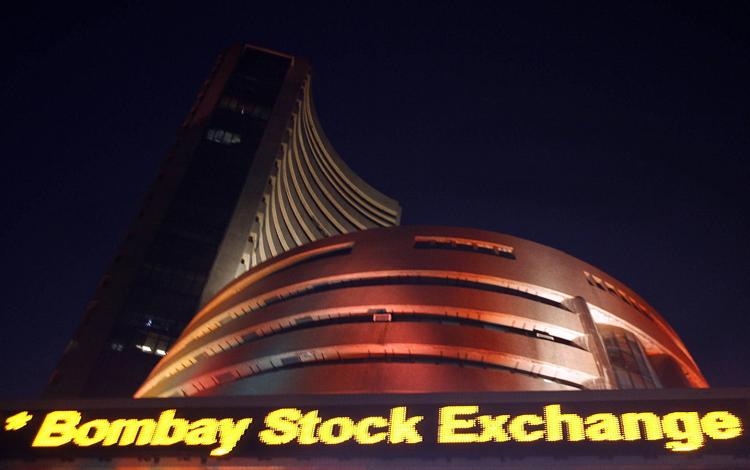

India : Sensex, Nifty close rangebound session on flat note; Idea up 7%

Late recovery amid consolidation helped the equity benchmarks close flat with a positive bias on Tuesday. Overall consolidation continued for the second consecutive session today due to lack of triggers and ahead of expiry of August derivative contracts & the speech by Federal Reserve Chief Janet Yellen.

The 30-share BSE Sensex closed at 27,990.21, up 4.67 points from its previous settlement. The 50-share NSE Nifty gained 3.45 points at 8,632.60 after trading in a range of 8,580-8,642.

The volatility may continue for couple of days as there will be expiry of August futures & options contracts on Thursday, feel experts.

“With derivatives’ expiry approaching, rollovers were seen gaining traction, infusing some life into an otherwise lacklustre market. Meanwhile, correction in oil, and uncertainty in timing of Fed’s next policy action kept global markets on a watch mode,” Anand James of Geojit BNP Paribas Financial Services said.

European stocks extended gains, buoyed by euro zone’s August PMI that came in at a seven-month high. Markets are in wait-and-see mode ahead of a speech on Friday by US Federal Reserve chair Janet Yellen at Jackson Hole and clues about the timing of the next US interest rate hike. France’s CAC, Germany’s DAX and Britain’s FTSE were up 0.4-0.7 percent, at the time of writing this article. Brent crude futures were below USD 49 a barrel, down 0.83 percent on profit booking.

Asian markets ended mixed, with the Japanese market falling 0.6 percent due to a weaker dollar buoying the yen.

On home turf, Idea Cellular shares surged 6.7 percent on hopes of merger with Vodafone. Sources have told CNBC-TV18 that both companies are in ‘exploratory’ talks that could conclude in a possible merger, a move that would result in a merged entity dislodging Bharti Airtel off its perch as the market leader. Both companies denied merger speculation. The news also has a rub off effect on other telecom stocks – Bharti Airtel gained 1 percent and Reliance Communications rose 2 percent.

Tata Power shed more than 3 percent after reporting a 76 percent degrowth in quarterly profit on account of one-time loss.

Technology stocks like TCS and Infosys rallied 2 percent on value buying whereas ITC, L&T and Bajaj Auto fell over a percent. NTPC (down 2.9 percent) and HPCL (down 5.3 percent) were under pressure after first quarter earnings.

BHEL lost 4.6 percent as Macquarie has retained its underperform rating on the stock with a target price of Rs 79. The brokerage house says the stock has held up on hopes of turnaround in orders & earnings but there is likelihood of scrapping of large tender by NTPC where the company was L1. It expects BHEL to return to meaningful profit only in FY19.

Meanwhile, the Indian Railways has streamlined its freight rates on movement of coal, with slab-wise revision seen as per distance.

Railways Board Member – Traffic, Mohd Jamshed said freight rates on movement of goods up 100 kms would be unchanged, for 200-700 kms would be revised upwards by 8-14 percent while for distances over 700 kms, rates would be cut by 4-13 percent.