How To Spot A ‘No-Brainer’ Investment In 30 Seconds Or Less

Several years ago, an investment-manager friend told me about the thirty-second rule.

It’s a powerful (yet remarkably simple) way to think about investment analysis — one that has stuck with me ever since that initial conversation.

“When you look at any investment,” he said, “you should know if it works within thirty seconds or less.”

At first I was skeptical. This sounded more like getting a psychic reading than a sound strategy for investing.

But — as he went on to explain — there’s actually a lot to be said for first impressions, whether it’s for people or stocks.

Here’s how his rule works. Basically, you divide potential investments into three groups.

The first group consists of ideas that clearly don’t work. These have an obvious flaw.

My friend estimated this amounts to about 5% of all the investment pitches out there. These are the ones we instantly reject.

The next group of potential investments is the “in-betweens.” My friend theorized that most investments out there fall into this category.

As the name suggests, these ideas are all plausible. To varying degrees, they have good points and weaker points. But none of them is so strong that it jumps out immediately as blockheaded or barnburner.

And this is where most investors get into trouble.

As he explained to me, most analysts get drawn in by these in-between investments, believing that deep investigation and appraisal will show whether they should be pursued. They sift through financial statements, crunch numbers, create complex models, conduct expert interviews and otherwise gather data points that are deemed crucial to determining the likely fate of these possibly attractive stocks.

Now, my friend is certainly no slouch when it comes to research. I’ve worked alongside him and observed his prowess in creating numerical spreadsheets to assess cash flow and net present value.

So I was shocked by what he told me next — about the approach he takes to the in-between stocks of the investment world.

He completely ignores them.

As he explained, it’s not worth spending your time and energy trying to decipher whether an on-the-fence opportunity will succeed — no matter how detailed and thorough your analysis, you’ll never know for sure if they’ll be winners.

Rather, he said, just focus on the thirty-second rule.

This strategy pivots on weeding out the in-betweens and the obvious failures of the investment world and instead zeroing in on the remaining 5% of firms — what I call the “no-brainers.”

The percentage might be a little off here. In truth, depending on market conditions, the “no-brainers” may well make up only 1% of the potential investments you’ll see in a year.

But they’re worth waiting for.

These are the companies that leap off the page as destined to succeed. They are the kind that you know within thirty seconds of leafing through a presentation — or sitting across from senior management — are on their way to great things.

These “no-brainers” are exactly what I look for in my premium newsletter service, Top 10 Stocks.

I know this idea may sound unlikely. In fact it completely flies in the face of the investment industry’s carefully-cultivated facade — the one that says investing is much too complicated for the average person.

But when you really think about the thirty-second rule, it makes perfect sense.

Take an enduring business such as Hershey (NYSE: HSY). Its financials are as clean as they come.

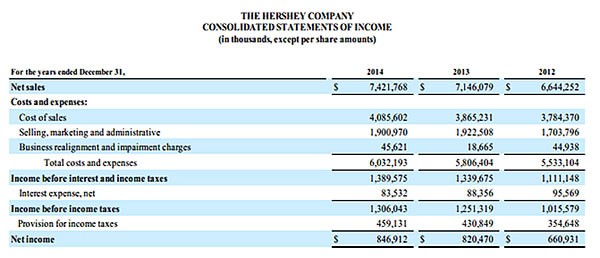

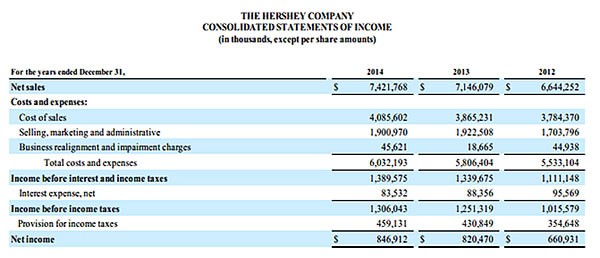

The guts of the firm’s income statements contain all of five lines — revenue, a few categories of expense items, income taxes, and that’s it. Below is a screen capture from the firm’s most recent annual filing.

That’s everything you need to make an informed initial impression of the company. It’s all neatly encapsulated in one-third of a page. It doesn’t take a rocket scientist to figure out that this company’s profit (net income) has been steadily growing and there are not a whole lot of “miscellaneous” items to confuse us.

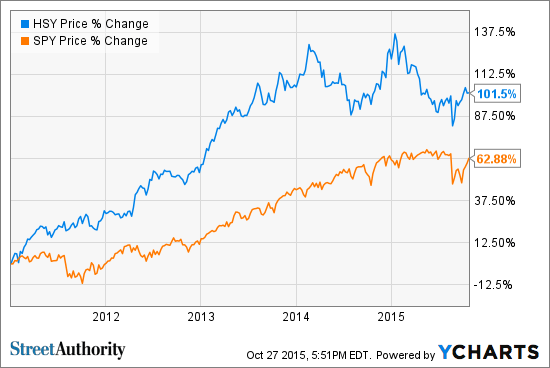

Case-in-point, investors who noticed Hershey’s financials and bought the stock as recently as 2011 knew they found a “no-brainer” early on…

It also doesn’t hurt that the company has paid uninterrupted dividends since 1930. There are very few companies that can say they’ve paid dividends 85 years in a row.

During my career I’ve noticed that many of the world’s best stocks have similarly basic financials. It not only makes analysis easier, but it also indicates that these are simple businesses — the kind that generate reliable profits year in and year out, with few hiccups or sea changes. Simply put, these are stocks that are so reliable you can buy them today and hold them for the rest of your life.

Look, investing doesn’t have to be complicated. Simply look for “no brainer” companies with clean financials that dominate their industry. Hershey is a perfect example.

This is why all of the stocks in my new report, The Top 10 Stocks For 2016, were specifically chosen to be the kinds of “no-brainer” stocks that you buy and hold forever. They’ve beaten the market for decades, and are perfectly positioned to continue beating it in the years to come…

My Top 10 Pick #4 is a perfect example. Its share price has soared an astonishing 17,000% since 1990. That turned every $ 100 invested back then into $ 72,713.36 (with dividend reinvestment). To learn how to get the name and ticker symbol of this stock as well as the rest of my picks, follow this link.