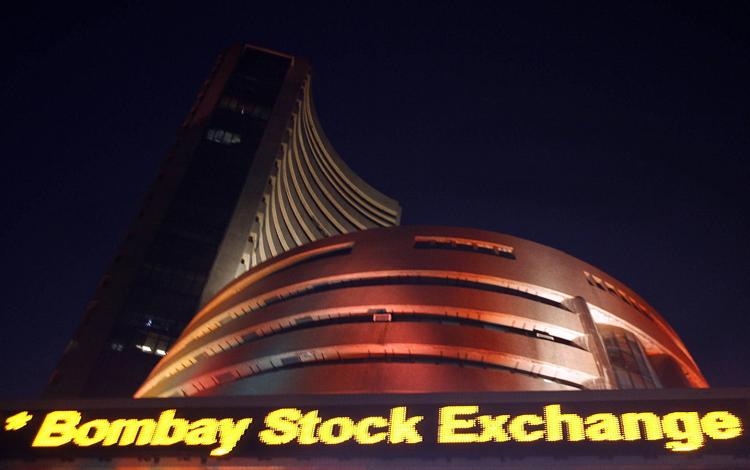

India : Profit booking drags Sensex 111 pts; Fed, BoJ decisions eyed

The BSE benchmark Sensex snapped four-day winning streak Tuesday, losing more than 100 points on profit booking and ahead of the outcome of two-day separate meetings of the Federal Reserve and Bank of Japan.

The 30-share BSE Sensex was down 111.30 points at 28523.20 and the 50-share NSE Nifty fell 32.50 points to 8775.90.

Experts feel the market is expected to remain volatile in near term. According to them, once the Federal Reserve and Bank of Japan meetings get over September 21, the market will start focussing on September quarter earnings that will kick off in second week of October.

So far the likely 25 basis points rate hike by Federal Reserve already priced in by the markets globally; hence the commentary will be closely watched, experts say.

“The consensus view is that the Fed will probably do nothing for this round but they might give a bit more guidance on what they will do in the next round,” Adrian Lim of Aberdeen Asset Management says.

Ian Hui of JPMorgan says that the Bank of Japan is likely to expand its quantitative and qualitative easing (QQE) as well as move more into the negative interest rate category that will mainly help Japan support its spending and inflation target.

Asian markets ended mixed. European stocks were choppy with the Britain’s FTSE and Germany’s DAX rising half a percent (at the time of writing this article) ahead of outcomes of separate policy meetings of central banks. Crude oil prices were down 0.6 percent on Venezuelan comments that the oil market is oversupplied by 10 percent.

Back home, FMCG, auto, infra and select technology stocks were under pressure.

Tata Motors declined a percent after agencies report indicated that luxury car maker Jaguar Land Rover has recalled 22,657 vehicles in North America.

Infosys, Adani Ports, Hero Motocorp, Bajaj Auto, HUL and Bharti Airtel were down 1-2 percent whereas ONGC and Tata Steel gained over a percent.

Jubilant Foodworks declined 6 percent after Ajay Kaul resigned as CEO and wholetime director of the company. Brokerage houses surprised with his decision.

Maintaining sell rating and a target price of Rs 945 per share, Citi says the exit is a negative for the stock as Kaul has been well-regarded and under his leadership, the company turned around in the last 11 years and embarked on its expansion journey.

Castrol India rallied 8.8 percent after its parent company Castrol Limited sold 8.5 percent shareholding in the company for around Rs 1,900 crore.

Kolte-Patil Developers climbed 6.6 percent on management’s aggressive FY17 guidance. The company expects 20 percent YoY increase in pre-sales and 18-20 percent uptick in topline in FY17.

Sharon Bio Medicine was locked at 20 percent upper circuit as the US Food & Drug Administration has approved company’s Taloja plant in Maharashtra.

The market breadth was in favour of declines as about 1512 shares slipped against 1190 advancing shares on the Bombay Stock Exchange.