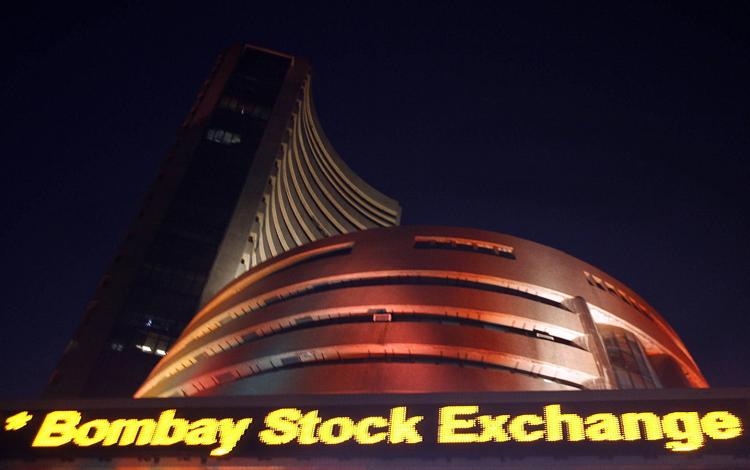

India : Late sell-off, Q1 earnings drag Sensex 119 pts, Nifty below 8600

After a consolidation, equity benchmarks extended losses in late trade Tuesday on profit booking, especially after June quarter earnings.The 30-share BSE Sensex was down 118.82 points at 27976.52 and the 50-share NSE Nifty dropped 45 points to 8590.65. About 1659 shares declined against 1040 advancing shares on the Bombay Stock Exchange.

Experts believe that the uptrend in market remains intact in near term due to liquidity despite intermittent profit booking.

The recent liquidity rush will continue into emerging markets, Ajay Srivastava of Dimensions Consulting says, adding investors are now hoping for an economic recovery.

If results are not visible in the next one or two quarters, scepticism will return, he feels. A 5-10 percent increase on earnings per share (EPS) side is legitimate, according to him.

Foreign investors continued to pump in money in Indian equities as they have bought Rs 7,294 crore worth of shares in July so far (till July 25) against Rs 3,957.95 crore worth of inflow in June.

Dr Reddy’s Labs shares plunged more than 4 percent after earnings fell short of expectations in Q1. Consolidated profit declined sharply by 76.3 percent year-on-year to Rs 153.5 crore, impacted largely by US business and weak operational performance.

Maruti Suzuki was down 1.4 percent as topline in June quarter missed analysts’ estimates, though profit grew by 23 percent on other income support. TVS Motor declined 3 percent as margin expanded only 20 basis points year-on-year despite 12 percent revenue growth and 45 percent jump in profit in the quarter ended June 2016.

Axis Bank gained nearly 3 percent. CFO Jairam Sridharan expects slippages during Q2 to be a “little more contained” although he said it was early to comment on how the operating environment in the second quarter will affect business of its clients.

HDFC, Asian Paints, Bajaj Auto, Bharti Airtel and Dabur India were under pressure ahead of June quarter earnings that will be announced on Wednesday.

ICICI Bank was the leading contributor to Sensex’s fall, down 2.6 percent followed by Tata Motors, SBI, Lupin, Hero Motocorp and ONGC with over a percent loss.