India : Sensex jumps 364 pts, Nifty at 15-month closing high; IT falls

Equity benchmarks showed spectacular performance on Friday with the Nifty ending at more than 15-month closing high, though it finished the week on a flat note.Consistent inflow of foreign money, government’s long term inflation target of 4 percent, above average monsoon, positive global cues post Bank of England’s stimulus measures and value buying on likely upgrade post the passage of GST Bill in the Rajya Sabha lifted the market sentiment today.

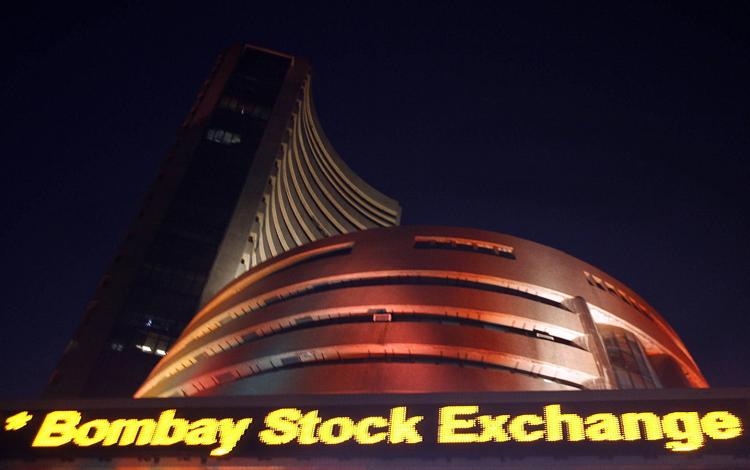

The 30-share BSE Sensex rallied 363.98 points or 1.31 percent to 28078.35. The 50-share NSE Nifty surged 132.05 points or 1.54 percent to 8683.15, the highest closing level since April 16, 2015.

The broader markets also traded in line with benchmarks, rising around 1.5 percent on positive breadth. About two shares gained for every share falling on the Bombay Stock Exchange.

Liquidity will continue to drive markets, Vibhav Kapoor of IL&FS said, adding the domestic factors are positive and if the US does well, for some time, this liquidity will stay.

According to him, the US elections are one thing to look out for.

Meanwhile, the government today notified 4 percent inflation target with a range of plus/minus 2 percent for the next five years under the monetary policy framework agreement with the Reserve Bank.

Meteorological Department expects August also to see above normal monsoon after better rainfall in July.

Auto stocks hogged the limelight today with the Nifty Auto index rising more than 3 percent led by Hero Motocorp (up 5 percent) and Bajaj Auto (up 4 percent).

Tata Motors surged 3.2 percent as Jaguar Land Rover reported strong sales performance in July, showing 34 percent growth on yearly basis. China sales grew by 64 percent during the month.

Bharat Forge spiked 12.5 percent after the largest forging company said the demand in July-September quarter will be slightly higher on sequential basis and the June quarter earnings were as per company’s expectations that already priced in.

Nifty Bank, Energy, Metal and Realty indices gained 2-2.7 percent while the IT underperformed, falling 0.1 percent as Infosys, Wipro and TCS were marginally lower.

Reliance Industries, L&T, Axis Bank, HDFC, ICICI Bank, SBI and Mahindra & Mahindra climbed 1.5-3.6 percent.

Next week will be crucial due to RBI policy on August 9 and lot of quarterly earnings. The RBI is likely to keep key rates unchanged in its monetary policy. Major PSU companies (SBI, Bank of Baroda, ONGC, BPCL, HPCL, IOC, Coal India, BHEL) and Tata Motors, Tata Steel, Hindalco Industries, Sun Pharma will announce April-June quarter earnings.

Asian markets closed mixed today with Nikkei losing 2 percent for the week. At the time of writing this article, European stocks were marginally higher after the Bank of England (BoE) unleashed a fresh stimulus package, but some caution remains ahead of US jobs numbers later in the day.