Can Natural Gas go higher like Oil?

Oil prices closed higher every day last week and have entered a technical bull market, which is loosely defined as prices rising 20% from a pivot low. Prices of WTI crude oil closed at $ 48.52 on Friday, up 24.4% from a low of $ 39.19 on August 3. This is a remarkable turnaround because prior to this oil was trading in a technicalbear market, declining by more than 20% from a high of $ 51.67 on June 9.

Momentum has been building in the oil markets ever since OPEC said it would hold an informal meeting on the side lines of an energy conference in Algeria at the end of September.With oil prices moving ahead at such a rapid clip, some investors are wondering if natural gas, the other commodity closely associated with oil, could perform similarly. So far, the answer seems to be no.

Fitch Ratings, a credit rating company, recently wrote in a note to investors, “We believe that the U.S. natural gas market is more reliant on improved demand fundamentals than the oil market, and may therefore take longer to see a reasonable price recovery. Continued drilling efficiency gains and limited export opportunities are likely to cap gas price gains in the near to medium term.”

Rising Natural Gas Supplies

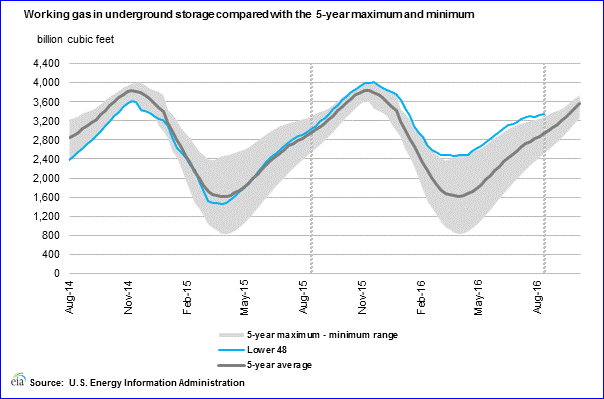

Much like oil, natural gas supplies appear plentiful. The drilling efficiency gains mentioned by Fitch are adding to natural gas supplies. This week the U.S. Energy Information Administration (EIA) reported another increase in natural gas inventories. The chart below shows that gas supply year-to-date (YTD) is well above the five-year average and five-year minimum-maximum range. This is putting a cap on prices and is also driving down the number of rigs drilling for natural gas.

Declining Baker Hughes Gas Rig Count

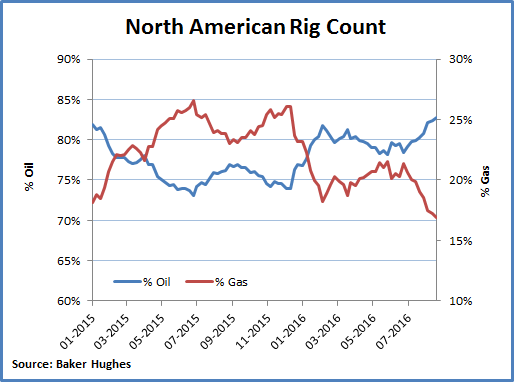

Last week Baker Hughes reported the 8th straight weekly increase in the number of oil rigs drilling in the United States. Reuters reports that this is the longest recovery streak in the rig count in over two years. While oil rigs are being deployed at an ever greater rate, the same cannot be said for natural gas rigs. The chart below shows that the percentage of rigs drilling for natural gas reached a new yearly low of just 17%. This compares with a new yearly high for oil rigs, with 83% drilling for oil, as the price of oil reaches $ 50 per barrel.

ETFs Provide Exposure for Investors

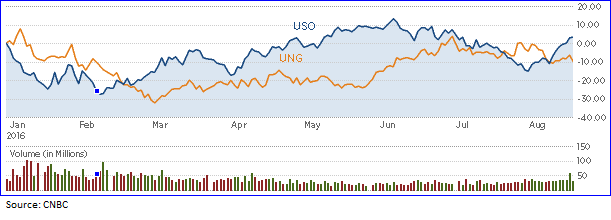

One way for investors to gain exposure to natural gas is to use exchange traded funds. One of the most liquid is United States Natural Gas (UNG). According to the description provided by Yahoo Finance, “The investment seeks to reflect the daily changes in percentage terms of the price of natural gas delivered at the Henry Hub, Louisiana, as measured by the daily changes in the price of a specified short-term futures contract.” The equivalent ETF for oil is USO. The chart below provides a year-to-date (YTD) comparison of the price performance of these two ETFs. USO recently moved into positive territory but UNG is still lagging, down around 10% for the year.

One major concern for investors to be aware of, however, is pure commodity ETFs do a relatively poor job of tracking the underlying price. These ETFs are funds made up of oil futures contracts. Oil futures contracts expire, however, so the ETF must actively move from the expiring contract to the next month’s contract. This can impede the performance of the fund. (See also: How Oil ETFs Perform Relative to the Oil Price.)

Natural Gas Company Out-performance

An alternative may be to invest directly in the companies that produce natural gas or are exposed to the sector. For example, the shares of several natural-gas related companies are performing well in 2016. The table below shows the YTD price performance for a handful of companies compared to the Energy Select Sector SPDR ETF (XLE). Some may argue that these valuations could be expensive given the strong run-up in price performance. Investors would need to conduct additional analysis or consult with a professional financial advisor before making any investment decisions.

The Bottom Line

Natural gas prices are currently lagging behind oil prices YTD. Oil prices are being driven higher by speculation that OPEC will reach some kind of output freeze agreement on the side lines of an energy conference in September. In the meantime, Fitch has said in a note to clients that natural gas prices could take longer to show any meaningful recovery. Yet the market is relatively positive on the future prospects for the sector, as reflected in the out-performance of some companies’ share price in 2016.

Disclaimer: Gary Ashton is an oil and gas financial consultant. The observations he makes are his own and are not intended as investment advice