The Nifty50 was one of the weakest stock markets throughout the passing week.

The Bearish setup mentioned last review by taking out the Low of October 17th has reached its target fully.

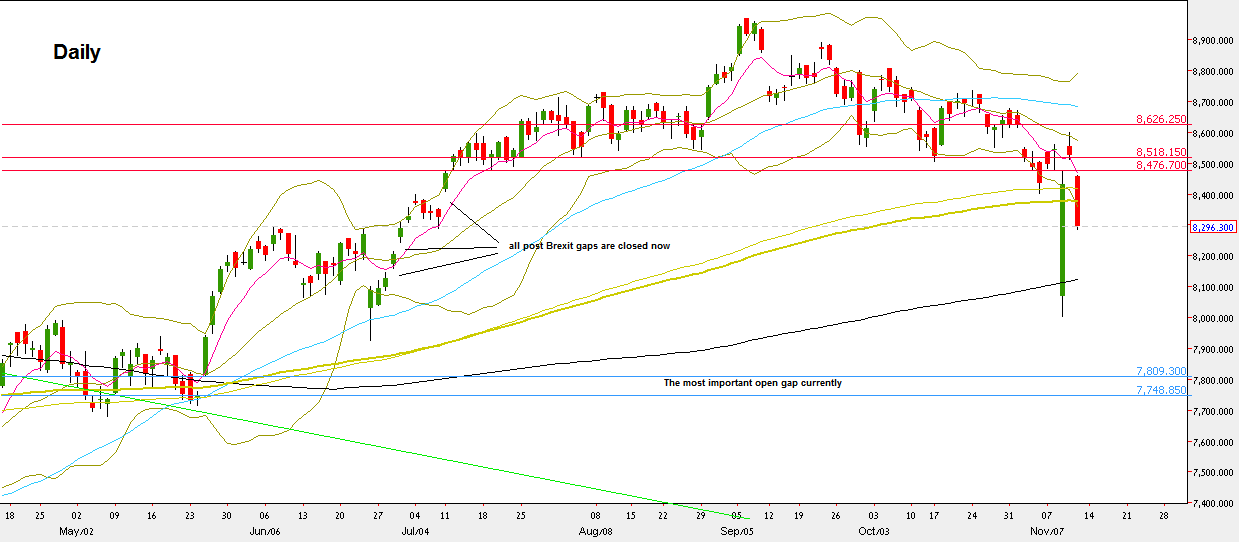

The huge volatility produced by the post US election day created a bullish Daily bar with the widest range since the beginning of 2016 which closed all open gaps that remained since the post Brexit bullish wave. That huge bullish bar started the move with a huge gap down finally closed the day after.

Pay attention to the fact that the bullish bar of last Wednesday respected the previous major Low of June 24th at 7927.05. Not only that, but the market took out the near major LHBL at 8559.4 right after.

This could have been a perfect sign of strength, unless an open gap above remained respected.

Currently, for a bearish position on 4H and above timeframes, we should wait for the Weekly Low at 8003 to be taken out, or we need another test of the High that doesn’t take out the High (8598.1), that eventually shows new signs of weakness.

Taking out the Weekly High is a bullish setup to reach a new “all time High”, but remember the open gap above (i.e. better to wait for the gap to close, to see a pullback and join it only on new signs of strength by then).

The major sign of weakness is that all the open gaps created at the beginning of the last bullish wave (post Brexit) – are closed now.

By the price action, I would not be surprised to see the market in the coming week consolidates inside the range of last week.

Nifty Futures, Daily chart (at the courtesy of netdania.com)

Disclaimer: Anyone who takes action by this article does it at his own risk, and the writer won’t have any liability for any damages caused by this action.