings and price-correlated graph. However, the company has continued to decline. Nevertheless, I think it represents an excellent example behind the thesis of this article.

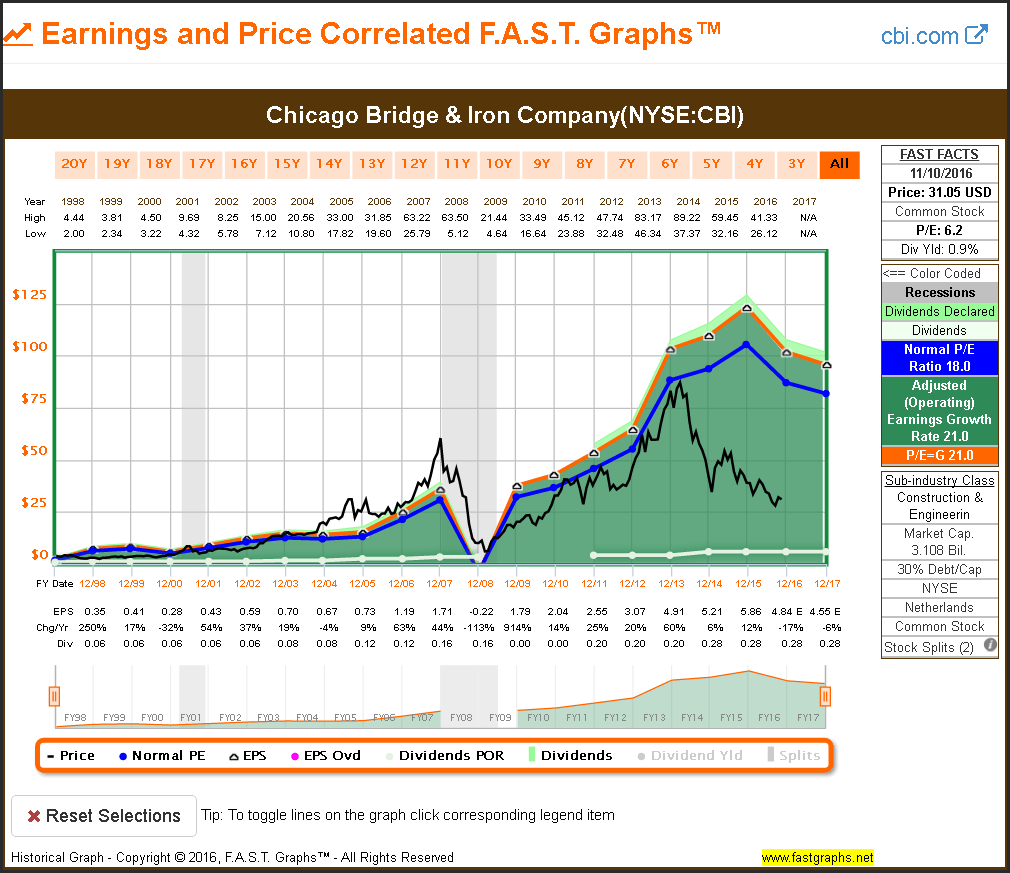

The following operating earnings and price-correlated graph on Chicago Bridge & Iron since the beginning of 1998 tells an interesting story regarding the long-term relationship of stock price to fundamentals. First and foremost, we see that in the long run price follows earnings (the orange line on the graph). We also see the price collapse and that the dividends were cut during the Great Recession when earnings also went negative.

The black line on the graph is a plotting of monthly closing stock prices. This is important because with only 12 dots connected for each year we get a perspective of the trend of stock prices over time. This would be in contrast to a graph showing daily price action which would be significantly more erratic or jagged. Nevertheless, we still see short periods of time where stock prices rise and fall and become disconnected from fundamental value.

However, in the longer run, we see stock prices clearly moving in tandem with earnings. To me, this illustrates the importance of fundamentals (earnings in this case) over price action in the long run. On the other hand, since April 2014 the disconnect between stock price and earnings appears more pronounced than at any other time over this long-term timeframe. It should also be pointed out that earnings are forecast to fall 17% for this fiscal year and another 6% for fiscal 2017. Therefore, at first glance, this provides a partial explanation of the recent price action.

[ Enlarge Image ]

[ Enlarge Image ]

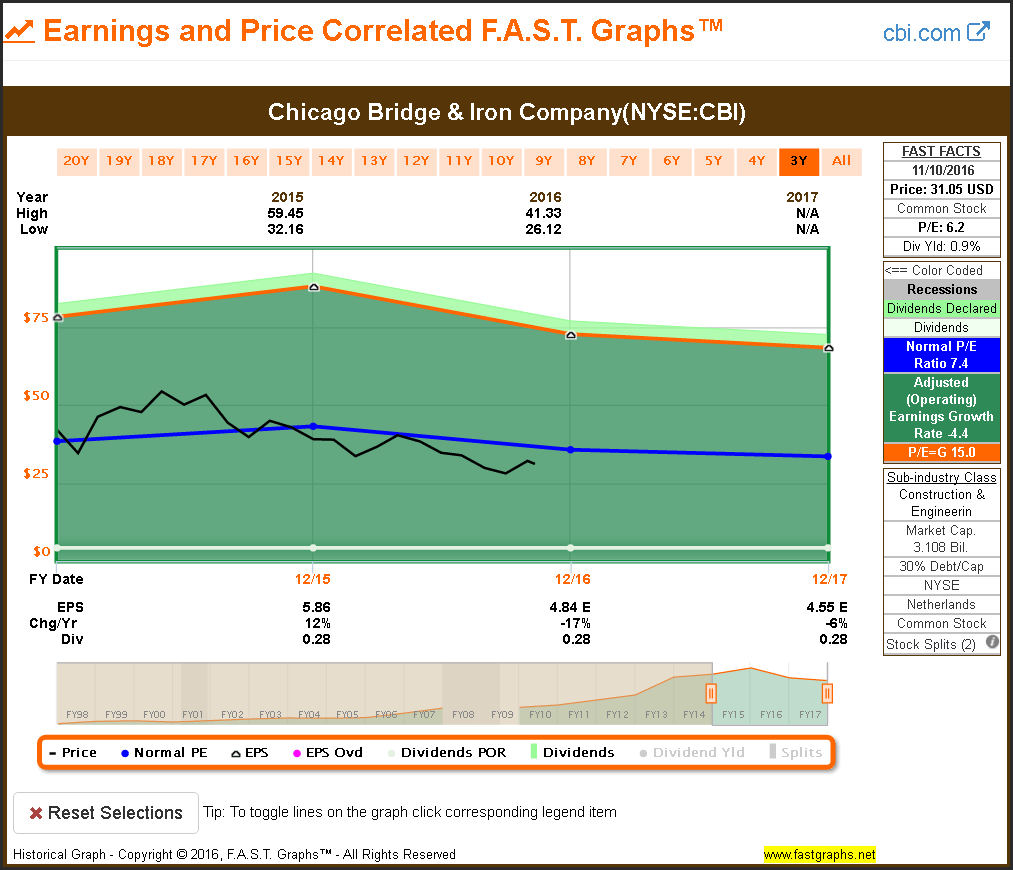

Therefore, when we shorten the timeframe covering only 2015 and 2016, the earnings and price relationship appears more rational. The normal price-earnings (P/E) ratio of 7.4 (the dark blue line) for this time period clearly reveals that current market sentiment is poor because of weak earnings. From my perspective, it is the weakening fundamentals that indicate to me that the stock might not be undervalued.

[ Enlarge Image ]

[ Enlarge Image ]

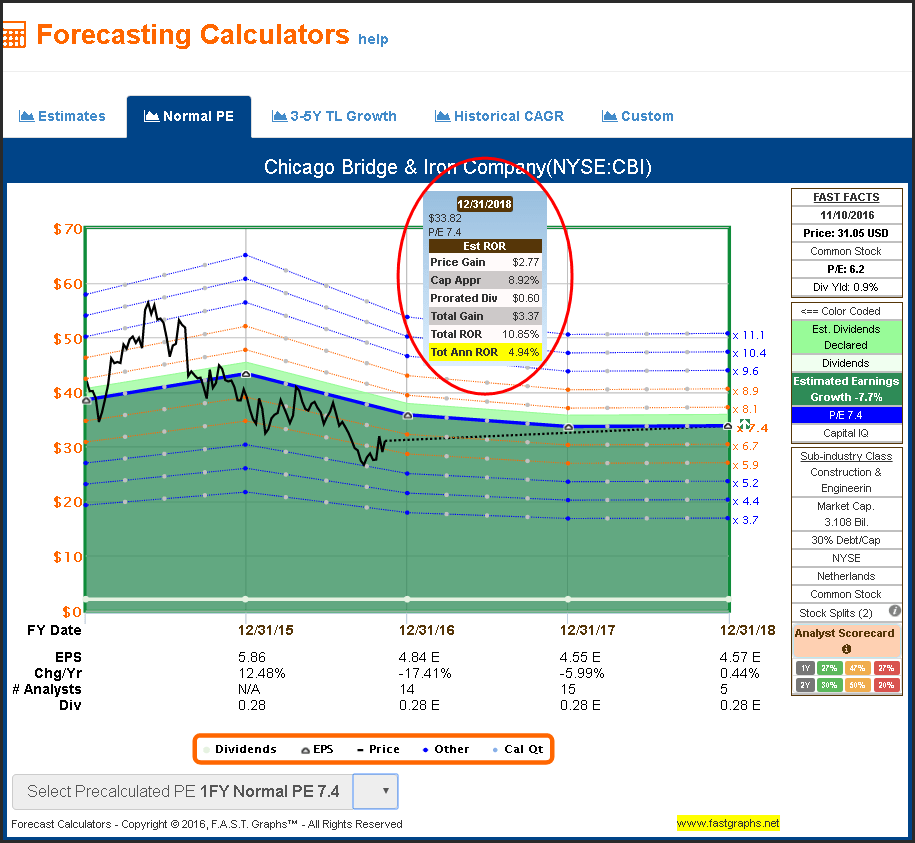

As I have often written, we can learn from the past, but we can only invest in the future. Therefore, a quick look at forecasts utilizing the normal P/E ratio as a valuation reference shows that future returns over the next year or two might not be that exciting if the 7.4 normal P/E ratio holds.

[ Enlarge Image ]

[ Enlarge Image ]

However, thus far we are only looking at Chicago Bridge & Iron based on operating earnings, but operating earnings are not the only fundamental metric to consider. They represent a good starting point, but I always suggest that subscribers take advantage of all the analytical horsepower thatF.A.S.T. Graphs™ offer. Personally, after I look at earnings, I typically move on to cash flows.

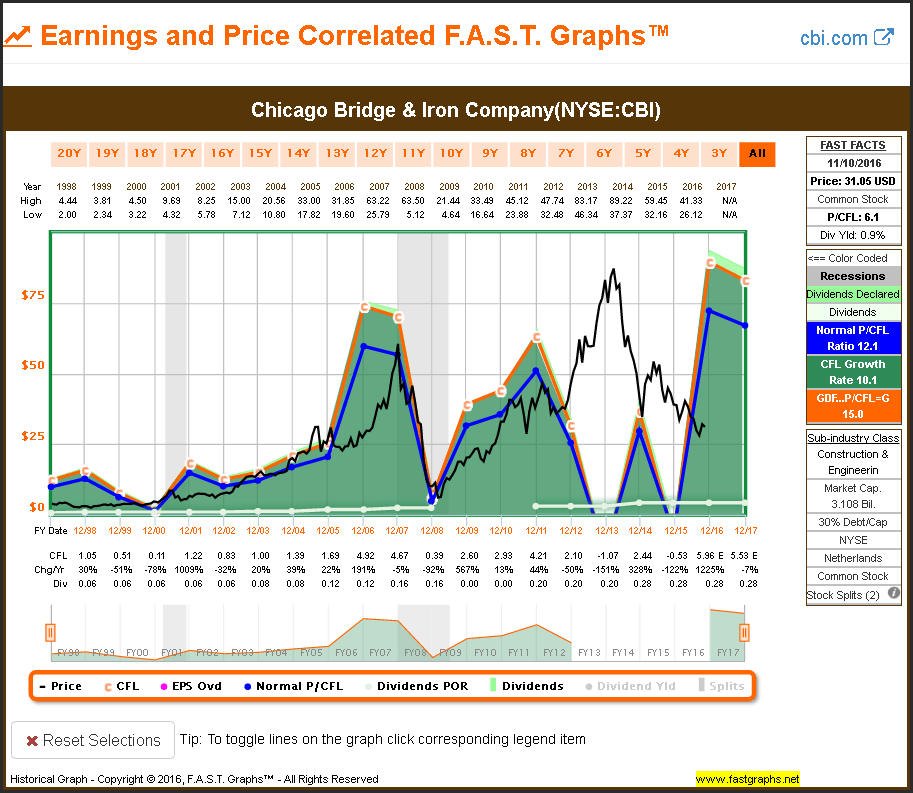

When I examined Chicago Bridge & Iron based on operating cash flows, the recent precipitous stock price drop makes a lot more sense. Cash flow generation has been horrible since 2011; therefore, this fundamental metric does not suggest undervaluation in 2014 and 2015 as operating earnings might have appeared to.

[ Enlarge Image ]

[ Enlarge Image ]

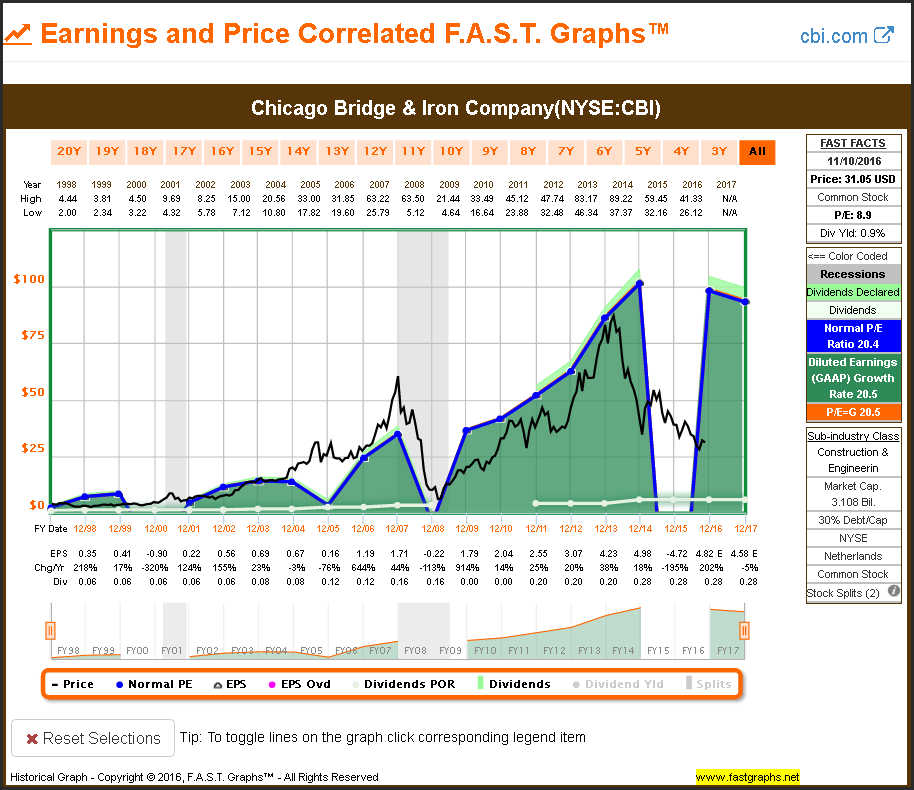

Also, GAAP (diluted) earnings for 2015 clearly indicate that Chicago Bridge & Iron’s price drop was rational based on this fundamental metric. Consequently, the threat of a value trap based on this metric would be sprung just as it was when I evaluated cash flows above. Additionally, we also see that fundamentals drive stock prices over the long run.

[ Enlarge Image ]

[ Enlarge Image ]

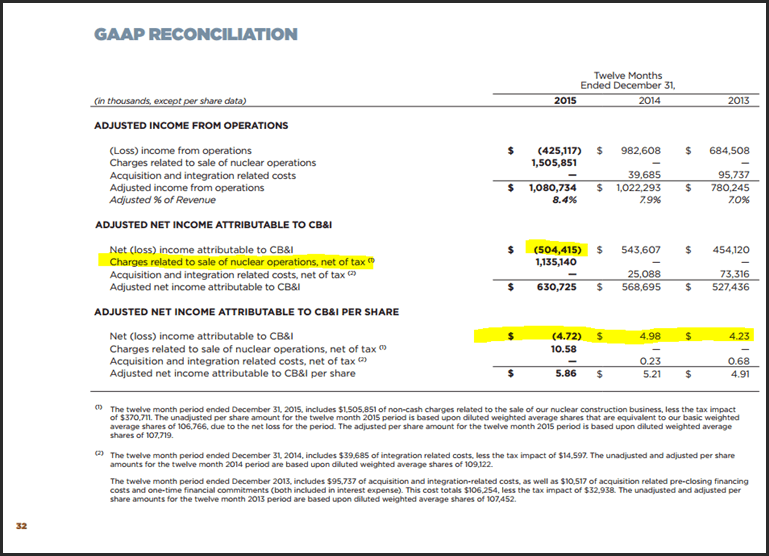

The following GAAP reconciliation from Chicago Bridge & Iron’s 2015 annual report reflects the reason for the 2015 diluted earnings loss, the point being that focusing on fundamentals, all fundamentals, provides more insight than simply looking at stock price movements.

[ Enlarge Image ]

[ Enlarge Image ]

The moral of the story is that a value trap can be avoided by focusing first and foremost on fundamentals. Chicago Bridge & Iron has at times been an excellent total return investment. However, the company also has experienced a significant amount of cyclicality within its operating results historically. Although this is reflected in the company’s long-term price action, a true understanding and perspective comes from focusing on fundamentals more than price.

Summary and conclusions

Excessive stock price volatility within the overall markets would suggest a level of anxiety with investors. However, anxiety is an emotional response and emotional responses tend to be temporary. Nevertheless, if all you focus on is short-term price action, you can be easily led astray. Personally, I prefer focusing on the fundamental strengths and weaknesses of each individual company in which I am interested in investing.

Consequently, I am not really as interested in whether the price of the stock is rising or falling as I am in how the current price relates to the fundamental value of the business. I never let the short-term direction of stock prices cloud my judgment. Instead, I base my decisions on what I believe the company under consideration is capable of achieving on an operating basis going forward. If valuation appears sound on that basis, I am happy to invest. If valuation appears rich, I will avoid or possibly sell if I already hold the stock. Consequently, I rarely see danger in price volatility, but sometimes I see it clearly when I examine fundamentals closely.

Disclosure: Long Chicago Bridge & Iron, CVS at the time of writing.