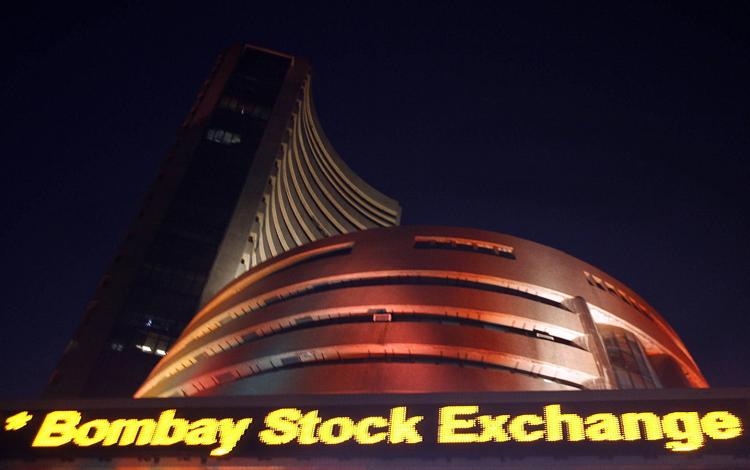

India : Sensex falls for 4th consecutive day, Nifty ends below 8100

Equity benchmarks closed rangebound session on a negative note Thursday with the Nifty ending below 8100 for the first time since June 27. Investors remained cautious about 2HFY17 growth after demonetisation.The 30-share BSE Sensex was down 71.07 points at 26227.62 and the 50-share NSE Nifty fell 31.65 points to 8079.95 while the broader markets were also under pressure. The BSE Midcap and Smallcap indices slipped 0.4 percent and 0.6 percent, respectively.

Gautam Duggad of Motilal Oswal India Strategy says against the current backdrop, he expects Q3FY17 earnings to be impacted the most and, thus, the earnings recovery thesis of 2HFY17 is now in jeopardy.

Post demonetisation, he sees obvious downside risks to FY17 earnings estimates for the Motilal Oswal universe as well as the benchmark Sensex.

Tanvee Gupta Jain of Macquarie Capital Securities expects a 30-50 bps downside to their GDP estimate of 7.4 percent for FY17 but she sees a higher probability of 25 bps cut in RBI’s December policy.

Technology, HDFC group, auto (except Tata Motors) and telecom stocks were under pressure while FMCG, healthcare and select banks stocks gained.

Nifty IT index lost 1.5 percent after information technology industry body NASSCOM on Wednesday cut growth guidance for the industry to 8-10 percent in constant currency terms from 10-12 percent earlier. TCS, HCL Technologies, Wipro and Infosys were down 1-2.5 percent.

Auto stocks were down due to likely slowdown in sales after demonetisation. Bajaj Auto, Maruti Suzuki and Hero Motocorp fell 1-2.5 percent but Tata Motors bucked the trend, up over 3 percent.

Bharti Airtel was the biggest loser among Sensex 30 stocks, down more than 4 percent followed by Coal India, HDFC Bank and Asian Paints with 1-2 percent loss. However, ITC, ICICI Bank, HUL, Axis Bank, GAIL, Cipla and NTPC gained 0.5-1.5 percent.

About 1671 shares declined against 946 advancing shares on the Bombay Stock Exchange.

In the broader space, jewellery stocks surged on short covering. Gitanjali Gems, PC Jeweller and TBZ gained 3-9 percent.