Could Gold reach $5,000 during this cycle

One of the world’s biggest central banks just swung its “sledgehammer.” On Thursday, the Bank of England (BoE) launched its biggest stimulus package since the 2008–2009 financial crisis. It cut its key interest rate to a record low. It started “printing” money again. And it announced a new “funding scheme.”

The BoE launched this massive easy money program to soften the blow of the “Brexit.” As you probably heard, Britain voted to leave the European Union (EU) on June 23. The historic event rattled Britain’s financial system. The FTSE 100, Britain’s version of the S&P 500, fell 3.1% on the news. It was the worst day for British stocks since 2008. The pound sterling, Britain’s currency, plunged 8%, its biggest one-day drop on record.

In the aftermath, many analysts predicted Britain’s economy would take a serious hit. Some even warned of a recession. The BoE sprang into action to prevent this.

Today, we’ll show you why the BoE’s “sledgehammer stimulus” program won’t work…why it could steer Britain’s economy off a cliff…and why it’s great news for gold. But first, let’s take a close look at what’s happening in England…

Britain’s economy is headed for a major slowdown…

Shortly after the Brexit, credit rating agency Standard & Poor’s (S&P) said Britain’s economy could slow by as much as 1.2% next year. Britain’s economy is currently growing at an annual rate of 2.2% per year.

Investment bank Goldman Sachs (GS) is even more pessimistic. It thinks Britain could be in a recession by early 2017. Britain’s last recession ended in 2009. The British government sees dark clouds on the horizon, too. Mark Carney, who heads the BoE, warned that a quarter million British people could lose their jobs.

The BoE cut its key interest rate from 0.5% to 0.25%…

It was the first time the BoE cut rates in seven years.

Central banks cut rates to “stimulate” the economy. The idea is that folks will spend more money if they can borrow money for cheap. According to the government’s flawed economic models, this will grow the economy.

The BoE also expanded its quantitative easing (QE) program for the first time since 2012. As you may know, QE is when a central bank creates money from nothing and pumps it into the economy. Under this new program, the BoE will now “print” an additional £70 ($ 91) billion. It also announced a new £100 ($ 130) billion “funding scheme.” Basically, the BoE will lend money to British banks for next to nothing. It hopes this will get British banks to issue more loans.

Most analysts expected the BoE to cut rates…

Few thought the BoE would aggressively ramp up its QE program. Of course, if you’ve been reading the Dispatch, you probably aren’t surprised this happened. Since the 2008–2009 financial crisis, central bankers have become terrified of recessions. They’ll do anything and everything to avoid them. They’ll cut interest rates, which they’ve done more than 650 times since 2008. And they’ll print money. Together, they’ve printed more than $ 12 trillion since 2008. In other words, the BoE stuck to the playbook every central bank in the world is using right now.

The British pound plunged 1.4% last Thursday…

The pound is now down 16% since last August. It’s trading at its lowest level since 1985. And it’s likely headed even lower.

On Thursday, U.K. Treasury Chief Philip Hammond said he’s “prepared to take any necessary steps to support the economy and promote confidence.”

That means British policymakers will use more stimulus if the current program doesn’t get the job done. And with interest rates already near zero, the BoE will likely have to print even more money. This won’t help the economy. It will only cause the pound to lose even more of its value.

If you live or are invested in Britain, we encourage you to get out of the pound immediately…

British officials have promised to keep feeding Britain’s economy easy money until it improves. But it won’t work…just like it didn’t work in the U.S., Japan, or the rest of Europe. Each of these economies is growing at their slowest rate in decades despite massive stimulus efforts.

Still, that won’t stop the BoE from doubling down on the same failed policies. The Financial Times reported last week:

“Monetary policy is more nimble and it is appropriate that it’s the first responder to a shock,” Mr. Carney said, adding that the determinants of long-term prosperity were in the government’s hands.

The more central bankers do to “help,” the more damage they will do to the global financial system. That’s why it’s critical that you protect yourself, even if you don’t live in Britain.

Investors are starting to realize the financial system is headed for disaster…

They’re getting out of stocks and bonds and into gold. This year, the price of gold has jumped 27%. Gold has beat global bonds 3-to-1 this year. It’s beat global stocks 8-to-1. If you don’t own gold, we encourage you to buy some today. As we often remind you, gold is real money. For centuries, its preserved wealth because it’s durable, easily divisible, and easy to transport.

Unlike paper currencies, gold doesn’t lose value when governments cut interest rates or print money. These reckless actions often cause the price of gold to soar.

Casey Research founder Doug Casey thinks folks will stampede into gold in the coming years…

Here’s Doug, days after the Brexit:

A panic into gold. You’ve heard this story many times before here. But it’s truer than ever as we approach a genuine crisis. There are no stable paper currencies anywhere in the world. The dollar has been strong only because it’s liquid. Liquidity is good, but here, we’re talking about liquid like nitroglycerin. Hedge funds will start buying gold in size. As will central banks, who don’t want to hold each other’s paper. As will individual investors.

Doug says you can make a lot of money if you own gold before the mad rush:

Right now, few people even think about gold, much less understand it. How to profit? Buy gold. I expect we’ll see it well over $ 5,000 this cycle. Silver should do even better in relative terms. And gold stocks have explosive upside.

If gold gets anywhere close to $ 5,000 an ounce, gold stocks will deliver enormous gains…

You see, gold stocks are leveraged to the price of gold. This year, gold’s 27% spike has caused the VanEck Vectors Gold Miners ETF (GDX), which tracks large gold stocks, to soar 120%.

That’s a huge gain for such a short period of time. But regular readers know gold stocks could go much higher. During the 2000–2003 bull market, the average gold stocks gained 602%. The best ones soared 1,000% or more.

Doug says a similar opportunity is staring us in the face right now. Gold is approaching its all-time high in England. When we talk about the price of gold, we’re usually talking about gold priced in U.S. dollars. That’s because the U.S. dollar is the world’s most important currency. And most of our readers live in the States.

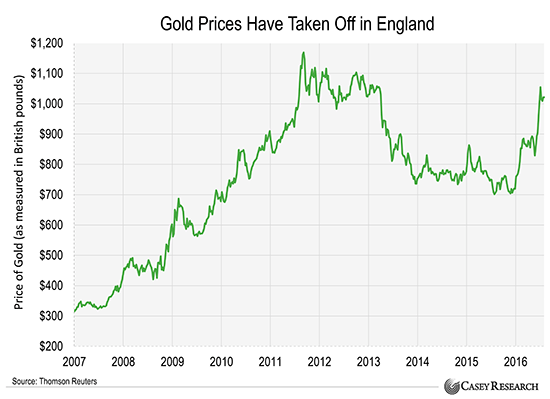

But we also monitor how gold is doing in other parts of the world. Today’s chart shows the price of gold priced in British pounds since 2007.

As you can see, gold, as measured in British pounds, is up 42% this year. Remember, gold is up 27% in terms of dollars. Gold prices have soared higher in Britain because the pound has plunged 11% this year.

The price of gold in England is now within 13% of its all-time high. But it’s likely headed much higher. So while the BoE’s “all in” stimulus package is bad news for the pound…it’s great news for gold.