The economy will still have jobs for humans for a while

Economics is called the dismal science, but of late its practitioners have shown themselves to be most optimistic figures in the debate over the state of the union.

Politicians, voters, and yes, journalists, have all recently fretted that this placid moment in the American economy won’t last, and that the third-longest period between recessions in post-war history, will soon give way to another crisis. But it was America’s highest-ranking economist, Janet Yellen, who assured us that “expansions don’t die of old age,” and that there’s no reason to expect a downturn, as long as we can avoid policy mistakes or another shock.

Economists like to back their arguments up with data, and the case for optimism about American growth has a lot of it on its side. Take for, instance, the recent period of low interest rates. The bear case is that money is so cheap because private actors see few opportunities for investment other than government debt. But looked at another way, it proves the confidence investors have in the American government’s ability to pay them back. And those low rates have set the stage for the kind of aggressive infrastructure spending that Larry Summers and other thinkers say could fuel decades of growth and solve the American underemployment problem.

And what about that job market? We hear all the time that wage growth is stagnant even as a sub-5% unemployment rate and average monthly job growth of 186,000 suggests that labor markets are getting tighter every day. But pay has actually risen steadily since 2002 when you control for other demographic trends (lower-paid younger workers replacing higher-paid older ones). According to a recent study from the Federal Reserve Bank of San Francisco, by this measure, on average workers saw their pay rise 3.1% in 2015—historically not gangbusters growth, but picking up much faster than the gloomy headlines suggest.

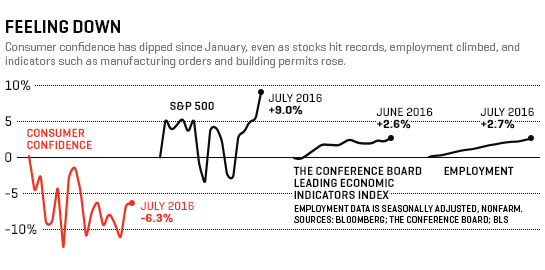

Wages aren’t the only thing on the rise. The S&P 500 touched a new high this August, while many housing markets across the country are doing the same. According to real estate data firm CoreLogic, the real estate markets 40% of U.S. metro areas have reached new peaks, with another 30% are within 10% of their highs during the bubble years. That means that many Americans that own their own homes are far richer today than eight years ago.

Still, these gains have been slow to filter their way through the broader economy. According to Vincent Reinhart, Chief Economist at Standish Mellon, “Nobody feels good in an economy trapped beneath 2% growth.” And this has made consumers reluctant to spend the wealth gains they’ve seen since the end of the recession. This is evidenced by retail sales growing under 2% for the past year, helping to put an artificial damper on overall growth.Perhaps the most important misconception, however, may be that blue-collar labor is headed for extinction as robots destroy more human jobs. While in recent years a tech boom may have made ordering pizza much easier, it hasn’t actually stimulated an attendant productivity boom. The latest reading, in fact, showed that worker productivity fell 0.4% in the second quarter year over year, meaning that the economy is actually producing less per worker today. That’s not a great omen for growth, but it’s a sign that the economy will still have jobs (and paychecks) for humans for a while.