What A Trump Victory Really Means For The Market

Simple: as we have repeatedly said, a Trump victory, coupled with lower taxes, a spike in infrastructure spending, and a surge in debt is precisely what the economy – and a normalized market, one not manipulated daily by central banks – wanted and needed, as it not only will prompt yields to rise, but it will assure even more QE in the near future as foreign buyers of US debt disappear (assuming Trump does not do away with the Fed entirely, which for a man running a real estate empire, he won’t do as he ultimately needs lower rates).

As Trump said overnight, in a far less combative speech than pundits had expected, “We’re going to rebuild our infrastructure…we’re going to put millions of people to work as we rebuild.” A tax-cutting and big-budget extravaganza means Treasuries will have a hard time staying higher, it also means a steepener yield curve, just the thing banks need and explains the jump in bank stocks this morning.

It also means much more fiscal stimulus, as various pundits discovered overnight.

“Fiscal stimulus seems to be the most logical explanation, with Trump and a Republican Congress expected to deliver higher deficits,” Gennadiy Goldberg, an interest-rate strategist in New York at TD Securities told Bloomberg.

A good comprehensive summary of what Trump’s victory really means came from DB’s Jim Reid who said that a Trump win is likely to be viewed negatively across a wide range of assets in the short-term but the range of medium-term outcomes are much wider.

So as the trend is already pointing to, expect lower risk assets at first, lower bond yields on a flight to quality but then higher yields once his spending plans are digested and an equity market that might at some point benefit from reflationary policies but with greater risks (lower trade and global openness) and higher volatility.

First Brexit, now Trump and the 2016 anti-establishment triumvirate could be formed in less than 4 weeks by a ‘No’ in the Italian constitutional reform referendum. The political world is changing and the consequences are likely huge over the years ahead. As we discussed as the main theme in our long-term study in September (An Ever Changing World), the 35-year super cycle in assets, politics, policy and globalisation has likely turned.

Furthermore the sharp rebound in December rate hike odds suggests that the market is certainly not worried that Trump will crush the economy overnight, and that Yellen may well go ahead with a December rate hike after all (even if it means pushing the US into a recession, then cutting rates and launching the much desired QE4).

There is also more good news for coal and other energy companies, who are certain to benefit as Trump moves the US away from the progressive “clean” agenda.

Not everyone will benefit: now that Republicans have swept the US government for the first time since 1928, it means Obamacare is over – just a matter of time – and Affordable Care Act-vulnerable stocks such as Universal Health Services, AmSurg and Mednax will likely plunge; on the other hand pure pharma stocks like MCK and ABC will benefit as rhetoric on drug pricing will diminish significantly, leading to more stable earnings if/when changes in drug pricing become more stable.

And while we will have much more to say about this in the coming days, here is a good “first take” from Bank of America’s Michael Hartnet.

Result: Trump wins

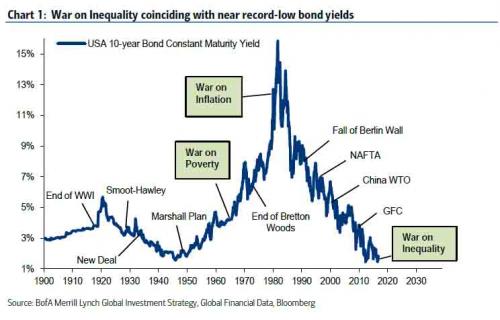

US election + BREXIT = populist repudiation of era of inequality, globalization, wage deflation; cements BofAML themes of peak Liquidity, Inequality, Globalization + Main St over Wall St. Electoral trends could mark secular low in long-term bond yields (Chart 1).

Tactics: credit spread to determine entry point

Gold surges toward $ 1400/oz, S&P 500 tumbles to 2000, 10-year Treasury yield to 1.5%; if credit spreads don’t crack (e.g. IBOXHYSE<500bps) and Mexico peso finds quick low = entry point for risk-takers (especially if Trump protectionist fears allayed); until then best Trump trades = long gold, short EU banks, long US small-cap, short EM.

Macro & policy: inflation and stagflation expectations rise

Uncertainty shock = lower US GDP estimates; markets will price in EU fragmentation; Fed likely passes Dec; but ultimate global growth impact of Trump will depend on whether protectionism or Keynesianism triumphs; either way inflation/stagflation = destination as policies focus on ending wage deflation via immigration controls, trade protectionism, fiscal spending. In our view, Republican sweep boosts probability of more meaningful fiscal stimulus to combat inequality.

Asset allocation: small returns, big rotation

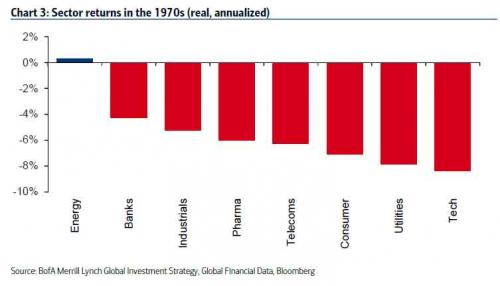

No change in BofAML asset allocation: overweight commodities, real estate, stocks and underweight bonds. Rotation towards assets, sectors, markets that benefit from higher inflation and steeper yield curve may take longer to play out but destination is clear. The risk is protectionist policies could lead to rising expectations of stagflation. Note 1970s “stagflation” was positive small-cap, value and energy stocks, commodities and real estate, negative large-cap, growth, tech and utilities stocks

Trump Q&A: the Presidential Inflection

Here’s a quick take on the impact of Donald Trump’s victory in the US Presidential election on the macro and the markets.

1. What does the Trump victory signify?

Victory for populism, another vote against inequality, raises risk of stagflation, likely will provide one of the last great opportunities to reduce exposure to bonds. US election + BREXIT = populist repudiation of era of inequality, globalization and wage deflation; cements BofAML themes of peak Liquidity, Inequality, Globalization, Main St assets over Wall St. Last time electorates shifted in this manner was 1980 when electorate said “end inflation.” Bond yields peaked. Today electorates seem to be saying end wage deflation via immigration controls, trade protectionism, fiscal spending (Chart 1).

2. Does US election result change our asset allocation views?

No. We are currently overweight commodities, real estate, stocks and underweight bonds. Trump victory will cause short-term risk-off and preference for Developed Markets over Emerging Markets. Rotation towards assets, sectors, markets that benefit from higher inflation and steeper yield curve may take longer to play out but destination is clear.

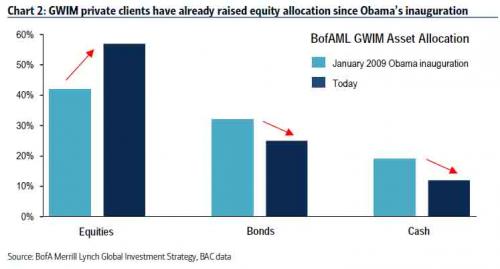

We believe peak liquidity, peak inequality, peak globalization = peak returns for stocks and bonds in coming years. Given the starting level of global interest rates for the next US president (5,000-year lows!) total returns likely to be exceedingly low in the coming years. Same for positioning: asset allocation of BofAML GWIM clients January 2009 Obama inauguration: Equity 42%, Debt 32%, Cash 19%, Other 6%. Today, GWIM asset allocation: Equity 57%, Debt 25%, Cash 12%, Other 5% (Chart 2).

3. Does the US election result change our views on the macro and policy?

Yes, at least initially. Economists are likely to lower growth estimates due to “policy uncertainty”. The election takes place amidst an improving global economy with global earnings revision ratios at 5.5-year highs, global PMI’s at their highest levels since early- 2014, Asian exports at 12-month highs and US wage growth at 7-year highs. Trump’s victory could temporarily derail stronger growth, higher rates narrative by raising expectations of a) protectionism, b) the Italian referendum following Brexit and US election as repudiation of elites and c) the Fed keeping rates on hold in December.

The Fed will likely be on hold in December. Trump’s criticism of Fed Chair Yellen is likely to unsettle global Treasury investors. On fiscal policy, he will likely push for tax cuts for individuals and businesses and a bipartisan deal to repatriate $ 2tn in foreign earnings at lower tax rates to fund federal infrastructure spending.

Uncertainty shock = lower US GDP estimates; markets will price in EU fragmentation; Fed likely to pass in Dec; ultimate growth impact of Trump will depend on whether his protectionism or Keynesianism triumphs; either way Trump will boost inflation/stagflation expectations as electorates say end wage deflation via immigration controls, trade protectionism, fiscal spending. 1970s “stagflation” was positive smallcap, value and energy stocks, commodities and real estate, negative large-cap, growth, tech and utilities stocks (Chart 3).

4. What is the trade?

Gold surges toward $ 1400/oz, S&P 500 tumbles toward 2000, 10-year Treasury yield to 1.5%; key is that credit spreads do not crack (e.g. IBOXHYSE<500bps – Table 1) and Mexico peso finds quick low = entry point for risk-takers (especially if Trump protectionist fears allayed); until then best Trump trades = long gold, short EU banks, long US small-cap, short EM.