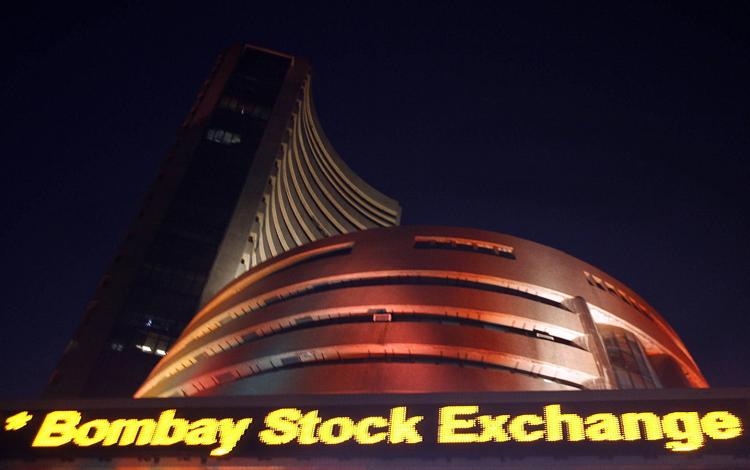

India : Sensex soars 440 pts, Nifty ends at fresh 16-month closing high

The 50-share NSE Nifty ended at fresh 16-month closing high on Tuesday, tracking positive global cues and due to improved FII inflow despite likely Fed rate hike. The market sentiment was also boosted after the RBI’s optimistic statement, saying the economy is likely to grow at 7.6 percent in FY17, though it quashed hopes of further repo rate cut in its annual report yesterday.The market gained for the third consecutive session. The 30-share BSE Sensex was up 440.35 points or 1.58 percent to end at fresh 13-month closing high of 28343.01. The 50-share NSE Nifty rose 136.90 points or 1.59 percent to 8744.35, the highest closing level since April 15, 2015.

Benchmark index will see an upside to 9300 level by year-end or first quarter of 2017, Laurence Balanco of CLSA says, adding the brokerage house is long on emerging market equities as against developed markets.

Vaibhav Sanghavi of Ambit Investment Advisory says the market in near term has a pretty strong base of 8500 on Nifty, which even after several attempts has not broken.

The broader markets surged to record closing high, up around 1 percent.

FIIs pumped in nearly Rs 300 crore on Monday after selling Rs 141 crore worth of shares in last week ahead of Federal Reserve Chief Janet Yellen’s speech at Jackson Hole.

Meanwhile, Reserve Bank of India Governor Raghuram Rajan on Monday in annual report warned, “the room to cut policy rates can emerge only if inflation is projected to fall further,” after retail inflation rose 6.07 percent in July.

Most of the indices ended at 52-week closing high while Nifty Bank ended at 17-month closing high of 19,531.55, up 1.6 percent.

About 18 stocks out of Nifty 50 hit fresh 52-week high. HDFC Bank, Infosys and ITC were the leading contributors to Sensex’s gains while Asian Paints, Maruti Suzuki and Bajaj Auto surged 3 percent each.

Bharti Airtel lost another 2.8 percent after the company yesterday slashed 3G and 4G prices by upto 80 percent. Idea Cellular was also down 0.7 percent.

The market breadth remained positive as about 1627 shares advanced against 1082 declining shares on the BSE.

Positive global markets indicated that likely Fed rate hike already priced in. Most Asia markets ended higher today on positive lead from Wall Street, while Japanese shares edged down in a muted reaction to better-than-expected economic data. European benchmarks like France’s CAC and Germany’s DAX were up nearly 1 percent at the time of writing this article.