BofA Is Still Not Buying It: “Everyone (Including Ourselves) Is A Seller Into Strength”

With the S&P retesting its stubborn support level of 1,812 as recently as a week ago, many have continued to predict that failures to breach said level would result in violent bear market rallies, most recently JPM which however “should be faded”, as it noted three weeks ago, looked at earnings and said that “16x and $ 120 create a firm ceiling at ~1950 and thus moves toward that level should be faded.”

Others such as BofA’s Michael Harnett, and overnight Citi, went so far as saying that unless the G-20 comes out with a big stimulative surprise, it would open the path for the market’s next leg lower, below this critical support.

Since then the market has indeed been gripped in the latest furious short squeeze, which as of right now has the S&P trading some 150 higher in under two weeks, at about 1962.

So has that change the big picture? Not for Bank of America.

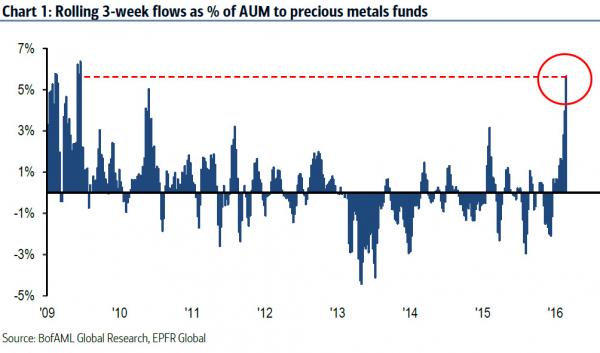

In a note released overnight by BofA’s Chief Investment Strategist, Michael Hartnett, he looks at the surge into gold, which as previously noted was the biggest 3 week inflow since January 2009.”

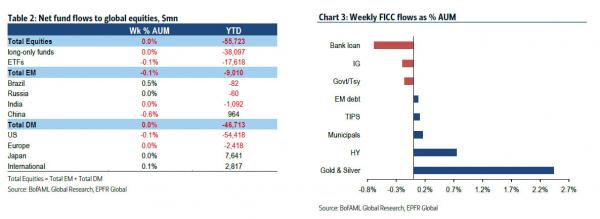

He also points out the short-cover not only in stocks but in credit: “largest inflows to HY in 16 weeks & first EM debt inflows in 7 weeks; risk-on shift in fixed income corroborated by first outflows from treasuries in 8 weeks & largest IG outflows in 9 weeks.”

More importantly, he notes that in equities it remains a very different picture with $ 3.6 billion in outflows in the past week, and outflows in 11 of past 12 weeks…

… and summarizes not only what BofA is seeing but what the fund managers he interacts with on a daily basis say.

Here is the punchline:

Everyone (including ourselves) a “seller into strength” which means risk can squeeze higher short-term into policy events…G20 (2/26-27), ECB (3/10), BoJ (3/15) & FOMC (3/16); flows nonetheless not close to “full-capitulation” levels.

Sure enough, as we wrapped first thing this morning, risk – and oil – are most certainly squeezing into this weekend’s policy event, the Shanghai G-20 meeting, and ignoring the Q4 GDP report which was actually negative for Q1 2016, as the lower inventory liquidation means more inventory disappointments are set to unfold in 2016.

Which brings us to BofA’s punchline: “policy meetings increasingly seen as selling (not buying) catalyst, so selling pressure resumes if policy disappoints.”

In other words, all eyes, and ears, will be tuned to Shanghai on Sunday when the G-20 communique is expected to hit. If it indeed disappoints and focuses on broad generalities and hollow promises of Chinese reform, it will be interesting to observe if BofA (and “everyone”) will resume selling into strenth.