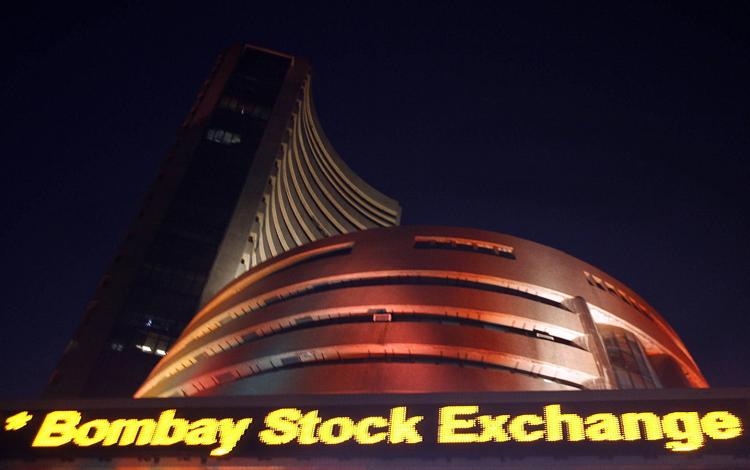

India : Nifty, Bank Nifty at 52-week closing high; Sensex up over 250pts

MUMBAI : The market has ended on a higher note with both Nifty and Nifty Bank end at fresh 52-week closing highs. The Nifty ended up 94.45 points or 1.1 percent at 8635.65. The Sensex was up 292.10 points or 1 percent at 28095.34. About 1721 shares have advanced, 999 shares declined, and 191 shares are unchanged. The Sensex ended at highest closing level since August 10, 2015.BHEL, Maruti, SBI, Asian Paints and Sun Pharma were top gainers while Dr Reddy’s, Bajaj Auto, Tata Steel and GAIL were losers in the Sensex.

The government today said a revenue of around Rs 2,237 crore has already been generated till May-end from the allocation of 74 coal mines.

“The revenue already generated till May 31, 2016 from the allocation of 74 coal mines under the provisions of the Coal Mines (Special Provisions) Act, 2015 is Rs 2,237 crore (excluding royalty, cess and taxes) which shall be devolving entirely to the coal bearing state concerned,” Coal and Power Minister Piyush Goyal said in a reply to Rajya Sabha.

The revenue which would accrue to the coal bearing states from the allocation of mines comprises of upfront payment as prescribed in allotment document, auction/allotment process and royalty on per tonne of coal production, the minister added.

India’s largest car maker Maruti Suzuki is expected to report a 7.5 percent growth in profit at Rs 1,276 crore in April-June quarter compared with Rs 1,193 crore in year-ago period, according to average of estimates of analysts polled by CNBC-TV18. Lower operational growth is likely hit bottomline. It will announce earnings on July 26.Revenue is seen rising 12.5 percent year-on-year to Rs 15,081 crore due to higher realisations, though volume growth slowed down from 14 percent in Q1FY16 to 2.1 percent in Q1FY17.

The company sold 3.48 lakh vehicles in June quarter against 3.41 lakh units in year-ago period. Domestic sales grew by 5.4 percent to 3.22 lakh units while exports declined 27 percent on yearly basis.

With widespread monsoon this year, sentiments are turning positive, says Ramesh Iyer, Vice-Chairman & MD of M&M Financial Services adding that the worst is behind for the company now.The company reported a subdued quarter with 2.25 percent fall in its net profit to Rs 87 crore and reduced its provisions to 30.5 percent to Rs 224.5 crore in Q1.

Asset quality quarter-on-quarter deteriorated to 36.9 percent at Rs 4,414.7 crore.

Change in product mix led to contraction in company’s margins and not lending rate, Iyer says. The upcoming festival season in October-November will see a positive uptick for the company.

Non-performing assets (NPAs), which increased in Q1, is expected to improve going ahead. NPAs increased in states like Maharashtra, Madhya Pradesh and parts of Uttar Pradesh.

On account of problems pertaining to developed markets, emerging markets look favourable from an investing point of view, Michael Every of Rabobank said, adding there are flows going into EMs now and India is a beneficiary of that.