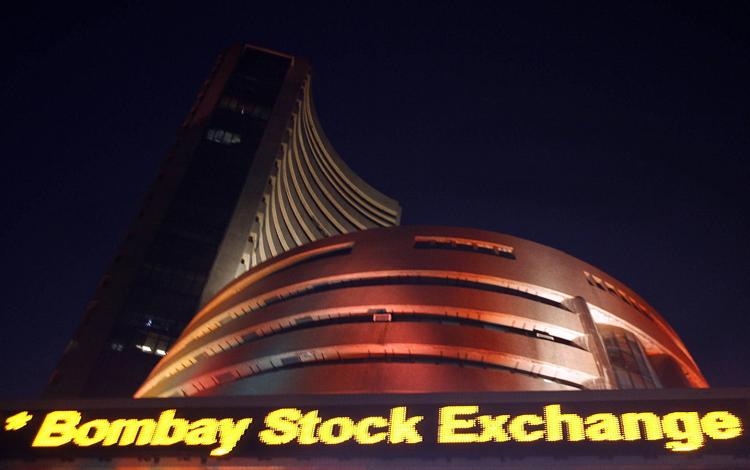

India : Sensex sinks 514pts, Midcap down 4% on demonetisation earnings

Dalal Street succumbed to more selling on Tuesday as the demonetisation effect and weak earnings drove the Sensex lower by 565 points and the Nifty below 8100 intraday. Strengthening of bond yields and US dollar on US president-elect Donald Trump policy also weighed on market sentiment.Equity benchmarks closed below their 200-daily moving average. The 30-share BSE Sensex tanked 514.19 points or 1.92 percent to 26304.63, the lowest closing level since May 25, taking the total loss for two consecutive days to 1200 points.

The 50-share NSE Nifty was down 187.85 points or 2.26 percent to close at 8108.45 after hitting an intraday low of 8093.20.

While maintaining overweight rating on India, Chris Wood of CLSA said demonetisation will be negative for equities in short term, adding that the move is a positive for bond and currency markets. Besides, demonetisation will help increase deposit growth of banks significantly, he said.

S Naren of ICICI Prudential MF said he does not expect February lows of 6900-7000 on the Nifty to be tested in near term.

The broader markets continued to underperform benchmarks with the BSE Midcap and Smallcap indices falling 3.91 percent and 4.7 percent, respectively. About 7 shares declined for every share rising on the exchange.

Nifty Auto, Metal and Realty indices hit hardest, falling 5 percent each followed by FMCG and Bank with more than 2 percent losses while IT (up 0.56 percent) and PSU Bank (up 2.26 percent) bucked the trend.

Tata Motors shares crashed 10 percent on lower-than-expected Q2 earnings; standalone business losses doubled to Rs 630.7 crore while JLR margin fell 190 basis points to 10.3 percent YoY. Tata Steel also fell nearly 8 percent post earnings.

Bank of Baroda gained 8.5 percent and Corporation Bank climbed 13 percent on improvement in Q2 asset quality.

Demonetisation impact – PSU banks like SBI, Union Bank, Canara Bank, Bank of India and Andhra Bank gained 1-3 percent on likely increase in deposits whereas non-banking finance companies like Can Fin Homes, Satin Creditcare, Shriram City, Ujjivan and Manappuram Finance cracked 12-20 percent on cash shortage. Jewellery and realty stocks were also under pressure.

HDFC shares fell more than 3.6 percent as foreign investors may have offloaded shares. Other reason for fall could be that insurance regulator IRDAI has expressed reservations about mega insurance merger plan between HDFC Life and Max India.

UltraTech Cement and Ambuja Cements were down 4-7 percent after Credit Suisse downgraded stocks to underperform, citing delayed cement upcycle.

Among other Sensex 30 stocks, Asian Paints, Maruti Suzuki, Axis Bank, Adani Ports, Coal India, ITC and ICICI Bank slipped 2-7 percent while Dr Reddy’s Labs and Wipro gained 1.5 percent.