Unloved Blue Chip Ready for a Quick Pop

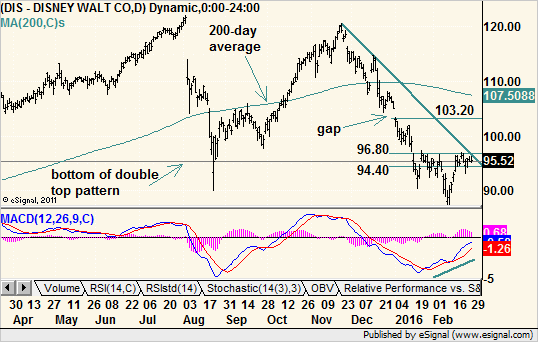

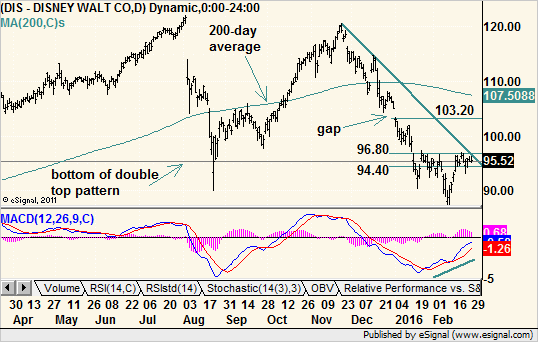

Shares of Walt Disney (NYSE: DIS) went on a roller-coaster ride in 2015 worthy of one of its theme parks. They rallied from $ 90 to over $ 120, not once but twice, and by early 2016, they had fallen back to $ 90 again.

Investors may still be gun-shy when it comes to this blue chip, but the technicals have once again turned in its favor, and the stock may be ready to deliver gains — at least in the short term.

After the close on Feb. 9, Disney reported better-than-expected earnings thanks to the release of the latest edition of “Star Wars.” But modest subscriber losses at ESPN spooked analysts and investors, who are concerned about declines in traditional cable subscriptions.

The stock, which had already been in a decline since November, dropped sharply in after-hours trading, gapping down on the Feb. 10 open with selling continuing in the morning.

But volume swelled that day, and DIS actually closed above its opening price. The following day, the bulls took over and prices moved higher, albeit at the same pace as the broader market. But on the charts it did look like a selling climax had occurred. In theory, everyone who was going to sell did so as the last bulls finally threw in the towel.

Without supply, the stock was dry kindling waiting for any demand to light it up.

A few days after the post-earnings low, we saw a surge in both price and volume in what could be called a “follow-through day.” This is a buy trigger identified by Investor’s Business Daily founder and former chairman William O’Neil that is usually applied to the S&P 500.

The idea is that after a long decline, bottom fishers can easily spark a bounce. But if buying surges a few days after the low, we can assume that real buying is returning to the market, or the stock in this case.

Following that signal, prices were locked in a tight range, mostly between $ 94.40 and $ 96.80, give or take a few pennies. During that time, subtle changes in several technical indicators suggested DIS was gathering strength in preparation for an upside move.

For example, Moving Average Convergence/Divergence (MACD), a momentum indicator, scored an upside crossover in January. While prices dipped a bit lower in February, the indicator continued to rise. This suggested momentum was turning to the upside.

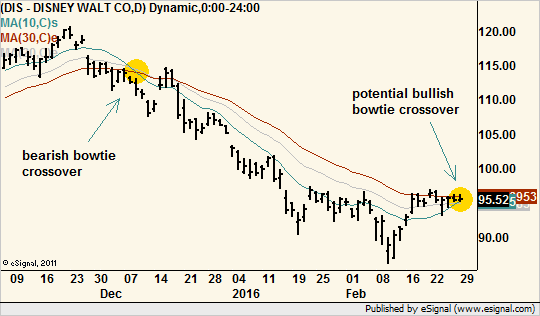

Additionally, moving averages are perhaps a day away from completing a bowtie crossover. Trader Dave Landry found that a system comprised of a 10-day simple moving average, a 20-day exponential moving average and a 30-day exponential moving average signals a change in short-term trend when they all cross at the same point. The chart looks like a bowtie as the averages converge and then diverge again.

In the case of DIS, the averages are all within 1 point of each other and trending in such a way that, barring a major price shock, they should cross very soon.

In the intermediate term, a trendline from the latest peak in November is now crossing resistance from the top of the short-term range. With Tuesday’s rally, DIS closed above both of these features, creating a buy signal.

There is one more reason to like Disney. The Aug. 24 closing low of $ 95.36 is right in the middle of the short-term trading range. The current rally took the stock above that level to negate the breakdown of the large double-top pattern created by the twin highs of 2015.

Keep in mind that this is not a long-term call. Disney’s major rising trendline from the 2011 low is already broken to the downside, and shares are still well below their 200-day average, which means many large investors will not touch it. After all, the simple rule of thumb is that a stock trading below its 200-day is in a decline. But a stock trading well below this moving average can bounce back if only to restore a shallower and more sustainable declining trend.

The target is the resistance at $ 105.08, defined by the Dec. 31 close and top of the Jan. 4 gap. This is also close to where the 200-day moving average will be later this month. If and when it gets there, we can decide if this blue chip is still a keeper.

Recommended Trade Setup:

— Buy DIS at the market price

— Set stop-loss at $ 93

— Set initial price target at $ 105.08 for a potential 8% gain in three weeks

Note: In the past six months, one trading prodigy’s recommendations have delivered gains of:

— 27% in four days

— 48% in five days

— 36% in one week

— 51% in eight days

— 62% in nine days

And over the past three years, his average trade generated an annualized 123% profit. To get his next trade risk free, click here.