“How Bad Could This Get?”

Just one month ago, Bank of America’s equity strategist Savita Subramanian told Barrons to stay the course and to expect a 2,200 year end target on the S&P based on a year end 125 EPS forecast and an implied 17.6x forward multiple. Incidentally her 2015 year end S&P500 forecast was an identical 2,200.

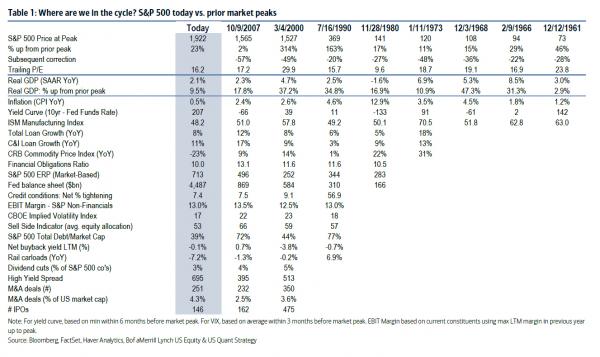

It appears that much has changed with the market’s “fundamentals” in the month that followed, because in a note released earlier today, the same Savita, when commenting on the “Worst start ever” to a new year by equity markets, is far less concerned with market upside as she is with analyzing the worst case scenarios.

Here is her take on “How bad could this get?”

While Savita forgets to mention that in none of the prior historical occasions was the Fed “half-pregnant” with a $ 4.5 trillion balance sheet at a time of tightening conditions, she does correctly note that the current environment is hardly a “supportive backdrop for profits.” Specifically she notes that the weak stock market performance comes in the context of:

- slowing US and global economic growth (US 4Q GDP tracking 1%)

- collapsing commodity prices (oil prices averaged -42% y/y in 4Q)

- renewed fears about China (Shanghai Composite -38% since last June)

- heightened geopolitical tensions (Middle East, North Korea, etc.)

- the first transition to Fed policy tightening in a decade.

Her conclusion is that “these factors have created a difficult backdrop for corporate profitability, and we forecast 4Q EPS growth of -1% y/y (consensus: -4%).”

Actually, according to Factset, Q4 EPS consensus has now tumbled to -5.3% and dropping by about 1% every 2 or so weeks. More on that in a later post.

So is BofA’s conclusion to ignore JPM’s “sell any rally” call and BTFD? Not anymore, although while BofA does admit that “panic is building” (suggesting this “sets the stage for a rally”), it also says there is one key ingredient missing: growth.

But not cautious enough to change the year end target of 2,200?