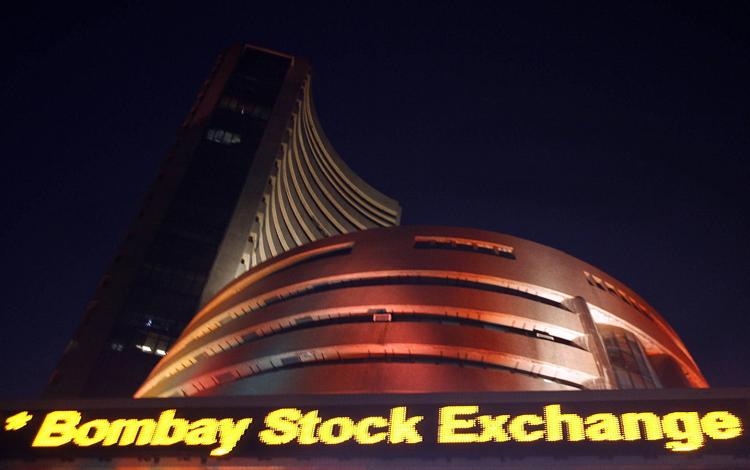

India : Sensex, Nifty snap 2-day rally; PSU Bank up 3%, BHEL zooms 15%

The market snapped two-day winning streak as profit booking drove equity benchmarks lower amid consolidation on Wednesday. Investors digested the likely delay in Fed rate hike due to weak US economic data. Indices had rallied 2 percent in previous two consecutive trading sessions.

The 30-share BSE Sensex was down 51.66 points at 28,926.36 after hovering in a range of 29,067-28,911. The 50-share NSE Nifty lost 25.05 points to 8917.95.

Experts say the consolidation was warranted after more than 4 percent rally from last week but the liquidity driven upside may continue as they expect more FII inflow into emerging markets after likely delay in Fed rate hike. FIIs bought more than Rs 1,400 crore worth of shares in previous session.

Seeing BSE 500 at new high is a very healthy sign and shows that the secular bull market in India is intact and is set to move higher in the coming days, Chris Roberts of Asianomics says.

He feels the Nifty can move towards 14,000 in medium to long-term.

BHEL was the biggest gainer, up 14.5 percent after better-than-expected quarterly earnings . Profit surged 54.2 percent to Rs 77.7 crore and revenue grew by 29 percent to Rs 5,622 crore YoY, driven by power business growth.

SpiceJet rallied nearly 16 percent after profit more than doubled to Rs 149 crore in the quarter ended June 2016 YoY and passenger load factor highest in industry at 92.5 percent.

Tata Motors ended 0.3 percent lower on profit booking after it touched fresh 19-month high of Rs 598.60 due to solid JLR August sales. The stock is just 3 percent away from its record high of Rs 605.56 touched on February 3, 2015. Citi raised target price on the stock to Rs 665 (from Rs 530) as it thinks there’s still some steam left, given JLR’s model momentum plus nascent recovery in parent business.

State-run banks stocks bucked the trend with the Nifty PSU Bank rising 3 percent as fall in yields on government bonds may benefit in treasury gains. State Bank of India gained 2.6 percent and Bank of Baroda was up 3 percent.

ICICI Bank continued to rally, up 2 percent after its life insurance subsidiary ICICI Prudential Life has received approval from the SEBI for initial public offering . JP Morgan added the stock in its model portfolio.

ONGC rallied 2.5 percent and GAIL fell 1.5 percent ahead of quarterly earnings later today. TCS lost further, down 1.5 percent on appreciation in rupee that hit over four-month high.

Among others, Infosys and Tata Steel climbed over a percent whereas HDFC, HDFC Bank, Asian Paints, Axis Bank and NTPC slipped 1-2 percent.

Federal-Mogul Goetze shares were locked at 20 percent upper circuit at Rs 534.10 as billionaire Carl Icahn’s investment firm, Icahn Enterprise said it would buy the remaining 18 percent of auto parts maker Federal-Mogul Holdings Corp for USD 9.25 per share. Federal-Mogul Holdings Corp held a little less than 75 percent stake in the Indian entity as of June 2016.

NMDC was up 7 percent after its production in April-August increased 11.1 percent to 11.69 MT and sales rose 14.7 percent to 12.93 MT on yearly basis.